Duke Energy 2012 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2012 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

33

PART II

Immediately preceding the merger, Duke Energy completed a one-for-three

reverse stock split with respect to the issued and outstanding shares of Duke

Energy common stock. The shareholders of Duke Energy approved the reverse

stock split at Duke Energy’s special meeting of shareholders held on August 23,

2011. All share and per share amounts presented herein refl ect the impact of

the one-for-three reverse stock split.

Progress Energy’s shareholders received 0.87083 shares of Duke Energy

common stock in exchange for each share of Progress Energy common stock

outstanding as of July 2, 2012. Generally, all outstanding Progress Energy

equity-based compensation awards were converted into Duke Energy equity-

based compensation awards using the same ratio. The merger was structured

as a tax-free exchange of shares.

For additional information on the details of this transaction including

regulatory conditions and accounting implications, see Note 2 to the

Consolidated Financial Statements, “Acquisitions and Dispositions of

Businesses and Sales of Other Assets.”

2012 Financial Results

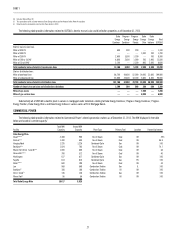

The following table summarizes adjusted earnings and net income

attributable to Duke Energy for the years ended December 31, 2012, 2011

and 2010.

Years Ended December 31,

2012 2011 2010

(in millions,

except per

share amounts) Amount

Per

diluted

share Amount

Per

diluted

share Amount

Per

diluted

share

Adjusted

earnings(a) $2,483 $4.32 $1,943 $4.38 $1,882 $4.29

Net income

attributable to

Duke Energy $1,768 $3.07 $1,706 $3.83 $1,320 $3.00

(a) See Results of Operations below for Duke Energy’s defi nition of adjusted earnings as well as a

reconciliation of this non-GAAP fi nancial measure to net income attributable to Duke Energy.

Adjusted earnings increased from 2011 to 2012 primarily due to the

inclusion of Progress Energy results beginning in July 2012, and the impact of

the 2011 Duke Energy Carolinas rate cases. Adjusted earnings increased from

2010 to 2011 primarily due to earnings attributable to Duke Energy’s ongoing

modernization program and increased results at International Energy net of less

favorable weather and higher operating expenses.

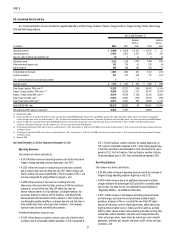

Net income for the year ended December 31, 2012 includes pretax

impairment and other charges of $628 million related to the Edwardsport

integrated gasifi cation combined cycle (IGCC) project and costs to achieve

the Progress Energy merger of $636 million. Net income for the year ended

December 31, 2011 includes pretax impairment charges of $222 million

related to the Edwardsport IGCC project and $79 million to write down the

carrying value of excess emission allowances held by Commercial Power to

fair value. Net income for the year ended December 31, 2010 was impacted

by goodwill and other impairment charges of $660 million, primarily related

to the nonregulated generation operations in the Midwest and gains on the

sale of assets of $248 million related to the sale of Q-Comm and the sale of

a 50 percent interest in DukeNet.

See “Results of Operations” below for a detailed discussion of the

consolidated results of operations, as well as a detailed discussion of fi nancial

results for each of Duke Energy’s reportable business segments, as well as Other.

2012 Areas of Focus and Accomplishments

In 2012, Duke Energy was focused on managing regulatory approvals

related to the merger with Progress Energy, completing its remaining major

capital projects and obtaining constructive regulatory outcomes.

Regulatory Approvals Related to the Merger with Progress Energy.

In June 2012, the FERC and NCUC conditionally approved Duke Energy’s

merger with Progress Energy. On July 2, 2012, Duke Energy successfully closed

the merger with Progress Energy. See Note 2 to the Consolidated Financial

Statements, “Acquisitions and Dispositions of Businesses and Sales of Other

Assets” for further discussion related to the merger with Progress Energy.

