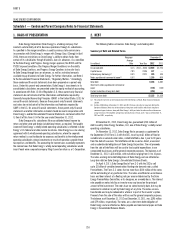

Duke Energy 2012 Annual Report Download - page 267

Download and view the complete annual report

Please find page 267 of the 2012 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

247

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. • CAROLINA POWER & LIGHT COMPANY d/b/a PROGRESS ENERGY

CAROLINAS, INC. • FLORIDA POWER CORPORATION d/b/a PROGRESS ENERY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC

.

Combined Notes to Consolidated Financial Statements – (Continued)

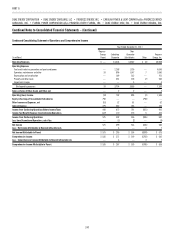

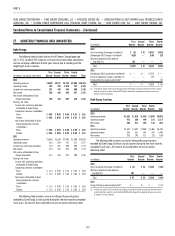

27. QUARTERLY FINANCIAL DATA (UNAUDITED)

Duke Energy

The following table includes the results of Progress Energy beginning

July 2, 2012. Quarterly EPS amounts are meant to be stand-alone calculations

and are not always additive to the full-year amount due to rounding and the

weighting of share issuances.

(in millions, except per share data)

First

Quarter

Second

Quarter

Third

Quarter

Fourth

Quarter Total

2012

Operating revenues $3,630 $3,577 $6,722 $5,695 $19,624

Operating income 495 786 1,078 767 3,126

Income from continuing operations 297 449 594 406 1,746

Net income 299 448 598 437 1,782

Net income attributable to Duke

Energy Corporation 295 444 594 435 1,768

Earnings per share:

Income from continuing operations

attributable to Duke Energy

Corporation common shareholders

Basic $ 0.66 $ 0.99 $ 0.84 $ 0.57 $ 3.01

Diluted $ 0.66 $ 0.99 $ 0.84 $ 0.57 $ 3.01

Net income attributable to Duke

Energy Corporation common

shareholders

Basic $ 0.66 $ 0.99 $ 0.85 $ 0.62 $ 3.07

Diluted $ 0.66 $ 0.99 $ 0.85 $ 0.62 $ 3.07

2011

Operating revenues $3,663 $3,534 $3,964 $3,368 $14,529

Operating income 814 679 767 517 2,777

Income from continuing operations 513 441 469 290 1,713

Net income 513 441 470 290 1,714

Net income attributable to Duke

Energy Corporation 511 435 472 288 1,706

Earnings per share:

Income from continuing operations

attributable to Duke Energy

Corporation common shareholders

Basic $ 1.15 $ 0.98 $ 1.06 $ 0.65 $ 3.83

Diluted $ 1.15 $ 0.98 $ 1.06 $ 0.65 $ 3.83

Net income attributable to Duke

Energy Corporation common

shareholders

Basic $ 1.15 $ 0.98 $ 1.06 $ 0.65 $ 3.83

Diluted $ 1.15 $ 0.98 $ 1.06 $ 0.65 $ 3.83

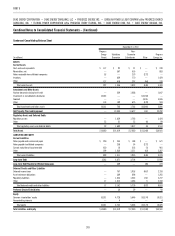

The following table includes unusual or infrequently occurring items

recorded by Duke Energy in each quarter during the two most recently completed

fi scal years. All amounts discussed below are pre-tax unless otherwise noted.

(in millions)

First

Quarter

Second

Quarter

Third

Quarter

Fourth

Quarter

2012

Costs to achieve the merger (see Note 2) $ (8) $ (7) $(457) $(164)

Edwardsport IGCC charges (see Note 4) (420) — (180) (28)

Voluntary Opportunity Plan deferral

(see Note 21) 101 — — —

Total $(327) $ (7) $(637) $(192)

2011

Edwardsport IGCC impairment (see Note 4) $ — $— $(222) $ —

Emission allowance charges (see Note 12) — — (79) —

Energy effi ciency revenue adjustment(a) — — — 59

Total $ — $— $(301) $ 59

(a) In the fourth quarter of 2011, Duke Energy recorded $59 million of previously deferred revenue resulting

from the receipt of an order from the NCUC which allowed the recognition of revenue in excess of

amounts billed to customers.

Duke Energy Carolinas

(in millions)

First

Quarter

Second

Quarter

Third

Quarter

Fourth

Quarter Total

2012

Operating revenues $1,501 $1,616 $1,939 $1,609 $6,665

Operating income 475 386 440 216 1,517

Net income 266 211 258 130 865

2011

Operating revenues $1,552 $1,607 $1,868 $1,466 $6,493

Operating income 363 331 541 245 1,480

Net income 205 193 311 125 834

The following table includes unusual or infrequently occurring items

recorded by Duke Energy Carolinas in each quarter during the two most recently

completed fi scal years. All amounts discussed below are pre-tax unless

otherwise noted.

(in millions)

First

Quarter

Second

Quarter

Third

Quarter

Fourth

Quarter

2012

Costs to achieve the merger (see Note 2) $ (4) $ (5) $(184) $(46)

Voluntary Opportunity Plan deferral

(see Note 21) 101 — — —

Total $ 97 $ (5) $(184) $(46)

2011

Energy effi ciency revenue adjustment(a) $ — $— $ — $ 59

(a) In the fourth quarter of 2011, Duke Energy Carolinas recorded $59 million of previously deferred revenue

resulting from the receipt of an order from the NCUC which allowed the recognition of revenue in excess

of amounts billed to customers.