Duke Energy 2012 Annual Report Download - page 273

Download and view the complete annual report

Please find page 273 of the 2012 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

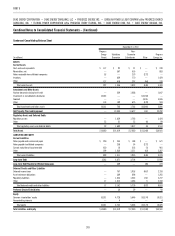

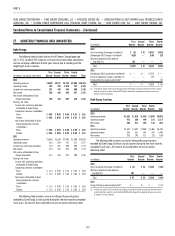

PART II

253

DUKE ENERGY CORPORATION

Schedule I — Condensed Parent Company Notes to Financial Statements

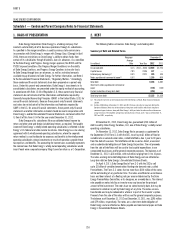

1. BASIS OF PRESENTATION

Duke Energy Corporation (Duke Energy) is a holding company that

conducts substantially all of its business operations through its subsidiaries.

As specifi ed in the merger conditions issued by various state commissions

in connection with Duke Energy’s merger with Cinergy Corp. (Cinergy) in April

2006, there are restrictions on Duke Energy’s ability to obtain funds from

certain of its subsidiaries through dividends, loans or advances. As a condition

to the Duke Energy and Progress Energy merger approval, the NCUC and the

PSCSC imposed conditions (the Progress Merger Conditions) on the ability

of Duke Energy Carolinas, and Progress Energy Carolinas to transfer funds

to Duke Energy through loans or advances, as well as restricted amounts

available to pay dividends to Duke Energy. For further information, see Note 4

to the Consolidated Financial Statements, “Regulatory Matters.” Accordingly,

these condensed fi nancial statements have been prepared on a parent-only

basis. Under this parent-only presentation, Duke Energy’s investments in its

consolidated subsidiaries are presented under the equity method of accounting.

In accordance with Rule 12-04 of Regulation S-X, these parent-only fi nancial

statements do not include all of the information and footnotes required by

Generally Accepted Accounting Principles (GAAP) in the United States (U.S.) for

annual fi nancial statements. Because these parent-only fi nancial statements

and notes do not include all of the information and footnotes required by

GAAP in the U.S. for annual fi nancial statements, these parent-only fi nancial

statements and other information included should be read in conjunction with

Duke Energy’s audited Consolidated Financial Statements contained within Part

II, Item 8 of this Form 10-K for the year ended December 31, 2012.

Duke Energy and its subsidiaries fi le a consolidated federal income tax

return and other state and foreign jurisdictional returns as required. The taxable

income of Duke Energy’s wholly owned operating subsidiaries is refl ected in Duke

Energy’s U.S. federal and state income tax returns. Duke Energy has a tax sharing

agreement with its wholly owned operating subsidiaries, where the separate

return method is used to allocate tax expenses and benefi ts to the wholly owned

operating subsidiaries whose investments or results of operations provide these

tax expenses and benefi ts. The accounting for income taxes essentially represents

the income taxes that Duke Energy’s wholly owned operating subsidiaries would

incur if each were a separate company fi ling its own tax return as a C-Corporation.

2. DEBT

The following table summarizes Duke Energy’s outstanding debt.

Summary of Debt and Related Terms

Weighted-

Average

Rate

December 31,

(in millions) Year Due 2012 2011

Unsecured debt 4.1 % 2013 – 2026 $4,929 $3,773

Capital leases 7.8 % 2046 127 —

Intercompany borrowings(a) 0.5 % 2021 105 105

Notes payable and commercial paper(b) 0.5 % 1,195 604

Total debt 6,356 4,482

Short-term notes payable and commercial

paper (745) (154)

Current maturities of long-term debt (256) —

Total long-term debt $5,355 $4,328

(a) This amount represents an intercompany loan with Duke Energy’s affi liate, Bison Insurance Company

Limited.

(b) Includes $450 million at December 31, 2012 and 2011 that was classifi ed as Long-term Debt on the

Condensed Balance Sheets due to the existence of long-term credit facilities which back-stop these

commercial paper balances, along with Duke Energy’s ability and intent to refi nance these balances on

a long-term basis. The weighted-average days to maturity was 18 days and 17 days as of December 31,

2012 and 2011, respectively.

At December 31, 2012, Duke Energy has guaranteed $734 million of

debt issued by Duke Energy Carolinas, LLC, one of Duke Energy’s wholly owned

operating subsidiaries.

On November 13, 2012, Duke Energy fi led a prospectus supplement to

the September 2010 Form S-3 with the SEC, to sell up to $1 billion of fi xed or

variable rate unsecured senior notes, called InterNotes, due 1 year to 30 years

from the date of issuance. The InterNotes will be issued as direct, unsecured

and unsubordinated obligations of Duke Energy Corporation. The net proceeds

from the sale of InterNotes will be used to fund capital expenditures in our

unregulated businesses and for general corporate purposes. The balance as of

December 31, 2012 is $36 million, with maturities ranging from 10 to 14 years.

The notes are long-term debt obligations of Duke Energy and are refl ected as

Long-term debt on Duke Energy’s Consolidated Balance Sheets.

On April 4, 2011, Duke Energy fi led a Form S-3 with the SEC to sell

up to $1 billion of variable denomination fl oating rate demand notes, called

PremierNotes. The Form S-3 states that no more than $500 million of the notes

will be outstanding at any particular time. The notes are offered on a continuous

basis and bear interest at a fl oating rate per annum determined by the Duke

Energy PremierNotes Committee, or its designee, on a weekly basis. The interest

rate payable on notes held by an investor may vary based on the principal

amount of the investment. The notes have no stated maturity date, but may be

redeemed in whole or in part by Duke Energy at any time. The notes are non-

transferable and may be redeemed in whole or in part at the investor’s option.

Proceeds from the sale of the notes will be used for general corporate purposes.

The balance as of December 31, 2012 and December 31, 2011, was $395 million

and $79 million, respectively. The notes are a short-term debt obligation of

Duke Energy and are refl ected as Notes payable and commercial paper on Duke

Energy’s Consolidated Balance Sheets.