Duke Energy 2012 Annual Report Download - page 223

Download and view the complete annual report

Please find page 223 of the 2012 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

203

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. • CAROLINA POWER & LIGHT COMPANY d/b/a PROGRESS

ENERGY CAROLINAS, INC. • FLORIDA POWER CORPORATION d/b/a PROGRESS ENERY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

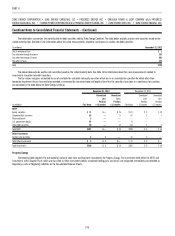

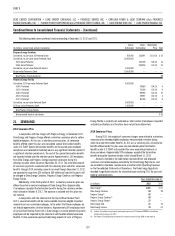

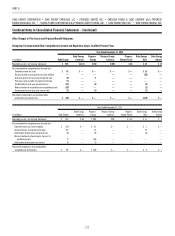

Non-consolidated VIEs

The tables below show the VIEs that the Duke Energy Registrants do not consolidate and how these entities impact the Duke Energy Registrants respective

Consolidated Balance Sheets. As discussed above, while Duke Energy consolidated CRC, Duke Energy Ohio and Duke Energy Indiana do not consolidate CRC as they

are not the primary benefi ciary.

Duke Energy

(in millions) DukeNet Renewables

FPC Capital I

Trust(a) Other Total

Duke Energy

Ohio

Duke Energy

Indiana

December 31, 2012

Receivables $ — $ — $ — $ — $ — $ 97 $116

Investments in equity method unconsolidated affi liates 118 147 — 27 292 — —

Intangibles — — — 104 104 104 —

Investments and other assets —— 9211——

Total assets 118 147 9 133 407 201 116

Other current liabilities —— —33——

Deferred credits and other liabilities — — 319 17 336 — —

Total liabilities — — 319 20 339 — —

Net assets (liabilities) $118 $147 $(310) $113 $ 68 $201 $116

(a) The entire balance of Investments and other assets and $274 million of the Deferred Credits and Other Liabilities balance applies to Progress Energy.

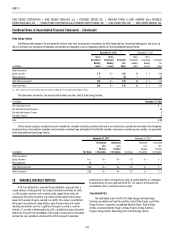

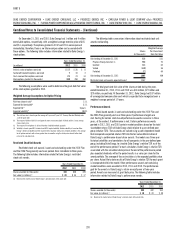

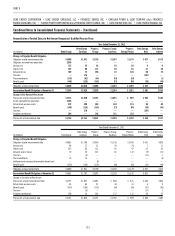

Duke Energy

(in millions) DukeNet Renewables Other Total

Progress

Energy

Duke Energy

Ohio

Duke Energy

Indiana

December 31, 2011

Receivables $ — $— $ — $ — $ — $129 $139

Investments in equity method unconsolidated affi liates 129 81 25 235 9 — —

Intangibles — — 111 111 — 111 —

Total assets 129 81 136 346 9 240 139

Other current liabilities — — 3 3 — — —

Deferred credits and other liabilities — — 18 18 273 — —

Total liabilities — — 21 21 273 — —

Net assets $129 $ 81 $115 $325 $(264) $240 $139

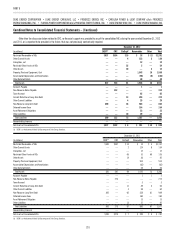

No fi nancial support that was not previously contractually required was

provided to any of the unconsolidated VIEs during the years ended December 31,

2012 and 2011, respectively, or is expected to be provided in the future.

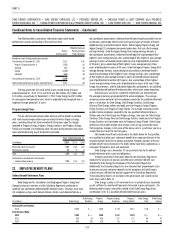

With the exception of the power purchase agreement with the Ohio Valley

Electric Corporation (OVEC), which is discussed below, and various guarantees,

refl ected in the table above as “Deferred Credits and Other Liabilities,” the

Duke Energy Registrants are not aware of any situations where the maximum

exposure to loss signifi cantly exceeds the carrying values shown above.

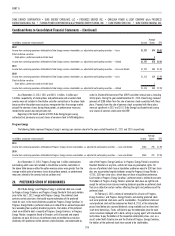

DukeNet.

In 2010, Duke Energy sold a 50% ownership interest in DukeNet to Alinda.

The sale resulted in DukeNet becoming a joint venture with Duke Energy and

Alinda each owning a 50% interest. In connection with the formation of the

new DukeNet joint venture, a 5-year, $150 million senior secured credit facility

was executed with a syndicate of 10 external fi nancial institutions. This credit

facility is non-recourse to Duke Energy. DukeNet is considered a VIE because it

has entered into certain contractual arrangements that provide DukeNet with

additional forms of subordinated fi nancial support. The most signifi cant activities

that impact DukeNet’s economic performance relate to its business development

and fi ber optic capacity marketing and management activities. The power to

direct these activities is jointly and equally shared by Duke Energy and Alinda. As

a result, Duke Energy does not consolidate the DukeNet. Accordingly, DukeNet is

a non-consolidated VIE that is reported as an equity method investment.

Unless consent by Duke Energy is given otherwise, Duke Energy and its

subsidiaries have no requirement to provide liquidity, purchase the assets of

DukeNet, or guarantee performance.

Renewables.

Duke Energy has investments in various entities that generate electricity

through the use of renewable energy technology. Some of these entities are

VIEs which are not consolidated due to the joint ownership of the entities when

they were created and the power to direct and control key activities is shared

jointly. Instead, Duke Energy’s investment is recorded under the equity method of

accounting. These entities are VIEs due to power purchase agreements with terms

that approximate the expected life of the project. These fi xed price agreements

effectively transfer the commodity price risk to the buyer of the power.