Duke Energy 2012 Annual Report Download - page 224

Download and view the complete annual report

Please find page 224 of the 2012 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

204

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. • CAROLINA POWER & LIGHT COMPANY d/b/a PROGRESS

ENERGY CAROLINAS, INC. • FLORIDA POWER CORPORATION d/b/a PROGRESS ENERY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

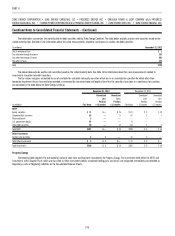

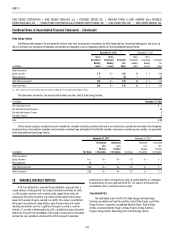

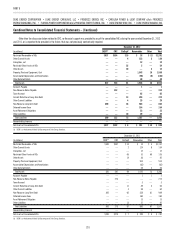

Combined Notes to Consolidated Financial Statements – (Continued)

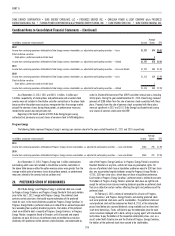

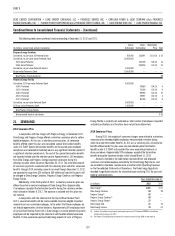

DS Cornerstone, LLC, a 50/50 joint venture entity with a third-party joint

venture partner, owns two windpower projects and has executed a third -

party fi nancing against the two windpower projects. DS Cornerstone was a

consolidated VIE of Duke Energy through August 31, 2012, as the members

equity was not suffi cient to support the operations of the joint venture as

demonstrated by the third -party fi nancing. Duke Energy provided a Production

Tax Credit (PTC) Remedy Agreement to the joint venture partner whereby Duke

Energy guaranteed the two windpower projects would achieve commercial

operation in 2012 and an agreed to number of wind turbines would qualify for

production tax credits. In the event the agreed to number of wind turbines of

the two wind generating facilities failed to qualify, the joint venture partner had

the option to put its equity ownership interest back to Duke Energy. The PTC

Remedy Agreement resulted in greater loss exposure to Duke Energy and, as a

result, Duke Energy consolidated DS Cornerstone, LLC through August 31, 2012,

until both projects reached commercial operation and the appropriate number

of wind turbines qualifi ed for PTC. As of December 31, 2012, DS Cornerstone

is a non-consolidated VIE. The most signifi cant activities that impact DS

Cornerstone’s economic performance are the decisions related to the ongoing

operations and maintenance activities. The power to direct these activities is

jointly and equally shared by Duke Energy and Sumitomo. As a result, Duke

Energy does not consolidate the DS Cornerstone. Accordingly, DS Cornerstone is

a non-consolidated VIE that is reported as an equity method investment.

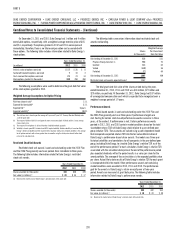

FPC Capital I Trust.

Progress Energy has variable interests in the FPC Capital I Trust (the Trust)

which is a VIE of which Duke Energy is not the primary benefi ciary. The Trust,

a fi nance subsidiary, was established in 1999 for the sole purpose of issuing

$300 million of 7.10% Cumulative Quarterly Income Preferred Securities due

2039, and using the proceeds thereof to purchase from Florida Progress Funding

Corporation (Funding Corp.), a wholly owned subsidiary of Progress Energy,

$300 million of 7.10% Junior Subordinated Deferrable Interest Notes due 2039.

The Trust has no other operations and its sole assets are the subordinated

notes and related guarantees. Funding Corp. was formed for the sole purpose

of providing fi nancing to Progress Energy Florida and its subsidiaries. Funding

Corp. does not engage in business activities other than such fi nancing and has

no independent operations. Progress Energy has guaranteed the payments of all

distributions required by the trust.

Other.

