Duke Energy 2012 Annual Report Download - page 258

Download and view the complete annual report

Please find page 258 of the 2012 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

238

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. • CAROLINA POWER & LIGHT COMPANY d/b/a PROGRESS ENERGY

CAROLINAS, INC. • FLORIDA POWER CORPORATION d/b/a PROGRESS ENERY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

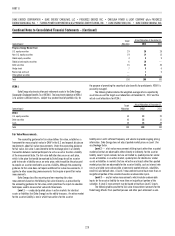

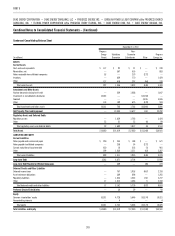

As of and For the Year Ended December 31, 2011

(in millions)

Duke

Energy

Duke

Energy

Carolinas

Progress

Energy

Progress

Energy

Carolinas

Progress

Energy

Florida

Duke

Energy

Ohio

Duke

Energy

Indiana

Net interest income recognized related to income taxes $ 12 $ 5 $ 24 $ 6 $ 22 $ — $ —

Net interest expense recognized related to income taxes — — — — — 1 1

Interest receivable related to income taxes 8 5 — — — — —

Interest payable related to income taxes — — 21 8 7 3 3

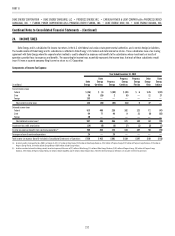

Year Ended December 31, 2010

(in millions)

Duke

Energy

Duke

Energy

Carolinas

Progress

Energy

Progress

Energy

Carolinas

Progress

Energy

Florida

Duke

Energy

Ohio

Duke

Energy

Indiana

Net interest income recognized related to income taxes $ 26 $ 18 $— $— $— $ 4 $ 5

Net interest expense recognized related to income taxes — — 9 4 5 — —

Duke Energy, Duke Energy Carolinas, Duke Energy Ohio and Duke Energy

Indiana are no longer subject to U.S. federal examination for years before 2004.

The years 2004 and 2005 are in Appeals, waiting for approval from the Joint

Committee. The 2006-2007 years are also in Appeals, waiting for the prior cycle

to close. The IRS is currently auditing the federal income tax returns for years

2008 through 2011.

Progress Energy, Progress Energy Carolinas and Progress Energy Florida

are no longer subject to U.S. federal examination for years before 2007. The IRS

has examined years 2007 through 2009 and examination has been completed.

With few exceptions, Duke Energy and its subsidiaries are no longer

subject to state, local or non-U.S. income tax examinations by tax authorities for

years before 2004.

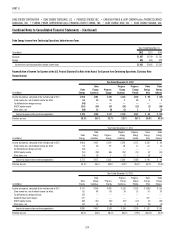

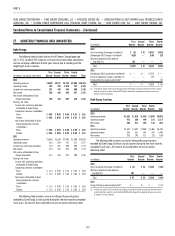

25. CONDENSED CONSOLIDATING STATEMENTS

Presented below are the Progress Energy Condensed Consolidating

Statements of Operations and Comprehensive Income, Balance Sheets

and Statements of Cash Flows as required by Rule 3-10 of Regulation S-X.

In September 2005, Progress Energy Parent issued a guarantee of certain

payments of two wholly owned indirect subsidiaries, FPC Capital I and Funding

Corp. The guarantees are in addition to the previously issued guarantees of

Progress Energy’s wholly owned subsidiary, Florida Progress.

FPC Capital I, a fi nance subsidiary, was established in 1999 for the

sole purpose of issuing $300 million of 7.10% Cumulative Quarterly Income

Preferred Securities due 2039, Series A (Preferred Securities), and using the

proceeds thereof to purchase from Funding Corp. $300 million of 7.10% Junior

Subordinated Deferrable Interest Notes due 2039 (Subordinated Notes). FPC

Capital I has no other operations and its sole assets are the Subordinated Notes

and Notes Guarantee (as discussed below). Funding Corp. is a wholly owned

subsidiary of Florida Progress and was formed for the sole purpose of providing

fi nancing to Florida Progress and its subsidiaries. Funding Corp. does not

engage in business activities other than such fi nancing and has no independent

operations. Since 1999, Florida Progress has fully and unconditionally

guaranteed the obligations of Funding Corp. under the Subordinated Notes. In

addition, Florida Progress guaranteed the payment of all distributions related to

the Preferred Securities required to be made by FPC Capital I, but only

to the extent that FPC Capital I has funds available for such distributions

(the Preferred Securities Guarantee). The two gwwuarantees considered

together constitute a full and unconditional guarantee by Florida Progress of FPC

Capital I’s obligations under the Preferred Securities. The Preferred Securities

and the Preferred Securities Guarantee were listed on the New York Stock

Exchange until the February 1, 2013 redemption discussed below.

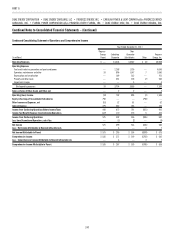

The Subordinated Notes may be redeemed at the option of Funding Corp.

at par value plus accrued interest through the redemption date. The proceeds

of any redemption of the Subordinated Notes will be used by FPC Capital I to

redeem proportional amounts of the Preferred Securities and common securities

in accordance with their terms. Upon liquidation or dissolution of Funding Corp.,

holders of the Preferred Securities would be entitled to the liquidation preference

of $25 per share plus all accrued and unpaid dividends thereon to the date

of payment. The annual interest expense related to the Subordinated Notes is

refl ected in the Consolidated Statements of Operations and Comprehensive

Income.

The Progress Energy parent has guaranteed the payment of all

distributions related to FPC Capital I’s Preferred Securities. At December 31, 2012,

FPC Capital I had outstanding 12 million shares of the Preferred Securities with

a liquidation value of $300 million. The Progress Energy parent’s guarantees

are joint and several, full and unconditional, and are in addition to the joint and

several, full and unconditional guarantees previously issued to FPC Capital I

and Funding Corp. by Florida Progress. Progress Energy’s subsidiaries have

provisions restricting the payment of dividends to the Progress Energy parent

in certain limited circumstances, and as disclosed in Note 4, there were no

restrictions on Progress Energy Carolina’s or Progress Energy Florida’s retained

earnings.

On January 2, 2013, Funding Corp. provided to the trustee of the

Subordinated Notes notice of its intent to redeem all of the Subordinated

Notes on February 1, 2013. The trustee then simultaneously notifi ed the

holders of the Preferred Securities that all of the Preferred Securities would

be redeemed on the same redemption date. These redemptions occurred

on February 1, 2013, and, therefore, the Preferred Securities, the Preferred

Securities Guarantee, the Subordinated Notes, and the Notes Guarantee all

ceased to be outstanding or in effect on February 1, 2013.

FPC Capital I is a VIE of which neither Progress Energy nor Duke

Energy is the primary benefi ciary. Separate fi nancial statements and other

disclosures concerning FPC Capital I have not been presented because

Progress Energy believes that such information is not material to investors.