Duke Energy 2012 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2012 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40

PART II

Partially offsetting these decreases was:

• A $54 million increase in purchase power to serve competitive retail

load auctions.

Other Income and Expense, net.

The variance is primarily due to the sale of certain DEGS operations and

higher equity earnings from the renewables portfolio.

Interest Expense.

The variance is primarily due to higher capitalized interest on wind

construction projects.

Income Tax (Benefi t) Expense.

The variance in tax benefi t is primarily due to a decrease in pretax

income. The effective tax rate for the years ended December 31, 2012 and 2011

was (9.5) % and (1.4) %, respectively.

Segment Income.

The variance is primarily attributable to lower revenues driven by the net

impact of the expiration of the 2009-2011 ESP and the impact of competitive

market dispatch for the Duke Energy Ohio coal-fi red assets, lower Duke Energy

Retail earnings, and lower PJM capacity revenues. These negative impacts were

partially offset by lower operating expenses, lower impairment charges, and

increased margins from the gas-fi red generation assets.

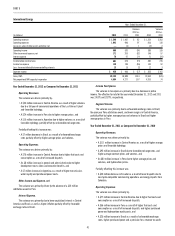

Year Ended December 31, 2011 as Compared to December 31, 2010

Operating Revenues.

The variance was driven primarily by:

• A $240 million increase in wholesale electric revenues due to higher

generation volumes, net of lower pricing and lower margin earned from

participation in wholesale auctions in 2011, and

• A $53 million increase in renewable generation revenues due to

additional renewable generation facilities placed in service after 2010

and a full year of operations for renewable generation facilities placed

in service throughout 2010.

Partially offsetting these increases were:

• A $178 million decrease in retail electric revenues resulting from lower sales

volumes driven by increased customer switching levels and unfavorable

weather net of higher retail pricing under the ESP in 2011, and

• A $66 million decrease in DEGS revenues, excluding renewables, due

primarily to a contract termination and plant maintenance.

Operating Expenses.

The variance was primarily driven by:

• A $584 million decrease in impairment charges primarily related to a

$660 million charge related to goodwill and nonregulated coal-fi red

generation asset impairments in the Midwest in 2010, as compared to

a $79 million impairment in 2011 to write down the carrying value of

excess emission allowances held to fair value as a result of the EPA’s

issuance of the Cross-State Air Pollution Rule (CSAPR) and a $9 million

impairment of the Vermillion generation station in 2011. See Note 12

to the Consolidated Financial Statements, “Goodwill, Intangible Assets

and Impairments,” for additional information, and

• A $65 million decrease in retail fuel and purchased power expenses due

to lower generation volumes net of higher purchased power volumes in

2011 as compared to 2010.

Partially offsetting these decreases were:

• A $156 million increase in wholesale fuel expenses due to higher

generation volumes, partially offset by favorable hedge realizations in

2011 as compared to 2010,

• A $46 million increase in operating expenses resulting primarily from

the recognition of MISO exit fees, higher maintenance expenses and

higher transmission costs, partially offset by lower governance costs in

2011 compared to 2010, and

• A $30 million increase in mark-to-market fuel expense on non-

qualifying fuel hedge contracts, consisting of mark-to-market losses of

$3 million in 2011 compared to gains of $27 million in 2010.

Other Income and Expense, net.

The variance is primarily due to distributions from South Houston Green

Power received in 2010 which did not recur in 2011.

Interest Expense.

The variance is primarily due to lower capitalized interest on wind

construction projects.

Income Tax (Benefi t) Expense.

The variance in pretax income was primarily due to a non-deductible

goodwill impairment in 2010. The effective tax rates for the year ended

December 31, 2011 and 2010, were (1.4%) and (7.2%), respectively.

Segment Income.

The variance is primarily attributable to lower goodwill, generation and

other asset impairment charges, higher wholesale margins due to increased

generation volumes, and an increase in renewables generation revenues.

These factors were partially offset by lower retail margins driven by customer

switching and unfavorable weather, higher operating expenses resulting from

the recognition of MISO exit fees and increased maintenance expenses, and net

mark-to-market losses on non-qualifying commodity hedge contracts in 2011

compared to gains in 2010.

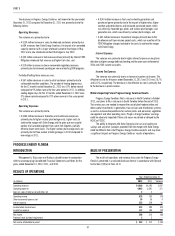

Matters Impacting Future Commercial Power Results

Changes or variability in assumptions used in calculating the fair value

of the renewables reporting unit for goodwill testing purposes including but

not limited to, legislative actions related to tax credit extensions, long-term

growth rates and discount rates, could signifi cantly impact the estimated fair

value of the renewables reporting unit. In the event of a signifi cant decline in

the estimated fair value of the renewables reporting unit, goodwill and other

asset impairment charges could be recorded. The carrying value of goodwill,

and intangible assets associated with proposed renewable projects within

Commercial Power’s renewables reporting unit was approximately $108 million

at December 31, 2012.

The current low energy price projections, as well as recently issued and

proposed environmental regulations pertaining to coal and coal-fi red generating

facilities, could impact future cash fl ows and market valuations of Commercial

Power’s coal-fi red generation assets which could lead to impairment charges.