Duke Energy 2012 Annual Report Download - page 177

Download and view the complete annual report

Please find page 177 of the 2012 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

157

PART II

Combined Notes to Consolidated Financial Statements – (Continued)

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. • CAROLINA POWER & LIGHT COMPANY d/b/a PROGRESS ENERGY

CAROLINAS, INC. • FLORIDA POWER CORPORATION d/b/a PROGRESS ENERY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

The Duke Energy Registrants have the ability under certain debt facilities

to call and repay the obligation prior to its scheduled maturity. Therefore, the

actual timing of future cash repayments could be materially different than as

presented above.

Available Credit Facilities

In November 2011, Duke Energy entered into a $6 billion, 5-year master

credit facility, expiring in November 2016, with $4 billion available at closing

and the remaining $2 billion became available July 2, 2012, following the

closing of the merger with Progress Energy. In October 2012, the Duke Energy

Registrants reached an agreement with banks representing $5.63 billion of

commitments under the master credit facility to extend the expiration date

by one year to November 2017. Through November 2016, the available credit

under this facility remains at $6 billion. The Duke Energy Registrants each have

borrowing capacity under the master credit facility up to specifi ed sub limits

for each borrower. However, Duke Energy has the unilateral ability at any time

to increase or decrease the borrowing sub limits of each borrower, subject to

a maximum sublimit for each borrower. See the table below for the borrowing

sub limits for each of the borrowers as of December 31, 2012. The amount

available under the master credit facility has been reduced, as indicated in the

table below, by the use of the master credit facility to backstop the issuances of

commercial paper, certain letters of credit and variable rate demand tax-exempt

bonds that may be put to the Company at the option of the holder. As indicated,

borrowing sub limits for the Subsidiary Registrants are also reduced for certain

amounts outstanding under the money pool arrangement.

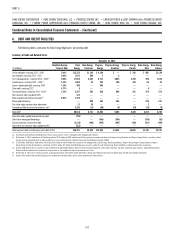

December 31, 2012

(in millions)

Duke

Energy

(Parent)

Duke

Energy

Carolinas

Progress

Energy

Carolinas

Progress

Energy

Florida

Duke

Energy

Ohio

Duke

Energy

Indiana

Total

Duke

Energy

Facility size $1,750 $1,250 $750 $750 $ 750 $ 750 $ 6,000

Reduction to backstop issuances

Notes payable and commercial paper (195) (300) — — (104) (201) (800)

Outstanding letters of credit (50) (7) (2) (1) — — (60)

Tax-exempt bonds — (75) — — (84) (81) (240)

Available capacity $1,505 $ 868 $748 $749 $ 562 $ 468 $4,900

Short-term Obligations Classifi ed as Long-term Debt

At December 31, 2012 and 2011, variable rate demand tax-exempt

bonds that may be put to the Company at the option of the holder, commercial

paper issuances and money pool borrowings were classifi ed as Long-term debt

on the Consolidated Balance Sheets. These variable rate tax-exempt bonds,

commercial paper issuances and money pool borrowings, which are short-term

obligations by nature, are classifi ed as long term due to Duke Energy’s intent

and ability to utilize such borrowings as long-term fi nancing. As Duke Energy’s

master credit facility has non-cancelable terms in excess of one year as of

the balance sheet date, Duke Energy has the ability to refi nance these

short-term obligations on a long-term basis. The following tables show

short-term obligations classifi ed as long-term debt.

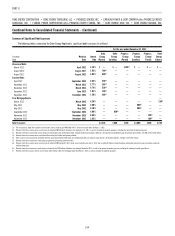

December 31, 2012

(in millions)

Duke

Energy

Duke Energy

Carolinas

Duke Energy

Ohio

Duke Energy

Indiana

Tax-exempt bonds(a)(b)(c)(d) $ 471 $ 75 $ 111 $285

Notes payable and commercial paper(e) 450 300 — 150

Revolving loan(f) 200 — — —

DERF(g) 300 300 — —

Total $1,421 $ 675 $ 111 $435

(a) Of the $471 million of tax-exempt bonds outstanding at December 31, 2012 at Duke Energy, the master credit facility served as a backstop for $240 million of these tax-exempt bonds, with the remaining balance backstopped

by other specifi c long-term credit facilities separate from the master credit facility.

(b) For Duke Energy Carolinas, the master credit facility served as a backstop for the $75 million of tax-exempt bonds outstanding at December 31, 2012.

(c) Of the $111 million of tax-exempt bonds outstanding at December 31, 2012 at Duke Energy Ohio, the master credit facility served as a backstop for $84 million of these tax-exempt bonds, with the remaining balance

backstopped by other specifi c long-term credit facilities separate from the master credit facility.

(d) Of the $285 million of tax-exempt bonds outstanding at December 31, 2012 at Duke Energy Indiana, $81 million were backstopped by Duke Energy’s master credit facility, with the remaining balance backstopped by other

specifi c long-term credit facilities separate from the master credit facility.

(e) Duke Energy has issued $450 million in Commercial Paper, which is backstopped by the master credit facility, and the proceeds are in the form of loans through the money pool to Duke Energy Carolinas and Duke Energy

Indiana as of December 31, 2012.

(f) Duke Energy International Energy’s revolving loan is due in December 2013 with the right to extend the maturity date for additional one year periods with a fi nal maturity date no later than December 2026.

(g) Duke Energy Receivables Finance Company, LLC (DERF) is a wholly owned limited liability company of Duke Energy Carolinas. See Note 18 for further information.