Duke Energy 2012 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2012 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

110

PART II

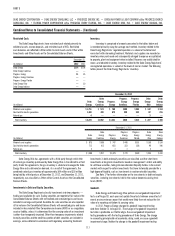

Combined Notes to Consolidated Financial Statements – (Continued)

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. • CAROLINA POWER & LIGHT COMPANY d/b/a PROGRESS ENERGY

CAROLINAS, INC. • FLORIDA POWER CORPORATION d/b/a PROGRESS ENERY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Energy Ohio include Duke Energy Ohio and its subsidiaries, unless otherwise

noted. Duke Energy Ohio is subject to the regulatory provisions of the Public

Utilities Commission of Ohio (PUCO), the Kentucky Public Service Commission

(KPSC) and the FERC. Duke Energy Ohio applies regulatory accounting treatment

to substantially all of the operations in its Franchised Electric and Gas operating

segment. Through November 2011, Duke Energy Ohio applied regulatory

accounting treatment to certain rate riders associated with retail generation of

its Commercial Power operating segment. See Note 3 for further information

about Duke Energy Ohio’s business segments.

Duke Energy Indiana, an indirect wholly owned subsidiary of Duke Energy,

is an electric utility that provides service in north central, central, and southern

Indiana. Its primary line of business is generation, transmission and distribution

of electricity. Duke Energy Indiana is subject to the regulatory provisions of the

Indiana Utility Regulatory Commission (IURC) and the FERC. Substantially all

of Duke Energy Indiana’s operations are regulated and qualify for regulatory

accounting treatment. As discussed further in Note 3, Duke Energy Indiana’s

operations include one reportable business segment, Franchised Electric.

Certain prior year amounts have been reclassifi ed to conform to current

year presentation. In addition, prior year fi nancial statements and footnote

disclosures for the Progress Energy Registrants have been reclassifi ed to

conform to Duke Energy’s presentation.

Reverse Stock Split.

On July 2, 2012, just prior to the close of the merger with Progress Energy,

Duke Energy executed a one-for-three reverse stock split with respect to the

issued and outstanding shares of Duke Energy common stock. All per-share

amounts included in this Form 10-K are presented as if the one-for-three reverse

stock split had been effective from the beginning of the earliest period presented.

Use of Estimates.

To conform to generally accepted accounting principles (GAAP) in the

U.S., management makes estimates and assumptions that affect the amounts

reported in the Consolidated Financial Statements and Notes. Although these

estimates are based on management’s best available information at the time,

actual results could differ.

Cost-Based Regulation.

The Duke Energy Registrants account for their regulated operations in

accordance with applicable regulatory accounting guidance. The economic

effects of regulation can result in a regulated company recording assets

for costs that have been or are expected to be approved for recovery from

customers in a future period or recording liabilities for amounts that are

expected to be returned to customers in the rate-setting process in a period

different from the period in which the amounts would be recorded by an

unregulated enterprise. Accordingly, the Duke Energy Registrants record assets

and liabilities that result from the regulated ratemaking process that would

not be recorded under GAAP for nonregulated entities. Regulatory assets and

liabilities are amortized consistent with the treatment of the related cost in the

ratemaking process. Management continually assesses whether regulatory

assets are probable of future recovery by considering factors such as applicable

regulatory changes, recent rate orders applicable to other regulated entities

and the status of any pending or potential deregulation legislation. Additionally,

management continually assesses whether any regulatory liabilities have

been incurred. Based on this continual assessment, management believes

the existing regulatory assets are probable of recovery and that no regulatory

liabilities, other than those recorded, have been incurred. These regulatory

assets and liabilities are classifi ed in the Consolidated Balance Sheets as

Regulatory assets and Other in Current Assets and as Regulatory liabilities

and Other in Current Liabilities, respectively. The Duke Energy Registrants

periodically evaluate the applicability of regulatory accounting treatment by

considering factors such as regulatory changes and the impact of competition.

If cost-based regulation ends or competition increases, the Duke Energy

Registrants may have to reduce their asset balances to refl ect a market basis

less than cost and write-off the associated regulatory assets and liabilities.

If it becomes probable that part of the cost of a plant under construction or

a recently completed plant will be disallowed for ratemaking purposes and a

reasonable estimate of the amount of the disallowance can be made, that

amount is recognized as a loss.

In November 2011, in conjunction with the PUCO’s approval of its new

Electric Security Plan (ESP), Duke Energy Ohio ceased applying regulatory

accounting treatment to generation operations within its Commercial Power

segment.

For further information, see Note 4.

Energy Purchases, Fuel Costs and Fuel Cost Deferrals.

The Duke Energy Registrants utilize cost-tracking mechanisms, commonly

referred to as a fuel adjustment clause, to recover the retail portion of fuel and

purchased power. The Duke Energy Registrants defer the related cost through

Fuel used in electric generation and purchased power — regulated on the

Consolidated Statement of Operations, unless a regulatory requirement exists

for deferral through Operating Revenues.

Fuel used in electric generation and purchased power — regulated

includes fuel, purchased power and recoverable costs that are deferred through

fuel clauses established by the Subsidiary Registrants’ regulators. These

clauses allow the Subsidiary Registrants to recover fuel costs, fuel-related costs

and portions of purchased power costs through surcharges on customer rates.

The Subsidiary Registrants record any under-recovery or over-recovery resulting

from the differences between estimated and actual costs as a regulatory asset

or regulatory liability until billed or refunded to customers, at which point the

differences are adjusted through revenues. Indiana law limits the amount of fuel

costs that Duke Energy Indiana can recover to an amount that will not result in

earning a return in excess of that allowed by the IURC.

As discussed in Note 4, beginning January 1, 2012, Duke Energy

Ohio procures energy for its retail customers through a third-party auction.

Purchases of energy through the auction process are a pass-through of costs

for Duke Energy Ohio, with no affect on earnings. Subsequent to December 31,

2011, Duke Energy Ohio’s generation assets are no longer dedicated to retail

customers and, accordingly, Duke Energy Ohio can no longer recover their

generation assets’ energy purchases and fuel costs from regulated customers.

Cash and Cash Equivalents.

All highly liquid investments with maturities of three months or less

at the date of acquisition are considered cash equivalents. At December 31,

2012, Duke Energy had cash and cash equivalents of $1,424 million, of which

$731 million is held in foreign jurisdictions and is forecasted to be used to fund

international operations and investments.