Duke Energy 2012 Annual Report Download - page 167

Download and view the complete annual report

Please find page 167 of the 2012 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

147

PART II

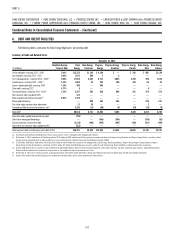

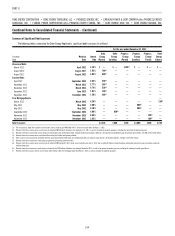

Combined Notes to Consolidated Financial Statements – (Continued)

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. • CAROLINA POWER & LIGHT COMPANY d/b/a PROGRESS ENERGY

CAROLINAS, INC. • FLORIDA POWER CORPORATION d/b/a PROGRESS ENERY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

fee assessments imposed under two new resolutions promulgated by the

Brazilian Electricity Regulatory Agency (ANEEL) (collectively, the Resolutions).

The Resolutions purport to impose additional transmission fees (retroactive to

July 1, 2004 and effective through June 30, 2009) on generation companies

located in the State of São Paulo for utilization of the electric transmission

system. The new charges are based upon a fl at-fee that fails to take into

account the locational usage by each generator. DEIGP’s additional assessment

under these Resolutions amounts to approximately $61 milli on, inclusive of

interest, through December 2012. Based on DEIGP’s continuing refusal to tender

payment of the disputed sums, on April 1, 2009, ANEEL imposed an additional

fi ne against DEIGP in the current amount of $9 million. DEIGP fi led a request

to enjoin payment of the fi ne and for an expedited decision on the merits or,

alternatively, an order requiring that all disputed sums be deposited in the

court’s registry in lieu of direct payment to the distribution companies.

On June 30, 2009, the court issued a ruling in which it granted DEIGP’s

request for injunction regarding the additional fi ne, but denied DEIGP’s request

for an expedited decision on the original assessment or payment into the court

registry. Under the court’s order, DEIGP was required to make installment

payments on the original assessment directly to the distribution companies

pending resolution on the merits. DEIGP fi led an appeal and on August 28, 2009,

the order was modifi ed to allow DEIGP to deposit the disputed portion of each

installment, which was most of the assessed amount, into an escrow account

pending resolution on the merits. Duke Energy has made deposits to escrow of

$33 million associated with this matter.

Brazil Expansion Lawsuit.

On August 9, 2011, the State of São Paulo fi led a lawsuit in Brazilian

state court against DEIGP based upon a claim that DEIGP is under a continuing

obligation to expand installed generation capacity by 15 percent pursuant to

a stock purchase agreement under which DEIGP purchased generation assets

from the state. On August 10, 2011, a judge granted an ex parte injunction

ordering DEIGP to present a detailed expansion plan in satisfaction of the 15 percent

obligation. DEIGP has previously taken a position that the 15 percent expansion

obligation is no longer viable given the changes that have occurred in the electric

energy sector since privatization of that sector. After fi ling various objections,

defenses and appeals regarding the referenced order, DEIGP submitted its proposed

expansion plan on November 11, 2011, but reserved its objections regarding

enforceability. The parties will in due course present evidence to the court regarding

their respective positions. No trial date has been set.

Crescent Litigation.

On September 3, 2010, the Crescent Resources Litigation Trust fi led

suit against Duke Energy along with various affi liates and several individuals,

including current and former employees of Duke Energy, in the U.S. Bankruptcy

Court for the Western District of Texas. The Crescent Resources Litigation Trust

was established in May 2010 pursuant to the plan of reorganization approved

in the Crescent bankruptcy proceedings in the same court. The complaint

alleges that in 2006 the defendants caused Crescent to borrow approximately

$1.2 billion from a consortium of banks and immediately thereafter distribute

most of the loan proceeds to Crescent’s parent company without benefi t to

Crescent. The complaint further alleges that Crescent was rendered insolvent by

the transactions, and that the distribution is subject to recovery by the Crescent

bankruptcy estate as an alleged fraudulent transfer. The plaintiff requests

return of the funds as well as other statutory and equitable relief, punitive

damages and attorneys’ fees. Duke Energy and its affi liated defendants believe

that the referenced 2006 transactions were legitimate and did not violate any

state or federal law. Defendants fi led a motion to dismiss in December 2010.

On March 21, 2011, the plaintiff fi led a response to the defendant’s motion

to dismiss and a motion for leave to fi le an amended complaint, which was

granted. The Defendants fi led a second motion to dismiss in response to

plaintiffs’ amended complaint.

The plaintiffs fi led a demand for a jury trial, a motion to transfer the

case to the federal district court, and a motion to consolidate the case with

a separate action fi led by the plaintiffs against Duke Energy’s legal counsel.

On March 22, 2012, the federal District Court issued an order denying the

defendant’s motion to dismiss and granting the plaintiffs’ motions for transfer

and consolidation. The court has not yet made a fi nal ruling on whether

the plaintiffs are entitled to a jury trial. Trial on this matter has been set to

commence in January 2014. Mediation, held on August 21 and 22, 2012, was

unsuccessful. It is not possible to predict whether Duke Energy will incur any

liability or to estimate the damages, if any, that Duke Energy might incur in

connection with this lawsuit. The ultimate resolution of this matter could have a

material effect on the consolidated results of operations, cash fl ows or fi nancial

position of Duke Energy.

Federal Advanced Clean Coal Tax Credits.

Duke Energy Carolinas has been awarded $125 million of federal

advanced clean coal tax credits associated with its construction of Cliffside Unit 6

and Duke Energy Indiana has been awarded $134 million of federal advanced

clean coal tax credits associated with its construction of the Edwardsport IGCC

plant. In March 2008, two environmental groups, Appalachian Voices and the

Canary Coalition, fi led suit against the Federal government in the United States

District Court for the District of Columbia challenging the tax credits awarded to

incentivize certain clean coal projects. Although Duke Energy was not a party to

the case, the allegations center on the tax incentives provided for the Cliffside

and Edwardsport projects. The initial complaint alleged a failure to comply

with the National Environmental Policy Act. The fi rst amended complaint, fi led

in August 2008, added an Endangered Species Act claim and also sought

declaratory and injunctive relief against the DOE and the U.S. Department of

the Treasury. In 2008, the District Court dismissed the case. On September 23,

2009, the District Court issued an order granting plaintiffs’ motion to amend

their complaint and denying, as moot, the motion for reconsideration. Plaintiffs

have fi led their second amended complaint. The Federal government has moved

to dismiss the second amended complaint; the motion is pending. On July 26,

2010, the District Court denied plaintiffs’ motion for preliminary injunction

seeking to halt the issuance of the tax credits.

Duke Energy Carolinas

New Source Review (NSR).

In 1999-2000, the U.S. Department of Justice (DOJ), acting on behalf

of the EPA and joined by various citizen groups and states, fi led a number

of complaints and notices of violation against multiple utilities across the

country for alleged violations of the NSR provisions of the CAA. Generally, the

government alleges that projects performed at various coal-fi red units were

major modifi cations, as defi ned in the CAA, and that the utilities violated

the CAA when they undertook those projects without obtaining permits and

installing the best available emission controls for SO2, NOx and particulate

matter. The complaints seek injunctive relief to require installation of pollution

control technology on various generating units that allegedly violated the CAA,