Duke Energy 2012 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2012 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57

PART II

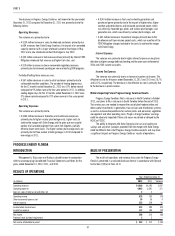

Operating Cash Flows

The following table summarizes key components of Duke Energy’s

operating cash fl ows for the three most recently completed fi scal years.

Years Ended December 31,

(in millions) 2012 2011 2010

Net income $1,782 $1,714 $1,323

Non-cash adjustments to net income 3,769 2,628 2,972

Contributions to qualifi ed pension plans (304) (200) (400)

Working capital (3) (470) 616

Net cash provided by operating activities $5,244 $3,672 $4,511

The increase in cash provided by operating activities in 2012 as compared

to 2011 was driven primarily by:

• An approximately $1,210 million increase in net income after non-cash

adjustments (depreciation and amortizations, higher Edwardsport

charges, severance expense and other Progress Energy merger related

costs), resulting from the inclusion of Progress Energy’s results

beginning July 2, 2012 and the impact of the 2011 North Carolina and

South Carolina rate cases, net of unfavorable weather; and

• A $560 million increase in traditional working capital, mainly due to

an increase in current year vacation and incentive accruals and prior

year refund of North Carolina overcollected fuels costs and current year

overcollection of North Carolina and South Carolina fuel costs, partially

offset by;

• A $100 million increase in contributions to company sponsored pension

plans due to contributions for Progress Energy pension plans.

The decrease in cash provided by operating activities in 2011 as

compared to 2010 was driven primarily by:

• Changes in traditional working capital amounts principally due to a

increase in coal inventory, resulting mainly from milder weather and

changes in the timing of payment of accounts payable and accrued

liabilities, partially offset by;

• A $200 million decrease in contributions to company sponsored pension

plans due to 2010 pre-funding of contributions resulting from favorable

borrowing conditions.

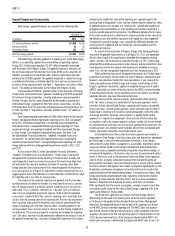

Investing Cash Flows

The following table summarizes key components of Duke Energy’s

investing cash fl ows for the three most recently completed fi scal years.

Years Ended December 31,

(in millions) 2012 2011 2010

Capital, investment and acquisition expenditures $(5,958) $(4,464) $(4,855)

Available for sale securities, net (182) (131) 95

Proceeds from sales of equity investments and other

assets, and sales of and collections on notes receivable 212 118 ) 406

Other investing items (269) 43 (69)

Net cash used in investing activities $(6,197) $(4,434) $(4,423)

The primary use of cash related to investing activities is capital,

investment and acquisition expenditures, detailed by reportable business

segment in the following table.

Years Ended December 31,

(in millions) 2012 2011 2010

U.S. Franchised Electric and Gas $4,220 $3,717 $3,891

Commercial Power 1,038 492 525

International Energy 551 114 181

Other 149 141 258

Total capital, investment and acquisition expenditures $5,958 $4,464 $4,855

The increase in cash used in investing activities in 2012 as compared to

2011 is primarily due to the following:

• A $1,490 million increase in capital, investment and acquisition

expenditures primarily due to the inclusion of Progress Energy’s capital

expenditures beginning July 2, 2012, higher expenditures on renewable

energy projects and the Chilean hydro acquisition, net of lower spending

on Duke Energy’s ongoing infrastructure modernization program as

these projects near completion and

• A $440 million increase in restricted cash primarily due to a secured

debt issuance related to Chilean hydro acquisition.

• The increase in cash used in investing activities in 2011 as compared

to 2010 is primarily due to the following:

• A $290 million decrease in proceeds from sales of equity investments

and other assets, and sales of and collections on notes receivable

as result of cash received in 2010 from the sale of a 50% interest

in DukeNet and the sale of Duke Energy’s 30% interest in Q-Comm,

partially offset by the 2011 sale of Windstream stock received in

conjunction with the Q-Comm sale in December 2010 and

• A $230 million increase in purchases of available-for-sale securities,

net of proceeds, due to the investment of excess cash held in foreign

jurisdictions.

These increases in cash used were partially offset by the following:

• A $390 million decrease in capital, investment and acquisition

expenditures primarily due to construction of the Edwardsport IGCC

plant and Cliffside Unit 6 nearing completion.

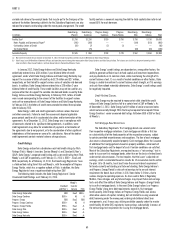

Financing Cash Flows

The following table summarizes key components of Duke Energy’s

fi nancing cash fl ows for the three most recently completed fi scal years.

Years Ended December 31,

(in millions) 2012 2011 2010

Issuance of common stock related to

employee benefi t plans $ 23 $ 67 $ 302

Issuance of long-term debt, net 1,672 2,292 1,091

Notes payable and commercial paper 278 208 (55)

Dividends paid (1,752) (1,329) (1,284)

Other fi nancing items 46 (36) (14)

Net cash provided by fi nancing activities $ 267 $ 1,202 $ 40