Duke Energy 2012 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2012 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

120

PART II

Combined Notes to Consolidated Financial Statements – (Continued)

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. • CAROLINA POWER & LIGHT COMPANY d/b/a PROGRESS ENERGY

CAROLINAS, INC. • FLORIDA POWER CORPORATION d/b/a PROGRESS ENERY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

in the service areas. The construction of these projects will occur over the next

two to three years. In conjunction with the Interim FERC Mitigation, Duke Energy

Carolinas and Progress Energy Carolinas entered into power sale agreements

with various counterparties that were effective with the consummation of the

merger. These agreements, or similar power sale agreements, will be in place

until the Long-term FERC Mitigation is operational. Under the agreements Duke

Energy will deliver around-the-clock power during the winter and summer in

quantities that vary by season and by peak period.

The FERC order requires an independent party to monitor whether the

power sale agreements remain in effect during construction of the transmission

projects and provide quarterly reports to the FERC regarding the status of

construction of the transmission projects.

On June 25, 2012, Duke Energy and Progress Energy accepted the

conditions imposed by the FERC.

On July 10, 2012, certain intervenors requested a rehearing seeking to

overturn the June 8, 2012 order by the FERC. On August 8, 2012, FERC granted

rehearing for further consideration.

North Carolina Utilities Commission and Public Service

Commission of South Carolina. In September 2011, Duke Energy and

Progress Energy reached settlements with the Public Staff of the North Carolina

Utilities Commission (NC Public Staff) and the South Carolina Offi ce of

Regulatory Staff (ORS) and certain other interested parties in connection with

the regulatory proceedings related to the merger, the JDA and the OATT that were

pending before the NCUC and PSCSC. These settlements were updated in May

2012 to refl ect the results of ongoing merger related applications pending before

the FERC.

On June 29, 2012, the NCUC approved the merger application and the JDA

application. On July 2, 2012, the PSCSC approved the JDA application subject

to Duke Energy Carolinas and Progress Energy Carolinas providing their South

Carolina retail customers pro rata benefi ts equivalent to those approved by the

NCUC in its merger approval order.

On July 6, 2012, the NCUC issued an order initiating investigation and

scheduling hearings on the Duke Energy Board of Directors’ decision on July 2,

2012, to replace William D. Johnson with James E. Rogers as President and

CEO of Duke Energy subsequent to the merger close, as well as other related

matters. On November 29, 2012, a settlement agreement was reached and

was subsequently approved by the NCUC on December 3, 2012. See Note 4

for further information.

As part of these settlements, approval of the merger by the NCUC and

PSCSC, and resolution of the subsequent investigation by the NCUC, Duke

Energy Carolinas and Progress Energy Carolinas agreed to the conditions and

obligations listed below.

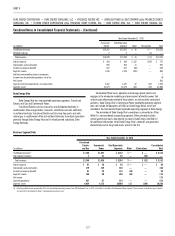

• Guarantee of $687 million in system fuel and fuel-related savings

over 60 to 78 months for North Carolina and South Carolina retail

and wholesale customers. The savings are expected to be achieved

through coal blending, coal commodity and transportation savings, gas

transportation savings, and the joint dispatch of Duke Energy Carolinas

and Progress Energy Carolinas generation fl eets.

• Duke Energy Carolinas and Progress Energy Carolinas will not seek

recovery from retail customers for the cost of the Long-term FERC

Mitigation for fi ve years following merger consummation. After fi ve

years, Duke Energy Carolinas and Progress Energy Carolinas may seek

to recover the costs of the Long-term FERC Mitigation, but must show

that the projects are needed to provide adequate and reliable retail

service regardless of the merger.

• A $65 million rate reduction over the term of the Interim FERC

Mitigation to refl ect the cost of capacity not available to Duke Energy

Carolinas and Progress Energy Carolinas wholesale and retail

customers during the Interim FERC Mitigation. The rate reduction will

be achieved through retail decrement riders apportioned between Duke

Energy Carolinas and Progress Energy Carolinas retail customers.

• Duke Energy Carolinas and Progress Energy Carolinas will not seek

recovery from retail customers for any revenue shortfalls or fuel-related

costs associated with the Interim FERC Mitigation. The Interim FERC

Mitigation agreements were in a loss position for Duke Energy as of the

date of the merger consummation.

• Duke Energy Carolinas and Progress Energy Carolinas will not seek

recovery from retail customers for any revenue shortfalls or fuel-related

costs associated with the Interim FERC Mitigation.

• Duke Energy Carolinas and Progress Energy Carolinas will not seek

recovery from retail customers for any of their allocable share of merger

related severance costs.

• Duke Energy Carolinas and Progress Energy Carolinas will provide

community support and charitable contributions for four years,

workforce development, low income energy assistance, and funding for

green energy at a total cost of approximately $105 million, which cannot

be recovered from retail customers.

• Duke Energy Carolinas and Progress Energy Carolinas will abide by

revised North Carolina Regulatory Conditions and Code of Conduct

governing their operations.

• Duke Energy will make certain management personnel changes and

create a special committee of the Board of Directors to oversee the

recommendation of a successor to James E. Rogers, President and CEO,

and the search for two new members of the Board of Directors (see

Note 4 for further information).

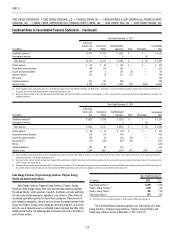

Kentucky Public Service Commission. On June 24, 2011, Duke

Energy and Progress Energy fi led a settlement agreement with the Kentucky

Attorney General. On August 2, 2011, the KPSC issued an order conditionally

approving the merger and required Duke Energy and Progress Energy to accept

all conditions contained in the order. Duke Energy and Progress Energy requested

and were granted rehearing on the limited issue of the wording of one condition

relating to the composition of Duke Energy’s post-merger Board of Directors. On

October 28, 2011, the KPSC issued its order approving a settlement with the

Kentucky Attorney General on the revised condition relating to the composition

of the post-merger Duke Energy board. Duke Energy and Progress Energy fi led

their acceptance of the condition on November 2, 2011. Duke Energy Kentucky

agreed to (i) not fi le new gas or electric base rate applications for two years

from the date of the KPSC’s fi nal order in the merger proceedings, (ii) make

fi ve annual shareholder contributions of $165,000 to support low-income

weatherization efforts and economic development within Duke Energy Kentucky’s

service territory and (iii) not seek recovery from retail customers for any of their

allocable share of merger related costs.

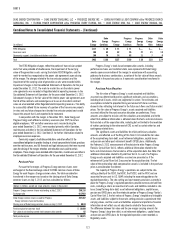

Accounting Charges Related to the Merger Consummation

The following pre-tax consummation charges were recognized upon

closing of the merger and are included in the Duke Energy Registrant’s

Consolidated Statements of Operations and Comprehensive Income for the year

ended December 31, 2012.