Duke Energy 2012 Annual Report Download - page 176

Download and view the complete annual report

Please find page 176 of the 2012 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

156

PART II

Combined Notes to Consolidated Financial Statements – (Continued)

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. • CAROLINA POWER & LIGHT COMPANY d/b/a PROGRESS ENERGY

CAROLINAS, INC. • FLORIDA POWER CORPORATION d/b/a PROGRESS ENERY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

registration statement. However, we do not expect the Progress Energy, Inc. to

issue any new securities of these types in the future. Under Progress Energy

Carolinas’ and Progress Energy Florida’s registration statements, they may issue

various long-term debt securities and preferred stock.

At December 31, 2012 and 2011, $734 million and $2.0 billion, respectively,

of debt issued by Duke Energy Carolinas was guaranteed by Duke Energy.

On November 13, 2012, Duke Energy fi led a prospectus supplement to

the September 2010 Form S-3 with the SEC, to sell up to $1 billion of fi xed

or variable rate unsecured senior notes, called InterNotes, due one year to

30 years from the date of issuance. The InterNotes will be issued as direct,

unsecured and unsubordinated obligations of Duke Energy Corporation. The net

proceeds from the sale of InterNotes will be used to fund capital expenditures

in our unregulated businesses and for general corporate purposes. The balance

as of December 31, 2012 is $36 million, with maturities ranging from 10 to

14 years. The notes are long-term debt obligations of Duke Energy and are

refl ected as Long-term debt on Duke Energy’s Consolidated Balance Sheets.

On April 4, 2011, Duke Energy fi led a Form S-3 with the SEC to sell

up to $1 billion of variable denomination fl oating rate demand notes, called

PremierNotes. The Form S-3 states that no more than $500 million of the notes

will be outstanding at any particular time. The notes are offered on a continuous

basis and bear interest at a fl oating rate per annum determined by the Duke

Energy PremierNotes Committee, or its designee, on a weekly basis. The interest

rate payable on notes held by an investor may vary based on the principal

amount of the investment. The notes have no stated maturity date, but may

be redeemed in whole or in part by Duke Energy at any time. The notes are

non-transferable and may be redeemed in whole or in part at the investor’s

option. Proceeds from the sale of the notes will be used for general corporate

purposes. The balance as of December 31, 2012 and December 31, 2011, was

$395 million and $79 million, respectively. The notes are a short-term debt

obligation of Duke Energy and are refl ected as Notes payable and commercial

paper on Duke Energy’s Consolidated Balance Sheets.

In January 2013, Duke Energy issued $500 million of unsecured junior

subordinated debentures, which carry a fi xed interest rate of 5.125%, are

callable at par after fi ve years and mature January 15, 2073. Proceeds from the

issuance were used to redeem at par $300 million of 7.10% junior subordinated

debt in February 2013, with the remainder to repay a portion of commercial

paper at it matures, to fund capital expenditures of our unregulated businesses

and for general corporate purposes.

Money Pool

The Subsidiary Registrants receive support for their short-term borrowing

needs through participation with Duke Energy and certain of its subsidiaries in a

money pool arrangement. Under this arrangement, those companies with short-

term funds may provide short-term loans to affi liates participating under this

arrangement. The money pool is structured such that the Subsidiary Registrants

separately manage their cash needs and working capital requirements.

Accordingly, there is no net settlement of receivables and payables between the

money pool participants. Per the terms of the money pool arrangement the parent

company, Duke Energy, may loan funds to its participating subsidiaries, but may

not borrow funds through the money pool. Accordingly, as the money pool activity

is between Duke Energy and its wholly owned subsidiaries, all money pool

balances are eliminated within Duke Energy’s Consolidated Balance Sheets.

Prior to the merger with Duke Energy, Progress Energy’s subsidiaries

participated in internal money pools, administered by Progress Energy Service

Company, LLC, to more effectively utilize cash resources and reduce external

short-term borrowings. The utility money pool allowed Progress Energy Carolinas

and Progress Energy Florida to lend to and borrow from each other. The non-utility

money pool allowed unregulated operations to lend to and borrow from each

other. The Progress Energy parent could lend money to the utility and non-utility

money pools but could not borrow funds.

Money pool receivable balances are refl ected within Notes receivable from

affi liated companies on the respective Subsidiary Registrants’ Consolidated

Balance Sheets and money pool payable balances are refl ected within either

Notes payable to affi liated companies or Long-term debt payable to affi liated

companies on the respective Consolidated Balance Sheets.

Increases or decreases in money pool receivables are refl ected within

investing activities on the respective Subsidiary Registrants’ Consolidated

Statements of Cash Flows, while increases or decreases in money pool

borrowings are refl ected within fi nancing activities on the respective Subsidiary

Registrants Consolidated Statements of Cash Flows.

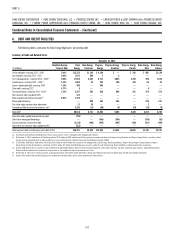

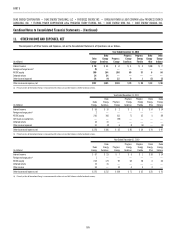

Maturities and Call Options

December 31, 2012

(in millions) Duke Energy(a)

Duke

Energy

Carolinas

Progress

Energy

Progress

Energy

Carolinas

Progress

Energy

Florida

Duke

Energy

Ohio

Duke

Energy

Indiana

2013 $ 3,098 $ 406 $ 843 $ 407 $ 435 $ 261 $ 405

2014 2,196 346 312 2 11 47 5

2015 2,478 506 1,262 701 561 7 5

2016 2,184 655 313 2 11 56 480

2017 1,321 116 311 51 261 2 3

Thereafter 25,873 6,712 11,387 3,677 4,041 1,624 2,804

Total long-term debt, including current maturities $37,150 $8,741 $ 14,428 $4,840 $5,320 $1,997 $3,702

(a) At December 31, 2012, capital leases of Duke Energy included $158 million and $907 million of capital lease purchase accounting adjustments for Progress Energy Carolinas and Progress Energy Florida, respectively, related

to power purchase agreements that are not accounted for as leases on their fi nancial statements because of grandfathering provisions in GAAP.