Duke Energy 2012 Annual Report Download - page 201

Download and view the complete annual report

Please find page 201 of the 2012 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

181

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. • CAROLINA POWER & LIGHT COMPANY d/b/a PROGRESS ENERGY

CAROLINAS, INC. • FLORIDA POWER CORPORATION d/b/a PROGRESS ENERY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC

.

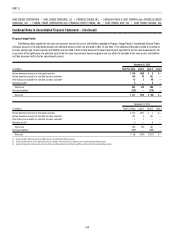

Combined Notes to Consolidated Financial Statements – (Continued)

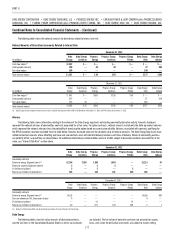

Foreign equity prices are translated from their trading currency using the currency

exchange rate in effect at the close of the principal active market. Prices have not

been adjusted to refl ect for after-hours market activity. The majority of investments

in equity securities are valued using Level 1 measurements. For certain

investments that are valued on a net asset value per share (or its equivalent),

or the net asset value basis, when the Duke Energy Registrants do not have the

ability to redeem the investment in the near term at net asset value per share (or

its equivalent), or the net asset value is not available as of the measurement date,

the fair value measurement of the investment is categorized as Level 3.

Investments in available-for-sale auction rate securities.

Duke Energy and Duke Energy Carolinas hold auction rate securities

for which an active market does not currently exist. During the year ended

December 31, 2012, $55 million of these investments in auction rate securities

were redeemed at full par value plus accrued interest. Auction rate securities

held are student loan securities for which at December 31, 2012 approximately

84% is ultimately backed by the U.S. government. At December 31, 2012,

approximately 24% of these securities are AAA rated. As of December 31,

2012, and 2011 all of these auction rate securities are classifi ed as long-term

investments and are valued using Level 3 measurements. The methods and

signifi cant assumptions used to determine the fair values of the investment in

auction rate debt securities represent estimations of fair value using internal

discounted cash fl ow models which incorporate primarily management’s own

assumptions as to the term over which such investments will be recovered at

par (ranging from 7 to 17 years), the current level of interest rates (less than

0.3%), and the appropriate risk-adjusted discount rates (up to 4.2% refl ecting a

tenor of up to 17 years). In preparing the valuations, all signifi cant value drivers

were considered, including the underlying collateral (primarily evaluated on the

basis of credit ratings, parity ratios and the percentage of loans backed by the

U.S. government).

There were no other-than-temporary impairments associated

with investments in auction rate debt securities during the years ended

December 31, 2012 or 2011.

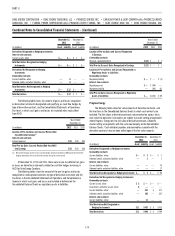

Investments in debt securities.

Most debt investments, including those held in the Nuclear

Decommissioning Trust Funds (NDTF), are valued based on a calculation using

interest rate curves and credit spreads applied to the terms of the debt instrument

(maturity and coupon interest rate) and consider the counterparty credit rating.

Most debt valuations are Level 2 measurements. If the market for a particular

fi xed income security is relatively inactive or illiquid, the measurement is a Level 3

measurement. U.S. Treasury debt is typically a Level 1 measurement.

Commodity derivatives.

The pricing for commodity derivatives is primarily a calculated value

which incorporates the forward price and is adjusted for liquidity (bid-ask

spread), credit or non-performance risk (after refl ecting credit enhancements

such as collateral) and discounted to present value. The primary difference

between a Level 2 and a Level 3 measurement relates to the level of activity

in forward markets for the commodity. If the market is relatively inactive, the

measurement is deemed to be a Level 3 measurement. Commodity derivatives

with clearinghouses are classifi ed as Level 1 measurements. For commodity

derivative contracts classifi ed as Level 3, Duke Energy utilizes internally-

developed fi nancial models based upon the income approach (discounted cash

fl ow method) are utilized to measure the fair values. The primary inputs to

these models are the forward commodity prices used to develop the forward

price curves for the respective instrument. The pricing inputs are derived from

published exchange transaction prices and other observable or public data

sources. In the absence of observable market information that supports the

pricing inputs, there is a presumption that the transaction price is equal to

the last observable price for a similar period. For the commodity derivative

contracts classifi ed as Level 3, the pricing inputs for natural gas and electricity

forward price curves are not observable for the full term of the related contracts.

In isolation, increases (decreases) in unobservable natural gas forward prices

would result in favorable (unfavorable) fair value adjustments for gas purchase

contracts. In isolation, increases (decreases) in unobservable electricity

forward prices would result in unfavorable (favorable) fair value adjustments

for electricity sales contracts. Duke Energy regularly evaluates and validates the

pricing inputs used to estimate fair value of gas purchase contracts by a market

participant price verifi cation procedure, which provides a comparison of internal

forward commodity curves to market participant generated curves.

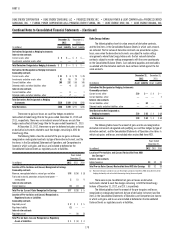

Contingent Value Obligations (CVO).

Progress Energy issued CVOs, which are derivatives, in connection

with the acquisition of Florida Progress Corporation (Florida Progress). In

November 2011, Progress Energy commenced a public tender offer that expired

on February 15, 2012. At December 31, 2012, and 2011 all CVOs not tendered,

have been classifi ed as Level 2 based on observable prices in the less-than-

active market.

In connection with the acquisition of Florida Progress during 2000, the

Progress Energy parent issued 98.6 million CVOs. Each CVO represents the

right of the holder to receive contingent payments based on the performance

of four coal-based solid synthetic fuels limited liability companies purchased

by subsidiaries of Florida Progress in October 1999. All of Progress Energy’s

synthetic fuels businesses were abandoned and all operations ceased as of

December 31, 2007. The payments are based on the net after-tax cash fl ows

the facilities generated. Progress Energy makes deposits into a CVO trust

for estimated contingent payments due to CVO holders based on the results

of operations and the utilization of tax credits. The balance of the CVO trust

at December 31, 2012 and 2011, was $11 million and is included in Other

within Investments and Other Assets on the Consolidated Balance Sheets.

Future payments from the trust to CVO holders will not be made until certain

conditions are satisfi ed and will include principal and interest earned during the

investment period, net of expenses deducted. Interest earned on the payments

held in trust for 2012 and 2011 were insignifi cant.

In October 2011, Progress Energy entered a settlement agreement and

release with a plaintiff under which the parties mutually released all claims

related to the CVOs and Progress Energy purchased all of the plaintiff’s CVOs

at a negotiated purchase price of $0.75 per CVO. In November 2011, Progress

Energy also commenced a tender offer for all remaining outstanding CVOs at the

same purchase price. The tender offer expired on February 15, 2012. Progress

Energy repurchased 83.4 million CVOs through the settlement agreement or

through the tender offer. The CVOs are derivatives and are recorded at fair value.

In 2011, pre-tax losses of $59 million from changes in fair value were recorded

in Other Income and Expenses, net on the Consolidated Statements of Income.

At December 31, 2012, the CVO liability included in Other within Deferred

Credits and Other Liabilities on the Consolidated Balance Sheets was $4 million

based on the 15.2 million outstanding CVOs not held by the Progress Energy

parent. At December 31, 2011, the CVO liability included in Other within Current

Liabilities on the Consolidated Balance Sheets was $14 million based on the

18.5 million CVOs outstanding not held by the Progress Energy parent.