Duke Energy 2012 Annual Report Download - page 175

Download and view the complete annual report

Please find page 175 of the 2012 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

155

PART II

Combined Notes to Consolidated Financial Statements – (Continued)

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. • CAROLINA POWER & LIGHT COMPANY d/b/a PROGRESS ENERGY

CAROLINAS, INC. • FLORIDA POWER CORPORATION d/b/a PROGRESS ENERY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

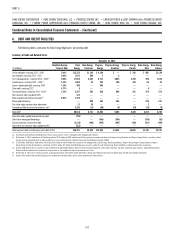

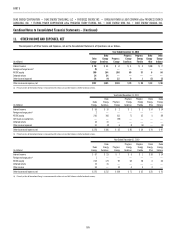

For the year ended December 31, 2011

Issuance

Date

Maturity

Date

Interest

Rate

Duke

Energy

(Parent)

Duke

Energy

Carolinas

Progress

Energy

(Parent)

Progress

Energy

Carolinas

Progress

Energy

Florida

Unsecured Debt:

January 2011 January 2021 4.40

% $ — $ — $500

(a) $— $ —

August 2011 September 2021 3.55

%500

(b) —— ——

November 2011 November 2016 2.15

%500

(c) —— ——

First Mortgage Bonds:

May 2011 June 2021 3.90

%— 500

(d) ———

August 2011 September 2021 3.10

%— ———

300(e)

September 2011 August 2021 3.00

%— — —500

(f) —

December 2011 December 2016 1.75

%— 350

(g) —— —

December 2011 December 2041 4.25 % — 650

(g) —— —

Total Issuances $1,000 $1,500 $500 $500 $300

(a) Proceeds from the issuance, along with available cash on hand, were used to repay $700 million 7.10% senior unsecured notes due March 1, 2011.

(b) Proceeds from the issuance were used to repay a portion of commercial paper as it matured, to fund capital expenditures in Duke Energy’s unregulated businesses in the U.S. and for general corporate purposes.

(c) Proceeds from the issuance were used to fund capital expenditures in unregulated businesses in the U.S. and for general corporate purposes.

(d) Proceeds from the issuance were used to fund capital expenditures and for general corporate purposes.

(e) Proceeds from the issuance were used to repay a portion of outstanding short-term debt, of which $300 million was used to repay the July 15, 2011 maturity of 6.65% fi rst mortgage bonds.

(f) Proceeds from the issuance were used to repay outstanding short-term debt and the remainder was used for general corporate purposes, including construction expenditures.

(g) Proceeds from the issuances were used to repay $750 million 6.25% senior unsecured notes which matured January 15, 2012, with the remainder to fund capital expenditures and for general corporate purposes.

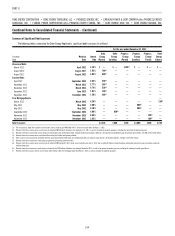

Current Maturities of Long-Term Debt

The following table shows the signifi cant components of Current

maturities of long-term debt on the Duke Energy Registrants’ respective

Consolidated Balance Sheets as of December 31, 2012. The amounts were

presented as Long-term Debt as of December 31, 2011, except for the secured

debt. The Duke Energy Registrants currently anticipate satisfying these

obligations with proceeds from additional borrowings, unless otherwise noted.

(in millions) Maturity Date Interest Rate December 31, 2012

Unsecured Debt:

Duke Energy (Parent) June 2013 5.650 % $ 250

Duke Energy Indiana September 2013 5.000 % 400

Secured Debt:

Duke Energy(a) March 2013 3.796 % 423

Duke Energy(b) June 2013 1.009 % 190

First Mortgage Bonds:

Duke Energy Carolinas November 2013 5.750 % 400

Progress Energy Carolinas September 2013 5.125 % 400

Progress Energy Florida March 2013 4.800 % 425

Duke Energy Ohio June 2013 2.100 % 250

Other 372

Current maturities of long-term debt $3,110

(a) Represents a construction loan related to a renewable project that will be converted to a term loan once construction in complete and requirements to convert are fulfi lled.

(b) Notes are fully offset with cash collateral, which is recorded in Other current assets in the Consolidated Balance Sheets as of December 31, 2012.

Other Debt Matters

In the fi rst quarter of 2012, Duke Energy completed the previously

announced sale of International Energy’s indirect 25% ownership interest in

Attiki Gas Supply, S.A (Attiki), a Greek corporation, to an existing equity owner

in a series of transactions that resulted in the full discharge of the related

debt obligation. No gain or loss was recognized on these transactions. As of

December 31, 2011, Duke Energy’s investment balance was $64 million and

the related debt obligation of $64 million was refl ected in Current maturities of

long-term debt on Duke Energy’s Consolidated Balance Sheets.

In September 2010, Duke Energy fi led a registration statement (Form S-3)

with the SEC. Under this Form S-3, which is uncapped, Duke Energy, Duke

Energy Carolinas, Duke Energy Ohio and Duke Energy Indiana may issue debt

and other securities in the future at amounts, prices and with terms to be

determined at the time of future offerings. The registration statement also allows

for the issuance of common stock by Duke Energy.

On March 1, 2012, the Progress Energy, Inc., as a well-known seasoned

issuer, Progress Energy Carolinas and Progress Energy Florida fi led a combined

shelf registration statement with the SEC, which became effective upon fi ling

with the SEC. The registration statement is effective for three years and does

not limit the amount or number of various securities that can be issued. On

July 3, 2012, the Progress Energy, Inc. deregistered its equity securities from

the registration statement in connection with the merger, but retained its ability

to issue senior debt securities and junior subordinated debentures under the