Duke Energy 2012 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2012 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

114

PART II

Combined Notes to Consolidated Financial Statements – (Continued)

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. • CAROLINA POWER & LIGHT COMPANY d/b/a PROGRESS ENERGY

CAROLINAS, INC. • FLORIDA POWER CORPORATION d/b/a PROGRESS ENERY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

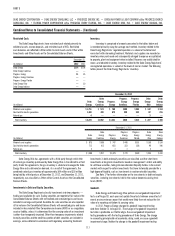

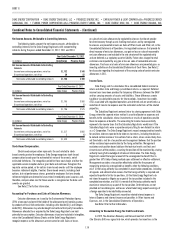

derecognition criteria and, therefore, Duke Energy Ohio and Duke Energy Indiana

account for the transfers of receivables to Cinergy Receivables as sales.

Accordingly, the receivables sold are not refl ected on the Consolidated Balance

Sheets of Duke Energy Ohio and Duke Energy Indiana. See Note 18 for further

information. Receivables for unbilled revenues related to retail and wholesale

accounts receivable at Duke Energy Ohio and Duke Energy Indiana included in

the sales of accounts receivable to CRC were as shown in the table below.

December 31,

(in millions) 2012 2011

Duke Energy Ohio $90 $89

Duke Energy Indiana 132 115

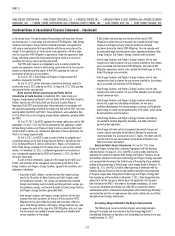

Allowance for Doubtful Accounts.

The Duke Energy Registrants’ allowances for doubtful accounts are

included in the following table:

December 31,

(in millions) 2012 2011 2010

Allowance for Doubtful Accounts

Duke Energy $34 $35 $34

Duke Energy Carolinas 3 3 3

Progress Energy 16 27 35

Progress Energy Carolinas 9 9 10

Progress Energy Florida 7 18 25

Duke Energy Ohio 2 16 18

Duke Energy Indiana 1 1 1

Allowance for Doubtful Accounts — VIEs

Duke Energy $44 $40 $34

Duke Energy Carolinas 6 6 6

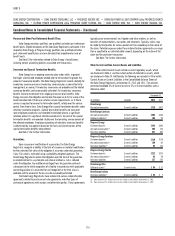

Accounting for Risk Management, Hedging Activities and Financial

Instruments.

The Duke Energy Registrants may use a number of different derivative

and non-derivative instruments in connection with their commodity price,

interest rate and foreign currency risk management activities, including swaps,

futures, forwards and options. All derivative instruments except those that

qualify for the normal purchase/normal sale (NPNS) exception within the

accounting guidance for derivatives are recorded on the Consolidated Balance

Sheets at their fair value. The effective portion of the change in the fair value of

derivative instruments designated as cash fl ow hedges is recorded in AOCI. The

effective portion of the change in the fair value of a fair value hedge is offset in

net income by changes in the hedged item. The Duke Energy Registrants may

designate qualifying derivative instruments as either cash fl ow hedges or fair

value hedges, while others either have not been designated as hedges or do not

qualify as a hedge (hereinafter referred to as undesignated contracts).

For all contracts accounted for as a hedge, the Duke Energy Registrants

prepare formal documentation of the hedge in accordance with the accounting

guidance for derivatives. In addition, at inception and at least every three

months thereafter, the Duke Energy Registrants formally assess whether the

hedge contract is highly effective in offsetting changes in cash fl ows or fair

values of hedged items. The Duke Energy Registrants document hedging activity

by transaction type and risk management strategy.

See Note 15 for further information.

Captive Insurance Reserves.

Duke Energy has captive insurance subsidiaries that provide coverage,

on an indemnity basis, to the Subsidiary Registrants as well as certain third

parties, on a limited basis, for various business risks and losses, such as

property, business interruption, workers’ compensation and general liability.

Liabilities include provisions for estimated losses incurred but not yet reported

(IBNR), as well as provisions for known claims which have been estimated on a

claims-incurred basis. IBNR reserve estimates involve the use of assumptions

and are primarily based upon historical loss experience, industry data and other

actuarial assumptions. Reserve estimates are adjusted in future periods as

actual losses differ from historical experience.

Duke Energy, through its captive insurance entities, also has reinsurance

coverage with third parties, which provides reimbursement for certain losses

above a per occurrence and/or aggregate retention. Duke Energy recognizes

a reinsurance receivable for recovery of incurred losses under its captive’s

reinsurance coverage once realization of the receivable is deemed probable.

Unamortized Debt Premium, Discount and Expense.

Premiums, discounts and expenses incurred with the issuance of

outstanding long-term debt are amortized over the terms of the debt issues. Any

call premiums or unamortized expenses associated with refi nancing higher-cost

debt obligations used to fi nance regulated assets and operations are amortized

consistent with regulatory treatment of those items, where appropriate. The

amortization expense is recorded as a component of Interest Expense in the

Consolidated Statements of Operations and is refl ected as Depreciation,

amortization and accretion within Net cash provided by operating activities on

the Consolidated Statements of Cash Flows.

Loss Contingencies and Environmental Liabilities.

The Duke Energy Registrants are involved in certain legal and

environmental matters that arise in the normal course of business. Contingent

losses are recorded when it is determined that it is probable that a loss has

occurred and the amount of the loss can be reasonably estimated. When a range

of the probable loss exists and no amount within the range is a better estimate

than any other amount, the Duke Energy Registrants record a loss contingency

at the minimum amount in the range. Unless otherwise required by GAAP, legal

fees are expensed as incurred.

Environmental liabilities are recorded on an undiscounted basis when

the necessity for environmental remediation becomes probable and the costs

can be reasonably estimated, or when other potential environmental liabilities

are reasonably estimable and probable. The Duke Energy Registrants expense

environmental expenditures related to conditions caused by past operations

that do not generate current or future revenues. Certain environmental expenses

receive regulatory accounting treatment, under which the expenses are recorded

as regulatory assets. Environmental expenditures related to operations that

generate current or future revenues are expensed or capitalized, as appropriate.

See Note 5 for further information.