Duke Energy 2012 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2012 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

125

PART II

Combined Notes to Consolidated Financial Statements – (Continued)

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. • CAROLINA POWER & LIGHT COMPANY d/b/a PROGRESS ENERGY

CAROLINAS, INC. • FLORIDA POWER CORPORATION d/b/a PROGRESS ENERY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

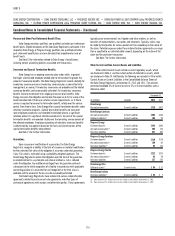

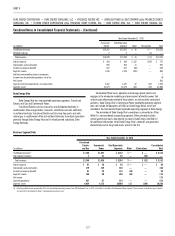

Year Ended December 31, 2010

(in millions) USFE&G

Commercial

Power

International

Energy

Total Reportable

Segments(a) Other Eliminations Total

Unaffi liated revenues $10,563 $2,440 $1,204 $14,207 $ 65 $ — $14,272

Intersegment revenues 34 8 — 42 53 (95) —

Total revenues $10,597 $2,448 $1,204 $14,249 $ 118 $(95) $14,272

Interest expense $ 569 $ 68 $ 71 $ 708 $ 132 $ — $ 840

Depreciation and amortization 1,386 225 86 1,697 89 — 1,786

Equity in earnings of unconsolidated affi liates — 7 102 109 7 — 116

Income tax expense (benefi t) 787 22 143 952 (62) — 890

Segment income(a)(b)(c) 1,380 (327) 305 1,358 (41) — 1,317

Add back noncontrolling interest component 3

Income from discontinued operations, net of tax 3

Net income 1,323

Capital investments expenditures and acquisitions 3,891 525 181 4,597 258 — 4,855

Segment assets 45,210 6,704 4,310 56,224 2,845 21 59,090

(a) Commercial Power recorded an impairment charge of $602 million, which consisted of a $500 million goodwill impairment charge associated with the nonregulated Midwest generating operations and a $102 million charge,

net of tax of $58 million, to write-down the value of certain nonregulated Midwest generating assets and emission allowances primarily associated with these generation assets.

(b) Other includes expense of $105 million, net of tax of $67 million, related to the 2010 voluntary severance plan and the consolidation of certain corporate offi ce functions from the Midwest to Charlotte, North Carolina. See Note

21 for additional information.

(c) Other recognized an $86 million gain, net of tax of $53 million, from the sale of a 50% ownership interest in DukeNet (See Note 2 for additional information), and $68 million gain, net of tax of $41 million, from the sale of an

equity method investment in Q-Comm Corporation (Q-Comm). See Note 13 for additional information.

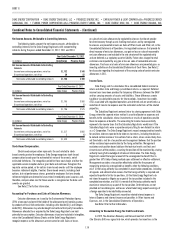

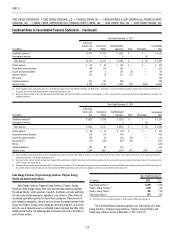

Geographic Data

(in millions) U.S.

Latin

Amereica(a) Consolidated

2012

Consolidated revenues $18,078 $1,546 $19,624

Consolidated long-lived assets 79,144 2,467 81,611

2011

Consolidated revenues $13,062 $1,467 $14,529

Consolidated long-lived assets 45,920 2,612 48,532

2010

Consolidated revenues $13,068 $1,204 $14,272

Consolidated long-lived assets 42,754 2,733 45,487

(a) Change in amounts of long-lived assets in Latin America includes foreign currency translation

adjustments on property, plant and equipment and other long-lived asset balances.

Progress Energy

Effective with the consummation of the merger with Duke Energy on July 2,

2012, Progress Energy’s reportable segments changed based on the fi nancial

information the chief decision maker evaluates for the allocation of resources

and assessing performance. Progress Energy’s sole reportable segment is now

Franchised Electric, which is primarily engaged in the generation, transmission,

distribution and sale of electricity in portions of North Carolina, South Carolina

and Florida. These electric operations also distribute and sell electricity to other

utilities, primarily on the east coast of the United States. The remainder of

Progress Energy’s operations is presented as Other. While it is not considered

an operating segment, Other primarily includes the Progress Energy holding

company and Progress Energy Service Company, LLC and other miscellaneous

nonregulated businesses, as well as costs to achieve the merger with Duke

Energy and certain governance costs allocated by its parent, Duke Energy. See

Note 14 for additional information. Also effective with the consummation of the

merger, management began evaluating segment performance based on Segment

Income. Segment Income is defi ned as income from continuing operations net of

income attributable to noncontrolling interests.

Prior periods’ segment information has been recast to conform to the

current year presentation. None of these segment changes impact Progress

Energy’s previously reported consolidated net income.