Duke Energy 2012 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2012 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34

PART II

to recover investments in Duke Energy’s ongoing infrastructure modernization

projects and operating costs. Planning for and obtaining favorable outcomes

from these regulatory proceedings are key factors in achieving Duke Energy’s

long-term growth assumptions.

Achieving Intended Merger Cost Savings and Effi ciencies. Duke

Energy is taking a disciplined and systematic approach to merger integration

work. Duke Energy is on track to achieve intended savings and effi ciencies. In

addition, through the effi cient joint dispatch of the Duke Energy Carolinas and

Progress Energy Carolinas generation fl eets, Duke Energy is ahead of schedule

in achieving fuels savings for customers in the Carolinas, achieving $52 million

in fuel costs during the fi rst six months following the merger. These savings are

passed to customers.

Management of Crystal River Unit 3 Retirement. On February 5, 2013,

following the completion of a comprehensive analysis, Duke Energy announced

its intention to retire Crystal River Unit 3. Duke Energy concluded that it did not

have a high degree of confi dence that repair could be successfully completed and

licensed within estimated costs and schedule, and that was in the best interests

of Progress Energy Florida’s customers and joint owners and Duke Energy’s

investors to retire the unit. Progress Energy Florida developed initial estimates

of the cost to decommission the plant during its analysis of whether to repair

or retire Crystal River Unit 3. With the fi nal decision to retire, Progress Energy

Florida is working to develop a comprehensive decommissioning plan, which

will evaluate various decommissioning options and costs associated with each

option. The plan will determine resource needs as well as the scope, schedule

and other elements of decommissioning. Progress Energy Florida intends to use a

safe storage (SAFSTOR) option for decommissioning. Generally, SAFSTOR involves

placing the facility into a safe storage confi guration, requiring limited staffi ng to

monitor plant conditions, until the eventual dismantling and decontamination

activities occur, usually in 40 to 60 years. This decommissioning approach is

currently utilized at a number of retired domestic nuclear power plants and is

one of three generally accepted approaches to decommissioning required by the

NRC. Additional specifi cs about the decommissioning plan are being developed.

Also on February 5, 2013, Progress Energy Florida announced it and NEIL had

accepted the mediator’s proposal whereby NEIL will pay Progress Energy Florida

an additional $530 million. Along with the $305 million which NEIL previously paid,

Progress Energy Florida will receive a total of $835 million in insurance proceeds.

Progress Energy Florida expects that the FPSC will review the prudence of the

retirement decision in Phase 2 of the Crystal River Unit 3 delamination regulatory

docket. Progress Energy Florida has also asked the FPSC to review the mediated

resolution of insurance claims with NEIL as part of Phase 3 of this regulatory

docket. Phase 2 and Phase 3 hearings have been tentatively scheduled to begin on

June 19, 2013.

Completing Remaining Major Capital Projects. Duke Energy

anticipates total capital expenditures of $5.9 billion to $6.3 billion in 2013.

Approximately $1.7 billion of these expenditures are related to expansion and

growth projects, including but not limited to, the Edwardsport IGCC plant and

the Sutton combined cycle facility. Following the completion of the Sutton

and Edwardsport facilities in 2013, the major components of Duke Energy’s fl eet

modernization program will be complete. The fl eet modernization program will

permit Duke Energy to retire up to 6,800 MW of older, less-effi cient coal-fi red

units by 2015, with approximately 3,800 MW retired by the end of 2013.

Optimizing Nuclear Fleet Performance. In 2012, Duke Energy’s

nuclear fl eet achieved a capacity factor over 90 percent, excluding Crystal River

Unit 3. Duke Energy will continue to leverage best practices across the nuclear

fl eet to maintain and improve the performance of the fl eet. To meet this goal,

targeted investments to increase overall fl eet performance and to meet the

NRC’s Fukushima-related requirements totaling $825 million are planned over

the next three years.

