Duke Energy 2012 Annual Report Download - page 187

Download and view the complete annual report

Please find page 187 of the 2012 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

167

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. • CAROLINA POWER & LIGHT COMPANY d/b/a PROGRESS ENERGY

CAROLINAS, INC. • FLORIDA POWER CORPORATION d/b/a PROGRESS ENERY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC

.

Combined Notes to Consolidated Financial Statements – (Continued)

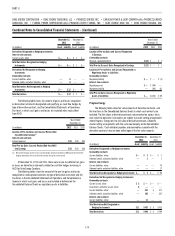

• Potentially more stringent environmental regulations from the

U.S. EPA — In May and July of 2010, the EPA issued proposed rules

associated with the regulation of CCRs to address risks from the

disposal of CCRs (e.g., ash ponds) and to limit the interstate transport

of emissions of NOx and SO2. These proposed regulations, along with

other pending EPA regulations, could result in signifi cant expenditures

for coal fi red generation plants, and could result in the early retirement

of certain generation assets, which do not currently have control

equipment for NOx and SO2, as soon as 2014.

• Customer switching — ESP customers have increasingly selected

alternative generation service providers, as allowed by Ohio legislation,

which further erodes margins on sales. In the second quarter of 2010,

Duke Energy Ohio’s residential class became the target of an intense

marketing campaign offering signifi cant discounts to residential

customers that switch to alternate power suppliers. Customer switching

levels were at approximately 55% at June 30, 2010 compared to

approximately 29% in the third quarter of 2009.

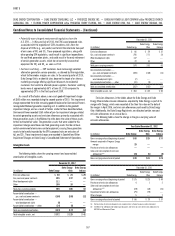

As a result of the factors above, a non-cash goodwill impairment charge

of $500 million was recorded during the second quarter of 2010. This impairment

charge represented the entire remaining goodwill balance for Commercial Power’s

non regulated Midwest generation reporting unit. In addition to the goodwill

impairment charge, and as a result of factors similar to those described above,

Commercial Power recorded $160 million of pre-tax impairment charges related

to certain generating assets and emission allowances primarily associated with

these generation assets in the Midwest to write-down the value of these assets

to their estimated fair value. The generation assets that were subject to this

impairment charge were those coal-fi red generating assets that do not have

certain environmental emissions control equipment, causing these generation

assets to be heavily impacted by the EPA’s proposed rules on emissions of

NOx and SO2. These impairment charges are recorded in Goodwill and Other

Impairment Charges on Duke Energy’s Consolidated Statement of Operations.

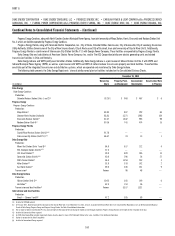

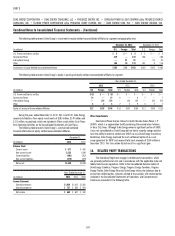

Intangible Assets

The following tables show the carrying amount and accumulated

amortization of intangible assets.

December 31, 2012

(in millions) Duke Energy

Duke Energy

Ohio

Duke Energy

Indiana

Emission allowances $ 80 $ 24 $ 29

Gas, coal and power contracts 295 272 24

Wind development rights 111 — —

Other 109 10 —

Total gross carrying amounts 595 306 53

Accumulated amortization —

gas, coal and power contracts (180) (168) (12)

Accumulated amortization —

wind development rights (9) — —

Accumulated amortization — other (34) (9) —

Total accumulated amortization (223) (177) (12)

Total intangible assets, net $ 372 $ 129 $ 41

December 31, 2011

(in millions) Duke Energy

Duke Energy

Ohio

Duke Energy

Indiana

Emission allowances $ 66 $ 29 $ 37

Gas, coal and power contracts 295 271 24

Wind development rights 137 — —

Other 72 10 —

Total gross carrying amounts 570 310 61

Accumulated amortization —

gas, coal and power contracts (169) (158) (11)

Accumulated amortization —

wind development rights (7) — —

Accumulated amortization — other (31) (9) —

Total accumulated amortization (207) (167) (11)

Total intangible assets, net $ 363 $ 143 $ 50

Emission allowances in the tables above for Duke Energy and Duke

Energy Ohio include emission allowances acquired by Duke Energy as part of its

merger with Cinergy, which were recorded at the then fair value on the date of

the merger in April 2006, and emission allowances purchased by Duke Energy

Ohio. Additionally, the Duke Energy Registrants are allocated certain zero cost

emission allowances on an annual basis.

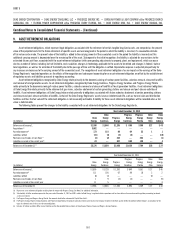

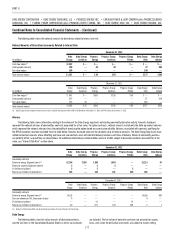

The following tables show the change in the gross carrying value of

emission allowances.

Year Ended December 31, 2012

(in millions) Duke Energy

Duke Energy

Ohio

Duke Energy

Indiana

Gross carrying value at beginning of period $ 66 $ 29 $ 37

Amounts acquired in Progress Energy

merger 29 —

Purchases of emission allowances —— —

Sales and consumption of emission

allowances(a)(b) (15) (5) (8)

Gross carrying value at end of period $ 80 $ 24 $ 29

December 31, 2011

(in millions) Duke Energy

Duke Energy

Ohio

Duke Energy

Indiana

Gross carrying value at beginning of period $175 $125 $ 49

Purchases of emission allowances 4 1 2

Sales and consumption of emission

allowances(a)(b) (39) (18) (21)

Impairment of emission allowances (79) (79) —

Other changes 5 — 7

Gross carrying value at end of period $ 66 $ 29 $ 37

(a) Carrying value of emission allowances are recognized via a charge to expense when consumed.

(b) See Note 2 for additional information regarding gains and losses on sales of emission allowances by

USFE&G and Commercial Power.