Duke Energy 2012 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2012 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

35

PART II

certain charges and credits, which management believes will not be recurring

on a regular basis, although it is reasonably possible such charges and credits

could recur. Mark-to-market adjustments refl ect the mark-to-market impact

of derivative contracts, which is recognized in GAAP earnings immediately as

such derivative contracts do not qualify for hedge accounting or regulatory

accounting treatment, used in Duke Energy’s hedging of a portion of economic

value of its generation assets in the Commercial Power segment. The economic

value of the generation assets is subject to fl uctuations in fair value due to

market price volatility of the input and output commodities (e.g., coal, power)

and, as such, the economic hedging involves both purchases and sales of those

input and output commodities related to the generation assets. Because the

operations of the generation assets are accounted for under the accrual method,

management believes that excluding the impact of mark-to-market changes

of the economic hedge contracts from operating earnings until settlement

better matches the fi nancial impacts of the hedge contract with the portion of

economic value of the underlying hedged asset. Management believes that the

presentation of adjusted earnings and adjusted diluted EPS provides useful

information to investors, as it provides them an additional relevant comparison

of Duke Energy’s performance across periods. Management uses this non-GAAP

fi nancial measure for planning and forecasting and for reporting results to the

Board of Directors, employees, shareholders, analysts and investors concerning

Duke Energy’s fi nancial performance. The most directly comparable GAAP

measure for Adjusted earnings and Adjusted diluted EPS is Net Income and

Diluted EPS attributable to Duke Energy common shareholders, which includes

the dollar and per share impact of special items, the mark-to-market impacts

of economic hedges in the Commercial Power segment and discontinued

operations.

OVERVIEW

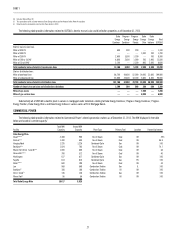

The following table reconciles Adjusted earnings to Net income attributable to Duke Energy and Adjusted diluted EPS to Diluted EPS attributable to Duke Energy

(amounts are net of tax):

Years Ended December 31,

2012 2011 2010

(in millions, except per share amounts) Amount

Per

diluted

share Amount

Per

diluted

share Amount

Per

diluted

share

Adjusted earnings $2,483 $ 4.32 $1,943 $ 4.38 $1,882 $ 4.29

Edwardsport charges (402) (0.70) (135) (0.30) — —

Costs to achieve mergers and acquisitions (397) (0.70) (51) (0.12) (17) (0.04)

Economic hedges (mark-to-market) (6) (0.01) (1) (0.01) 21 0.04

Democratic National Convention host committee support (6) (0.01) —— ——

Employee severance and offi ce consolidation 60 0.11 — — (105) (0.24)

Emission allowance impairment ——(51) (0.12) — —

Goodwill and other asset impairments ——— — (602) (1.37)

Litigation reserves ——— — (16) (0.04)

Asset sales ——— — 154 0.35

Income from discontinued operations 36 0.06 1 — 3 0.01

Net income attributable to Duke Energy $1,768 $ 3.07 $1,706 $ 3.83 $1,320 $ 3.00

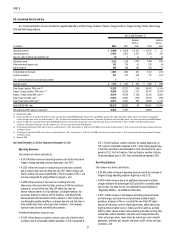

The variance in adjusted earnings for the year ended December 31, 2012,

compared to the year ended December 31, 2011, was primarily due to:

• The inclusion of Progress Energy results beginning in July 2012; and

• Increased retail pricing and riders primarily resulting from the

implementation of revised rates in North Carolina and South Carolina.

Partially offset by

• Unfavorable weather in 2012 compared to 2011;

• Higher depreciation and amortization expense;

• Lower nonregulated Midwest coal generation results; and

• Incremental shares issued to complete the Progress Energy merger

(impacts per share diluted amounts only).

The variance in adjusted earnings for the year ended December 31, 2011,

compared to the year ended December 31, 2010, was primarily due to:

• Increased earnings associated with major construction projects at

USFE&G;

• Effect of 2010 Duke Energy Foundation funding;

• Increased results in Brazil due to higher average contract prices;

• Increased earnings from National Methanol Company (NMC);

• Lower corporate governance costs;

• Increased results in Peru due to additional capacity revenues and an

arbitration award; and

• Increased results in Central America due to higher average prices and

volumes.

Partially offset by

• Less favorable weather in 2011 compared to 2010 at USFE&G;

• Increased operation and maintenance costs at USFE&G; and

• Lower volumes as a result of customer switching in Ohio, net of

retention by Duke Energy Retail Sales, LLC (Duke Energy Retail) at

Commercial Power.

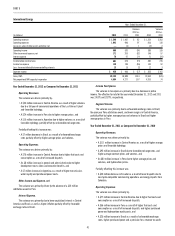

Segment Results

In 2012, management began evaluating segment performance based

on segment income. Segment income is defi ned as income from continuing

operations net of income attributable to noncontrolling interests. Segment

income, as discussed below, includes intercompany revenues and expenses

that are eliminated in the Consolidated Financial Statements. In conjunction