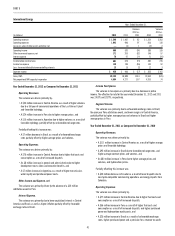

Completion and Placing in Service of Major Capital Projects. In

2012, U.S. Franchised Electric and Gas (USFE&G) made signifi cant progress

toward advancing its fl eet modernization program. Duke Energy Carolinas has

invested approximately $3.5 billion through 2012 in three key generation fl eet

modernization projects with approximately 2,065 megawatts (MW) of capacity.

In 2012, Duke Energy Carolinas placed its 620 MW Dan River combined cycle

natural gas-fi red generation facility and its 825 MW coal-fi red Cliffside Unit 6

in service, completing its portion of the fl eet modernization program.

Progress Energy Carolinas has invested approximately $1.7 billion through

2012 in three key generation fl eet modernization projects with approximately

2,140 megawatts (MW) of capacity. In 2012, Progress Energy Carolinas placed

in service the second of these projects, the 920 MW Lee combined cycle natural

gas-fi red generation facility, and continued to construct the 625 MW combined cycle

natural gas-fi red generation Sutton facility, which is 64% complete at December 31,

2012. The Sutton project is scheduled to be placed in service in 2013.

Duke Energy Indiana has invested approximately $3.4 billion through

2012 in its generation fl eet modernization project, the 618 MW Edwardsport

IGCC plant, which is 99% complete at December 31, 2012. In 2012, Duke

Energy Indiana experienced cost pressures and regulatory scrutiny related

to the Edwardsport IGCC project. As a result, Duke Energy Indiana recorded

additional pre-tax impairment and other charges of approximately $628 million.

This project is scheduled to be placed in service during 2013. See Note 4 to the

Consolidated Financial Statements, “Regulatory Matters” for further discussion

of the Edwardsport IGCC project.

In 2012, Commercial Power completed fi ve new wind farms and three

solar farms, totaling approximately 800 MW, of which 150 MW were contributed

to a joint venture with Sumitomo Corporation of America.

Obtaining Constructive Regulatory Outcomes. In 2012, Duke Energy

successfully fi led three rate cases in North Carolina and Ohio, including

Progress Energy Carolinas’ fi rst request for a base rate increase in 25 years.

In the fourth quarter of 2012, Duke Energy reached a settlement

agreement with the NCUC, the North Carolina Public Staff and the North

Carolina Department of Justice (NCDOJ) regarding the NCUC’s and NCDOJ’s

investigations into the post-merger CEO change. The settlement agreements

resolve all matters related to the NCUC and NCDOJ investigations.

On December 27, 2012, the Indiana Utility Regulatory Commission (IURC)

approved a settlement agreement fi nalized in April 2012, between Duke Energy

Indiana, the OUCC, the Duke Energy Indiana Industrial Group and Nucor Steel-

Indiana, on the cost increase for the construction of the project. The settlement

agreement, as approved, caps costs to be refl ected in customer rates at

$2.595 billion, including estimated fi nancing costs through June 30, 2012.

2013 Objectives

Duke Energy will focus on obtaining constructive regulatory outcomes

related to its pending and planned rate cases, achieving intended savings and

effi ciencies from its merger with Progress Energy, successfully managing the

Crystal River Unit 3 retirement and related regulatory proceedings, completing

the remaining major capital projects in its fl eet modernization program and

optimizing nuclear fl eet performance.

Obtaining Constructive Regulatory Outcomes. The signifi cant majority

of Duke Energy’s future earnings are anticipated to be contributed from USFE&G,

which consists of Duke Energy’s regulated businesses. Duke Energy has several

ongoing rate cases and other regulatory proceedings in North Carolina, Ohio and

Indiana. Later in 2013, Duke Energy Carolinas and Progress Energy Carolinas

will fi le additional rate cases in South Carolina. Duke Energy expects resolution

of these cases in 2013 or early 2014. These planned rates cases are needed