Duke Energy 2012 Annual Report Download - page 183

Download and view the complete annual report

Please find page 183 of the 2012 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

163

PART II

Combined Notes to Consolidated Financial Statements – (Continued)

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. • CAROLINA POWER & LIGHT COMPANY d/b/a PROGRESS ENERGY

CAROLINAS, INC. • FLORIDA POWER CORPORATION d/b/a PROGRESS ENERY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

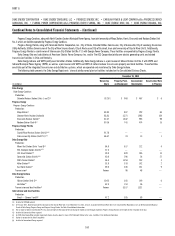

estimate, Progress Energy Florida increased its asset retirement regulatory asset

and its ARO liability by approximately $234 million in 2012. Retail accruals on

Progress Energy Florida’s reserves for nuclear decommissioning were previously

suspended under the terms of previous base rate settlement agreements.

Progress Energy Florida will continue this suspension based on the FPSC’s

approval on April 30, 2012 of its 2010 nuclear decommissioning fi ling. No

nuclear decommissioning reserve accrual is recorded at Progress Energy Florida

following a FERC accounting order issued in November 2006.

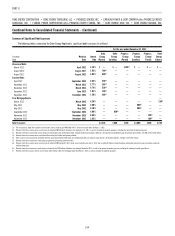

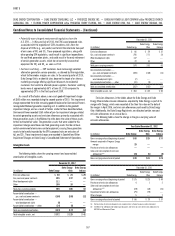

The operating licenses for the Duke Energy Registrants’ nuclear units

are subject to extension. The following table includes the current expiration of

nuclear operating licenses.

Unit Year of Expiration

Duke Energy Carolinas

Catawba Unit 1 2043

Catawba Unit 2 2043

McGuire Unit 1 2041

McGuire Unit 2 2043

Oconee Unit 1 2033

Oconee Unit 2 2033

Oconee Unit 3 2034

Progress Energy Carolinas

Brunswick Unit 1 2036

Brunswick Unit 2 2034

Harris 2046

Robinson 2030

Progress Energy Florida

Crystal River Unit 3 2016

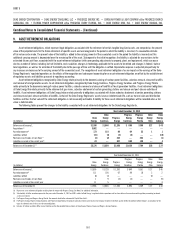

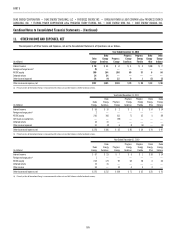

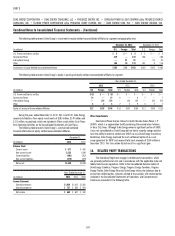

10. PROPERTY, PLANT AND EQUIPMENT

December 31, 2012

(in millions)

Estimated

Useful Life Duke Energy

Duke Energy

Carolinas

Progress

Energy

Progress Energy

Carolinas

Progress Energy

Florida

Duke Energy

Ohio

Duke Energy

Indiana

(Years)

Land $ 1,368 $ 378 $ 618 $ 380 $ 239 $ 136 $ 90

Plant — Regulated

Electric generation, distribution and

transmission

2 – 138 73,181 29,269 30,250 18,009 12,041 3,774 8,622

Natural gas transmission and distribution 12 – 60 2,026 — — — — 2,026 —

Other buildings and improvements 2 – 100 1,319 444 609 283 318 125 149

Plant — Unregulated

Electric generation, distribution and transmission 2 – 100 6,055 — — — — 3,870 —

Other buildings and improvements 9 – 90 2,940 — — — — 191 —

Nuclear fuel 2,127 1,277 850 850 — — —

Equipment 1 – 34 1,448 279 604 336 90 255 141

Construction in process 6,655 1,996 1,424 946 474 204 2,836

Other 5 – 60 3,272 547 791 380 270 243 174

Total property, plant and equipment(a) 100,391 34,190 35,146 21,184 13,432 10,824 12,012

Total accumulated depreciation — regulated(b)(c)(d) (29,471) (11,437) (12,512) (8,185) (4,072) (1,995) (3,692)

Total accumulated depreciation — unregulated(c)(d) (2,498) — — — — (703) —

Generation facilities to be retired, net 136 73 63 63 — — —

Total net property, plant and equipment $ 68,558 $ 22,826 $ 22,697 $13,062 $ 9,360 $ 8,126 $ 8,320

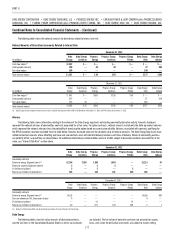

(a) Includes capitalized leases of $1,844 million, $53 million, $339 million, $150 million, $189 million, $86 million, and $28 million at Duke Energy, Duke Energy Carolinas, Progress Energy, Progress Energy Carolinas, Progress

Energy Florida, Duke Energy Ohio, and Duke Energy Indiana, respectively, primarily in regulated plant. The Progress Energy, Progress Energy Carolinas and Progress Energy Florida amounts are net of $49 million, an

insignifi cant amount and $48 million, respectively, of accumulated amortization of capitalized leases.

(b) Includes $857 million, $557 million, $300 million and $300 million of accumulated amortization of nuclear fuel at Duke Energy, Duke Energy Carolinas, Progress Energy and Progress Energy Carolinas, respectively.

(c) Includes accumulated amortization of capitalized leases of $34 million, $3 million, $12 million and $5 million at Duke Energy, Duke Energy Carolinas, Duke Energy Ohio and Duke Energy Indiana, respectively.

(d) Includes accumulated depreciation of VIEs of $103 million and an insignifi cant amount at December 31, 2012 at Duke Energy and Progress Energy, respectively.