Duke Energy has investments in various other entities that are VIEs which

are not consolidated. The most signifi cant of these investments is Duke Energy

Ohio’s 9% ownership interest in OVEC. Through its ownership interest in OVEC,

Duke Energy Ohio has a contractual arrangement through June 2040 to buy

power from OVEC’s power plants. The proceeds from the sale of power by OVEC

to its power purchase agreement counterparties, including Duke Energy Ohio, are

designed to be suffi cient for OVEC to meet its operating expenses, fi xed costs, debt

amortization and interest expense, as well as earn a return on equity. Accordingly,

the value of this contract is subject to variability due to fl uctuations in power

prices and changes in OVEC’s costs of business, including costs associated with

its 2,256 megawatts of coal-fi red generation capacity. As discussed in Note 5, the

proposed rulemaking on cooling water intake structures, MATS, CSAPR and CCP’s

could increase the costs of OVEC which would be passed through to Duke Energy

Ohio. The initial carrying value of this contract was recorded as an intangible

asset when Duke Energy acquired Cinergy in April 2006.

In addition, the company has guaranteed the performance of certain

entities in which the company no longer has an equity interest. As a result, the

company has a variable interest in certain other VIEs that are non-consolidated.

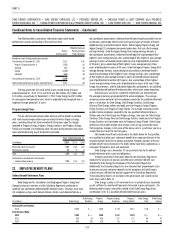

CRC.

As discussed above, CRC is consolidated only by Duke Energy.

Accordingly, the retained interest in the sold receivables recorded on the

Consolidated Balance Sheets of Duke Energy Ohio and Duke Energy Indiana are

eliminated in consolidation at Duke Energy.

The proceeds obtained from the sales of receivables are largely cash but

do include a subordinated note from CRC for a portion of the purchase price

(typically approximates 25% of the total proceeds). The subordinated note is

a retained interest (right to receive a specifi ed portion of cash fl ows from the

sold assets) and is classifi ed within Receivables in Duke Energy Ohio’s and

Duke Energy Indiana’s Consolidated Balance Sheets at December 31, 2012 and

2011, respectively. The retained interests refl ected on the Consolidated Balance

Sheets of Duke Energy Ohio and Duke Energy Indiana approximate fair value.

The carrying values of the retained interests are determined by allocating

the carrying value of the receivables between the assets sold and the interests

retained based on relative fair value. Because the receivables generally turnover

in less than two months, credit losses are reasonably predictable due to the

broad customer base and lack of signifi cant concentration, and the purchased

benefi cial interest (equity in CRC) is subordinate to all retained interests and

thus would absorb losses fi rst, the allocated basis of the subordinated notes are

not materially different than their face value. The hypothetical effect on the fair

value of the retained interests assuming both a 10% and a 20% unfavorable

variation in credit losses or discount rates is not material due to the short

turnover of receivables and historically low credit loss history. Interest accrues

to Duke Energy Ohio and Duke Energy Indiana on the retained interests using

the acceptable yield method, which generally approximates the stated rate on

the notes since the allocated basis and the face value are nearly equivalent. An

impairment charge is recorded against the carrying value of both the retained

interests and purchased benefi cial interest whenever it is determined that an

other-than-temporary impairment has occurred. The key assumptions used in

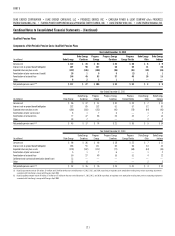

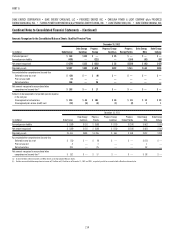

estimating the fair value in 2012 and 2011 is detailed in the following table:

2012 2011

Duke Energy Ohio

Anticipated credit loss ratio 0.7% 0.8%

Discount rate 1.2% 2.6%

Receivable turnover rate 12.7% 12.7%

Duke Energy Indiana

Anticipated credit loss ratio 0.3% 0.4%

Discount rate 1.2% 2.6%

Receivable turnover rate 10.2% 10.2%