Economic Factors for Duke Energy’s Business

The historical and future trends of Duke Energy’s operating results have

been and will be affected in varying degrees by a number of factors, including

those discussed below. Duke Energy’s revenues depend on customer usage,

which varies with weather conditions and behavior patterns, general business

conditions and the cost of energy services. Various regulatory agencies approve

the prices for electric service within their respective jurisdictions and affect

Duke Energy’s ability to recover its costs from customers.

Declines in demand for electricity as a result of economic downturns

reduce overall electricity sales and have the potential to lessen Duke Energy’s

cash fl ows, especially if retail customers reduce consumption of electricity. A

weakening economy could also impact Duke Energy’s customers’ ability to pay,

causing increased delinquencies, slowing collections and leading to higher than

normal levels of accounts receivables, bad debts and fi nancing requirements. A

portion of USFE&G’s business risk is mitigated by its regulated allowable rates

of return and recovery of fuel costs under fuel adjustment clauses.

If negative market conditions should persist over time and estimated

cash fl ows over the lives of Duke Energy’s individual assets, including

goodwill, do not exceed the carrying value of those individual assets, asset

impairments may occur in the future under existing accounting rules and

diminish results of operations. A change in management’s intent about the

use of individual assets (held for use versus held for sale) could also result

in impairments or losses. Duke Energy evaluates the carrying amount of its

recorded goodwill for impairment on an annual basis as of August 31 and

performs interim impairment tests if a triggering event occurs that indicates it

is not more likely than not that the fair value of a reporting unit is less than its

carrying value. For further information on key assumptions that impact Duke

Energy’s goodwill impairment assessments, see “Critical Accounting Policy for

Goodwill Impairment Assessments” and Note 12 to the Consolidated Financial

Statements, “Goodwill, Intangible Assets and Impairments.”

Duke Energy’s goals for 2013 and beyond could also be substantially

at risk due to the regulation of its businesses. Duke Energy’s businesses in

the U.S. are subject to regulation on the federal and state level. Regulations,

applicable to the electric power industry, have a signifi cant impact on the nature

of the businesses and the manner in which they operate. USFE&G has four

outstanding rate cases and plans to initiate two additional rate cases in 2013.

New legislation and changes to regulations are ongoing, including anticipated

carbon legislation, and Duke Energy cannot predict the future course of changes

in the regulatory or political environment or the ultimate effect that any such

future changes will have on its business.

Duke Energy’s earnings are impacted by fl uctuations in commodity

prices. Exposure to commodity prices generates higher earnings volatility in

the unregulated businesses. To mitigate these risks, Duke Energy enters into

derivative instruments to effectively hedge some, but not all, known exposures.

Additionally, Duke Energy’s investments and projects located outside of

the U.S. expose Duke Energy to risks related to laws of other countries, taxes,

economic conditions, fl uctuations in currency rates, political conditions and

policies of foreign governments. Changes in these factors are diffi cult to predict

and may impact Duke Energy’s future results.

Duke Energy also relies on access to both short-term money markets and

longer-term capital markets as a source of liquidity for capital requirements not

met by cash fl ow from operations. An inability to access capital at competitive

rates or at all could adversely affect Duke Energy’s ability to implement its

strategy. Market disruptions or a downgrade of Duke Energy’s credit rating

may increase its cost of borrowing or adversely affect its ability to access one

or more sources of liquidity. For further information related to management’s

assessment of Duke Energy’s risk factors, see Item 1A, “Risk Factors.”

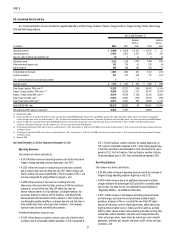

RESULTS OF OPERATIONS

In this section, Duke Energy provides analysis and discussion of earnings

and factors affecting earnings on both a GAAP and non-GAAP basis.

Management evaluates fi nancial performance in part based on the

non-GAAP fi nancial measure, Adjusted earnings and Adjusted diluted earnings

per share (EPS), which is measured as income from continuing operations

after deducting income attributable to noncontrolling interests, adjusted for the

dollar and per share impact of special items and the mark-to-market impacts

of economic hedges in the Commercial Power segment. Special items represent