Duke Energy 2012 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2012 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

63

PART II

Commodity Price Risk

The Duke Energy Registrants are exposed to the impact of market

fl uctuations in the prices of electricity, coal, natural gas and other energy-related

products marketed and purchased as a result of its ownership of energy related

assets. The Duke Energy Registrants’ exposure to these fl uctuations is limited

by the cost-based regulation of its U.S. Franchised Electric and Gas operations

as these regulated operations are typically allowed to recover substantially all

of these costs through various cost-recovery clauses, including fuel clauses.

While there may be a delay in timing between when these costs are incurred

and when these costs are recovered through rates, changes from year to year

generally do not have a material impact on operating results of these regulated

operations. At December 31, 2012, substantially all derivative commodity

instrument positions were subject to regulatory accounting treatment.

Price risk represents the potential risk of loss from adverse changes in

the market price of electricity or other energy commodities. The Duke Energy

Registrants’ exposure to commodity price risk is infl uenced by a number of

factors, including contract size, length, market liquidity, location and unique

or specifi c contract terms. The Duke Energy Registrants employ established

policies and procedures to manage the risks associated with these market

fl uctuations, which may include using various commodity derivatives, such as

swaps, futures, forwards and options. For additional information, see Note 15

to the Consolidated Financial Statements, “Risk Management, Derivative

Instruments and Hedging Activities.”

Validation of a contract’s fair value is performed by an internal group

separate from the Duke Energy Registrants’ deal origination areas. While

the Duke Energy Registrants use common industry practices to develop their

valuation techniques, changes in their pricing methodologies or the underlying

assumptions could result in signifi cantly different fair values and income

recognition.

Hedging Strategies.

The Duke Energy Registrants closely monitor the risks associated with

commodity price changes on their future operations and, where appropriate, use

various commodity instruments such as electricity, coal and natural gas forward

contracts to mitigate the effect of such fl uctuations on operations, in addition

to optimizing the value of the non regulated generation portfolio. Duke Energy’s

primary use of energy commodity derivatives is to hedge the generation portfolio

against exposure to the prices of power and fuel.

The majority of instruments used to manage the Duke Energy Registrants’

commodity price exposure are either not designated as a hedge or do not

qualify for hedge accounting. These instruments are referred to as undesignated

contracts. Mark-to-market changes for undesignated contracts entered into

by regulated businesses are refl ected as regulatory assets or liabilities on

the Consolidated Balance Sheets. Undesignated contracts entered into by

unregulated businesses are marked-to-market each period, with changes in the

fair value of the derivative instruments refl ected in earnings.

Certain derivatives used to manage the Duke Energy Registrants’

commodity price exposure are accounted for as either cash fl ow hedges or

fair value hedges. To the extent that instruments accounted for as hedges

are effective in offsetting the transaction being hedged, there is no impact to

the Consolidated Statements of Operations until after delivery or settlement

occurs. Accordingly, assumptions and valuation techniques for these contracts

have no impact on reported earnings prior to settlement to the extent they

are effective. Several factors infl uence the effectiveness of a hedge contract,

including the use of contracts with different commodities or unmatched terms

and counterparty credit risk. Hedge effectiveness is monitored regularly and

measured at least quarterly.

In addition to the hedge contracts described above and recorded on

the Consolidated Balance Sheets, the Duke Energy Registrants enter into other

contracts that qualify for the NPNS exception. When a contract meets the

criteria to qualify as an NPNS, the Duke Energy registrants apply such exception.

Income recognition and realization related to NPNS contracts generally

coincide with the physical delivery of power. For contracts qualifying for the

NPNS exception, no recognition of the contract’s fair value in the Consolidated

Financial Statements is required until settlement of the contract as long as the

transaction remains probable of occurring.

Generation Portfolio Risks.

The Duke Energy Registrants are primarily exposed to market price

fl uctuations of wholesale power, natural gas, and coal prices in the U.S.

Franchised Electric and Gas and Commercial Power segments. The Duke Energy

Registrants optimize the value of their wholesale and non regulated generation

portfolios. The portfolios include generation assets (power and capacity), fuel,

and emission allowances. Modeled forecasts of future generation output, fuel

requirements, and emission allowance requirements are based on forward

power, fuel and emission allowance markets. The component pieces of the

portfolio are bought and sold based on models and forecasts of generation in

order to manage the economic value of the portfolio in accordance with the

strategies of the business units. For Duke Energy Carolinas and Duke Energy

Indiana, as well as the Kentucky regulated generation owned by Duke Energy

Ohio, the generation portfolio not utilized to serve retail operations or committed

load is subject to commodity price fl uctuations, although the impact on the

Consolidated Statements of Operations is partially offset by mechanisms in

these regulated jurisdictions that result in the sharing of net profi ts from these

activities with retail customers. Duke Energy Ohio is subject to wholesale

commodity price risks for its non regulated generation portfolio. The non-

regulated generation portfolio dispatches all of their electricity into unregulated

markets and receives wholesale energy margins and capacity revenues from

PJM. Duke Energy Ohio has fully hedged its forecasted coal-fi red generation

for 2013. Capacity revenues are 100% contracted in PJM through May 2015.

International Energy generally hedges its expected generation using long-term

bilateral power sales contracts when favorable market conditions exist and it is

subject to wholesale commodity price risks for electricity not sold under such

contracts. International Energy dispatches electricity not sold under long-term

bilateral contracts into unregulated markets and receives wholesale energy

margins and capacity revenues from national system operators. Derivative

contracts executed to manage generation portfolio risks for delivery periods

beyond 2013 are also exposed to changes in fair value due to market price

fl uctuations of wholesale power, fuel oil and coal. See “Sensitivity Analysis for

Generation Portfolio and Derivative Price Risks” below, for more information

regarding the effect of changes in commodity prices on the Duke Energy

Registrants’ net income.

Other Commodity Risks.

At December 31, 2012, pre-tax income in 2013 was not expected to be

materially impacted for exposures to other commodities’ price changes.

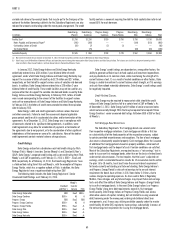

Sensitivity Analysis for Generation Portfolio and Derivative Price Risks.

The table below summarizes the estimated effect of commodity price

changes on the Duke Energy Registrants’ pre-tax net income, based on a

sensitivity analysis performed as of December 31, 2012 and December 31,

2011 for Duke Energy and Duke Energy Ohio. Forecasted exposure to commodity

price risk for Duke Energy Carolinas, Progress Energy Carolinas, Progress Energy

Florida and Duke Energy Indiana is not anticipated to have a material adverse

effect on their consolidated results of operations in 2013, based on a sensitivity

analysis performed as of December 31, 2012. The sensitivity analysis performed

as of December 31, 2011 related to forecasted exposure to commodity price

risk during 2012 also indicated that commodity price risk would not have a

material adverse effect on the consolidated results of operations of Duke Energy

Carolinas, Progress Energy Carolinas, Progress Energy Florida and Duke Energy

Indiana during 2012 and the impacts of changing commodity prices in their

consolidated results of operations for 2012 was insignifi cant. The following

commodity price sensitivity calculations consider existing hedge positions and

estimated production levels, as indicated in the table below, but do not consider

other potential effects that might result from such changes in commodity prices.