Duke Energy 2012 Annual Report Download - page 230

Download and view the complete annual report

Please find page 230 of the 2012 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

210

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. • CAROLINA POWER & LIGHT COMPANY d/b/a PROGRESS

ENERGY CAROLINAS, INC. • FLORIDA POWER CORPORATION d/b/a PROGRESS ENERY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

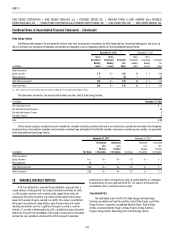

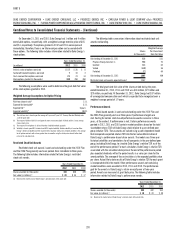

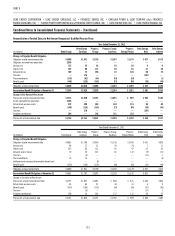

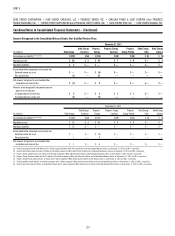

The following table summarizes information about stock-based

performance awards outstanding at the maximum level.

Shares

(in thousands)

Weighted-Average

Per Share Grant

Date Fair Value

Number of stock-based performance awards:

Outstanding at December 31, 2011 2,123 $42

Progress Energy transfers in 1,548 50

Granted 352 54

Vested (1,009) 56

Forfeited (668) 48

Outstanding at December 31, 2012 2,346 47

Stock-based performance awards expected to vest 2,132 48

The total grant date fair value of the shares vested during the years

ended December 31, 2012, 2011 and 2010 was $ 56 million, $33 million and

$15 million, respectively. At December 31, 2012, Duke Energy had $25 million

of unrecognized compensation cost, which is expected to be recognized over a

weighted-average period of 1.6 years.

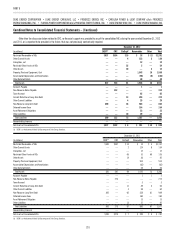

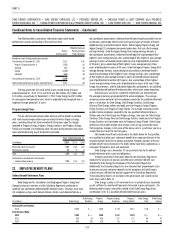

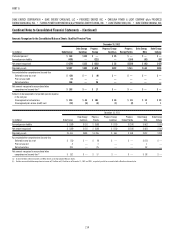

Progress Energy Plans

Pre-tax stock-based compensation expense and tax benefi t associated

with stock-based compensation expense related to former Progress Energy

plans, including those that were converted to Duke plans upon the merger,

recorded to Progress Energy, Progress Energy Carolinas, and Progress Energy

Florida are included in the following table. No stock-based compensation costs

were capitalized during any of the periods presented.

Years Ended December 31,

(in millions) 2012 2011 2010

Restricted stock unit awards $27 $24 $21

Performance awards 12 96

Total $39 $33 $27

Tax benefi t associated with stock-based

compensation expense $15 $13 $11

23. EMPLOYEE BENEFIT PLANS

Defi ned Benefi t Retirement Plans

Duke Energy and its subsidiaries (including legacy Progress Energy and

Cinergy businesses) maintain, and the Subsidiary Registrants participate in,

qualifi ed, non-contributory defi ned benefi t retirement plans. The plans cover most

U.S. employees using a cash balance formula. Under a cash balance formula, a

plan participant accumulates a retirement benefi t consisting of pay credits that are

based upon a percentage (which varies with age and years of service) of current

eligible earnings and current interest credits. Certain legacy Progress Energy and

legacy Cinergy U.S. employees are covered under plans that use a fi nal average

earnings formula. Under the legacy Cinergy fi nal average earnings formula, a

plan participant accumulates a retirement benefi t equal to a percentage of their

highest 3-year average earnings, plus a percentage of their highest 3-year average

earnings in excess of covered compensation per year of participation (maximum

of 35 years), plus a percentage of their highest 3-year average earnings times

years of participation in excess of 35 years. Under the legacy Progress Energy fi nal

average earnings formula, a plan participant accumulates a retirement benefi t

equal to a percentage of their highest 4-year average earnings, plus a percentage

of their highest 4-year average earnings in excess of covered compensation per

year of participation (maximum of 35 years), plus a percentage of their highest

4-year average earnings times years of participation in excess of 35 years. Duke

Energy also maintains, and the Subsidiary Registrants participate in, non-qualifi ed,

non-contributory defi ned benefi t retirement plans which cover certain executives.

Actuarial gains and losses subject to amortization are amortized over

the average remaining service period of the active employees. The average

remaining service period of active employees covered by the qualifi ed retirement

plans is nine years for Duke Energy, Duke Energy Carolinas, Duke Energy

Ohio and Duke Energy Indiana and eight years for Progress Energy, Progress

Energy Carolinas and Progress Energy Florida. The average remaining service

period of active employees covered by the non-qualifi ed retirement plans is

thirteen years for Duke Energy and Progress Energy, nine years for Duke Energy

Carolinas, Duke Energy Ohio and Duke Energy Indiana, twelve years for Progress

Energy Carolinas and seventeen years for Progress Energy Florida. Duke Energy

determines the market-related value of plan assets using a calculated value

that recognizes changes in fair value of the plan assets in a particular year on a

straight line basis over the next fi ve years.

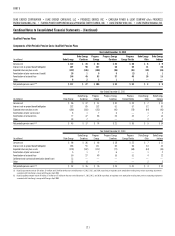

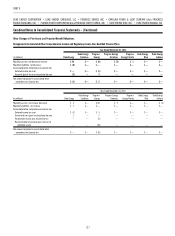

Net periodic benefi t costs disclosed in the tables below for the qualifi ed,

non-qualifi ed and other post-retirement benefi t plans represent the cost of the

respective benefi t plan for the periods presented. However, portions of the net

periodic benefi t costs disclosed in the tables below have been capitalized as a

component of property, plant and equipment.

Duke Energy uses a December 31 measurement date for its defi ned

benefi t retirement plan assets and obligations.

Amounts presented in the tables below for the Subsidiary Registrants

represent the amounts of pension and other post-retirement benefi t cost

allocated by Duke Energy for employees of the Subsidiary Registrants.

Additionally, the Subsidiary Registrants are allocated their proportionate share

of pension and post-retirement benefi t cost for employees of Duke Energy’s

shared services affi liate that provide support to the Subsidiary Registrants.

These allocated amounts are included in the governance and shared service

costs discussed in Note 14.

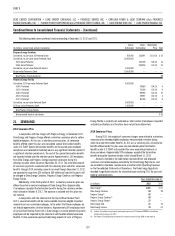

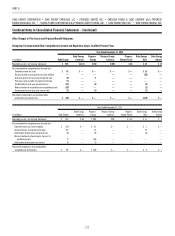

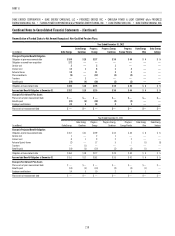

Duke Energy’s policy is to fund amounts on an actuarial basis to provide

assets suffi cient to meet benefi t payments to be paid to plan participants. The

following table includes information related to the Duke Energy Registrants’

contributions to its U.S. qualifi ed defi ned benefi t pension plans.

(in millions) Duke Energy

Duke Energy

Carolinas

Progress

Energy

Progress Energy

Carolinas

Progress

Energy Florida

Duke Energy

Ohio

Duke Energy

Indiana

Anticipated Contributions:

2013 $350 $ — $ 320 $ 94 $121 $ 18 $—

Contributions Made:

2012 $304 $ — $346 $141 $128 $— $—

2011 200 33 334 217 112 48 52

2010 400 158 129 95 34 45 46