Duke Energy 2012 Annual Report Download - page 226

Download and view the complete annual report

Please find page 226 of the 2012 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

206

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. • CAROLINA POWER & LIGHT COMPANY d/b/a PROGRESS

ENERGY CAROLINAS, INC. • FLORIDA POWER CORPORATION d/b/a PROGRESS ENERY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

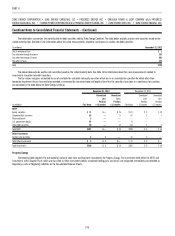

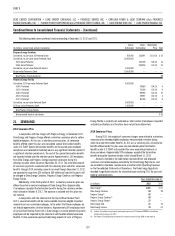

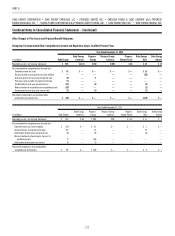

(in millions, except per-share amounts) Income

Average

Shares EPS

2012

Income from continuing operations attributable to Duke Energy common shareholders, as adjusted for participating securities — basic $1,727 574 $3.01

Effect of dilutive securities:

Stock options, performance and restricted stock 1

Income from continuing operations attributable to Duke Energy common shareholders, as adjusted for participating securities — diluted $1,727 575 $3.01

2011

Income from continuing operations attributable to Duke Energy common shareholders, as adjusted for participating securities — basic and diluted $1,702 444 $3.83

2010

Income from continuing operations attributable to Duke Energy common shareholders, as adjusted for participating securities — basic $1,315 439 $2.99

Effect of dilutive securities:

Stock options, performance and restricted stock 1

Income from continuing operations attributable to Duke Energy common shareholders, as adjusted for participating securities — diluted $1,315 440 $2.99

As of December 31, 2012, 2011 and 2010, 1 million, 3 million and

5 million, respectively, of stock options and performance and unvested stock

awards were not included in the dilutive securities calculation in the above table

because either the option exercise prices were greater than the average market

price of the common shares during those periods, or performance measures

related to the awards had not yet been met.

Beginning in the fourth quarter of 2008, Duke Energy began issuing

authorized but previously unissued shares of common stock to fulfi ll obligations

under its Dividend Reinvestment Plan (DRIP) and other internal plans, including

401(k) plans. During the year ended December 31, 2010, Duke Energy received

proceeds of $288 million from the sale of common stock associated with these

plans. Proceeds from the sale of common stock associated with these plans

were not signifi cant in 2012 and 2011. Duke Energy has discontinued issuing

new shares of common stock under the DRIP.

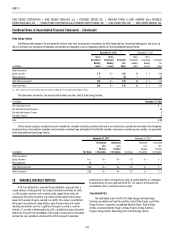

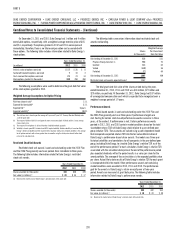

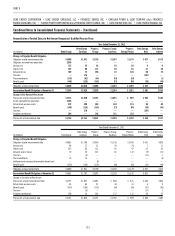

Progress Energy

The following tables represent Progress Energy’s earnings per common share for the years ended December 31, 2011 and 2010, respectively.

(in millions, except per-share amounts) Income

Average

Shares EPS

2011

Income from continuing operations attributable to Progress Energy common shareholders, as adjusted for participating securities — basic and diluted $580 296 $1.96

2010

Income from continuing operations attributable to Progress Energy common shareholders, as adjusted for participating securities — basic and diluted $860 291 $2.96

As of December 31, 2010, Progress Energy had 1 million stock options

outstanding which were not included in the dilutive securities calculation in

the above table because either the option exercise prices were greater than the

average market price of common shares during those periods, or performance

measures related to the awards had not yet been met.

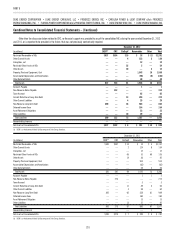

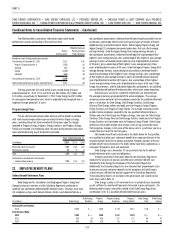

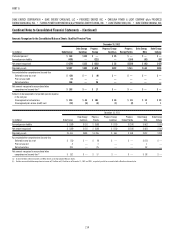

20. PREFERRED STOCK OF SUBSIDIARIES

All of Duke Energy’s and Progress Energy’s preferred stock was issued

by Progress Energy Carolinas and Progress Energy Florida to third-party holders

prior to the July 2, 2012 merger with Progress Energy. The preferred stock

contains certain provisions that could require redemption of the preferred

stock for cash. In the event dividends payable on Progress Energy Carolinas’ or

Progress Energy Florida’s preferred stock are in default for an amount equivalent

to or exceeding four quarterly dividend payments, the holders of the preferred

stock are entitled to elect a majority of Progress Energy Carolinas’ or Progress

Energy Florida’s respective Board of Directors until all accrued and unpaid

dividends are paid. All classes of preferred stock are entitled to cumulative

dividends with preference to the common stock dividends, are redeemable by

vote of the Progress Energy Carolinas’ or Progress Energy Florida’s respective

Board of Directors at any time, and do not have any preemptive rights. All

classes of preferred stock have a liquidation preference equal to $100 per share

plus any accumulated unpaid dividends except for Progress Energy Florida’s

4.75%, $100 par value class, which does not have a liquidation preference.

Each holder of Progress Energy Carolinas’ preferred stock is entitled to one vote.

The holders of Progress Energy Florida’s preferred stock have no right to vote

except for certain circumstances involving dividends payable on preferred stock

that are in default or certain matters affecting the rights and preferences of the

preferred stock.

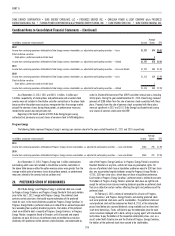

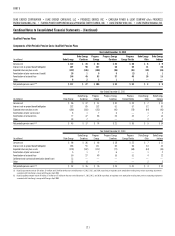

On February 6, 2013, notices of redemption for all series of Progress

Energy Carolinas’ and Progress Energy Florida’s outstanding preferred stock

and serial preferred stock were sent to shareholders. The preferred stock and

serial preferred stock will be redeemed on March 8, 2013, at the redemption

prices listed below plus accrued dividends using available cash on hand and

short-term borrowings. Funds suffi cient to pay the redemption price for each

series have been deployed with a bank, acting as paying agent, with irrevocable

instructions to pay the holders at the respective redemption prices, and, as a

result, under North Carolina law and the Charter of Progress Energy Carolinas,

the holders of the preferred stock have ceased to be stockholders.