Duke Energy 2012 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2012 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42

PART II

Partially offsetting these increases was:

• A $27 million decrease in Ecuador due to lower fuel consumption as a

result of lower dispatch, and lower maintenance costs.

Other Income and Expense, net.

The variance was primarily driven by a $44 million increase in equity

earnings from NMC due to higher average prices partially offset by higher butane

costs, and a $20 million arbitration award in Peru.

Interest Expense.

The variance was primarily a result of infl ation impact in Brazil and lower

interest expense in Central America due to prepayment of debt.

Income Tax Expense.

The variance is primarily due to an increase in pretax income. The

effective tax rate for the year ended December 31, 2011 and 2010 was 28.9%

and 31.1%, respectively.

Segment Income.

As discussed above, the variance was primarily due to favorable contract

prices and exchange rates in Brazil, arbitration award and higher margins in Peru,

favorable hydrology in Central America, and higher equity earnings at NMC.

Other

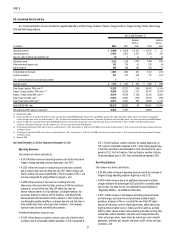

Years Ended December 31,

(in millions) 2012 2011

Variance

2012 vs.

2011 2010

Variance

2011 vs.

2010

Operating revenues $74 $44 $ 30 $ 142 $ (98)

Operating expenses 704 133 571 389 (256)

(Losses) gains on sales of other assets and other, net (7) (8) 1 145 (153)

Operating loss (637) (97) (540) (102) 5

Other income and expense, net 16 49 (33) 126 (77)

Interest expense 297 157 140 136 21

Loss before income taxes (918) (205) (713) (112) (93)

Income tax benefi t (378) (114) (264) (62) (52)

Less: Loss attributable to noncontrolling interests (2) (15) 13 (9) (6)

Net expense $(538) $ (76) $(462) $ (41) $ (35)

Year Ended December 31, 2012 as Compared to December 31, 2011

Operating Revenues.

The variance was driven primarily by higher premiums earned at Bison

Insurance Company Limited (Bison) as a result of the addition of Progress Energy

and mark-to-market activity at Duke Energy Trading and Marketing, LLC (DETM).

Operating Expenses.

The variance was driven primarily by charges related to the Progress

Energy merger, increased severance costs and higher current year donations.

These negative impacts were partially offset by higher JV costs related to DETM

in the prior year.

Other Income and Expense, net.

The variance was driven primarily by current year impairments and

prior year gains on sales of investments, higher interest income recorded in

2011 following the resolution of certain income tax matters related to prior

years and reversal of reserves related to certain guarantees Duke Energy had

issued on behalf of Crescent in 2011. These negative impacts were partially

offset by higher returns on investments that support benefi t obligations in 2012

compared to 2011.

Interest Expense.

The variance was due primarily to higher debt balances as a result of debt

issuances and the inclusion of Progress Energy interest expense beginning in

July 2012.

Income Tax Benefi t.

The variance is primarily due to an increase in pretax loss. The effective

tax rate for the years ended December 31, 2012 and 2011 was 41.1% and

56.0%, respectively.

Net Expense.

The variance was due primarily to charges related to the Progress Energy

merger, increased severance costs, and higher interest expense. These negative

impacts were partially offset by higher income tax benefi t due to increased net

expense and higher returns on investments that support benefi t obligations in

2012 compared to 2011.

Year Ended December 31, 2011 as Compared to December 31, 2010

Operating Revenues.

The variance was driven primarily by the deconsolidation of DukeNet in

December 2010 and the subsequent accounting for Duke Energy’s investment in

DukeNet as an equity method investment.

Operating Expenses.

The variance was driven primarily by $172 million of 2010 employee

severance costs related to the voluntary severance plan and the consolidation of

certain corporate offi ce functions from the Midwest to Charlotte, North Carolina,

prior year donations of $56 million to the Duke Energy Foundation, which

is a nonprofi t organization funded by Duke Energy shareholders that makes

charitable contributions to selected nonprofi ts and government subdivisions,