Duke Energy 2012 Annual Report Download - page 209

Download and view the complete annual report

Please find page 209 of the 2012 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

189

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. • CAROLINA POWER & LIGHT COMPANY d/b/a PROGRESS ENERGY

CAROLINAS, INC. • FLORIDA POWER CORPORATION d/b/a PROGRESS ENERY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

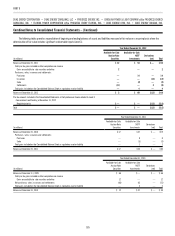

The following tables provide a reconciliation of beginning and ending

balances of assets and liabilities measured at fair value on a recurring basis

where the determination of fair value includes signifi cant unobservable inputs

(Level 3):

Year Ended December 31, 2011

(in millions)

Derivatives

(net)

Balance at December 31, 2010 $ —

Total losses included on the Consolidated Balance Sheet as regulatory

asset or liability (1)

Transfers out of Level 3 1

Balance at December 31, 2011 $ —

Year Ended December 31, 2010

(in millions)

Derivatives

(net)

Balance at December 31, 2009 $(12)

Total losses included on the Consolidated Balance Sheet as regulatory

asset or liability (17)

Transfers out of Level 3 — commodities 29

Balance at December 31, 2010 $ —

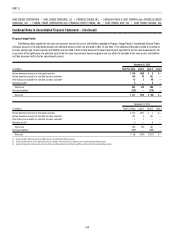

Duke Energy Ohio

The following tables provide the fair value measurement amounts for

assets and liabilities recorded on Duke Energy Ohio’s Consolidated Balance

Sheets. Derivative amounts in the table below exclude cash collateral amounts

which are disclosed in Note 15. Financial assets and liabilities are classifi ed

in their entirety based on the lowest level of input signifi cant to the fair value

measurement. Our assessment of the signifi cance of a particular input to the fair

value measurement requires judgment and may affect the valuation of fair value

assets and liabilities and their placement within the fair value hierarchy levels.

(in millions)

Total Fair Value

December 31,

2012 Level 1 Level 2 Level 3

Derivative assets(a) $ 59 $ 48 $ 2 $ 9

Derivative liabilities(b) (38) (15) (8) (15)

Net assets (liabilities) $ 21 $ 33 $(6) $ (6)

(in millions)

Total Fair Value

December 31,

2011 Level 1 Level 2 Level 3

Derivative assets(a) $ 56 $ 42 $ 5 $ 9

Derivative liabilities(b) (30) (10) (8) (12)

Net assets (liabilities) $ 26 $ 32 $(3) $ (3)

(a) Included in Other Current Assets within Current Assets and Other within Investments and Other Assets in

the Consolidated Balance Sheets.

(b) Included in Derivative Liabilities within Current Liabilities and Other within Deferred Credits and Other

Liabilities in the Consolidated Balance Sheets.

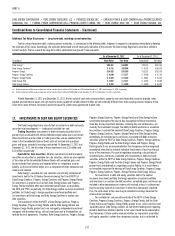

The following tables provide a reconciliation of beginning and ending

balances of assets and liabilities measured at fair value on a recurring basis

where the determination of fair value includes signifi cant unobservable inputs

(Level 3).

Year Ended December 31, 2012

(in millions)

Derivatives

(net)

Balance at December 31, 2011 $ (3)

Total pre-tax realized or unrealized gains (losses) included in earnings:

Regulated electric 1

Revenue, nonregulated electric, natural gas, and other (4)

Purchases, sales, issuances and settlements:

Settlements 1

Total losses included on the Consolidated Balance Sheet as regulatory

asset or liability (1)

Balance at December 31, 2012 $ (6)

Year Ended December 31, 2011

(in millions)

Derivatives

(net)

Balance at December 31, 2010 $ 13

Total pre-tax realized or unrealized gains (losses) included in earnings:

Revenue, nonregulated electric, natural gas, and other (4)

Purchases, sales, issuances and settlements:

Settlements (14)

Total gains included on the Consolidated Balance Sheet as regulatory

asset or liability 2

Balance at December 31, 2011 $ (3)

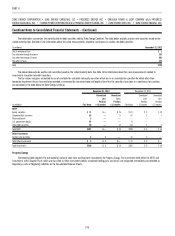

Year Ended December 31, 2010

(in millions)

Derivatives

(net)

Balance at December 31, 2009 $ 7

Total pre-tax realized or unrealized gains (losses) included in earnings:

Revenue, nonregulated electric, natural gas, and other 8

Fuel used in electric generation and purchased power nonregulated (12)

Total pre-tax losses included in other comprehensive income:

Losses on commodity cash fl ow hedges (1)

Net purchases, sales, issuances and settlements: 8

Total gains included on the Consolidated Balance Sheet as regulatory

asset or liability 3

Balance at December 31, 2010 $ 13

Pre-tax amounts included in the Consolidated Statements of Compre-

hensive Income related to Level 3 measurements outstanding at

December 31, 2011:

Revenue, nonregulated electric and other $ 17

Total $ 17