Duke Energy 2012 Annual Report Download - page 186

Download and view the complete annual report

Please find page 186 of the 2012 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

166

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. • CAROLINA POWER & LIGHT COMPANY d/b/a PROGRESS ENERGY

CAROLINAS, INC. • FLORIDA POWER CORPORATION d/b/a PROGRESS ENERY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

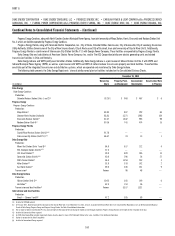

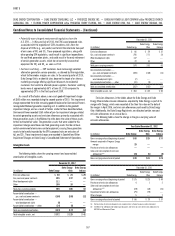

12. GOODWILL AND INTANGIBLE ASSETS

Goodwill

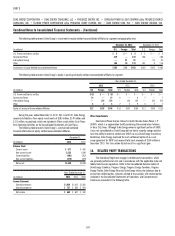

The following tables present goodwill by reportable operating segment for

Duke Energy and Duke Energy Ohio.

Duke Energy

(in millions) USFE&G

Commercial

Power

International

Energy Total

Balance at December 31, 2011:

Goodwill $ 3,483 $ 940 $297 $ 4,720

Accumulated impairment charges — (871) — (871)

Balance at December 31, 2011,

as adjusted for accumulated

impairment charges 3,483 69

297 3,849

Acquisitions(a) 12,467 — 59 12,526

Foreign exchange and other changes — (7) (3) (10)

Balance at December 31, 2012:

Goodwill 15,950 933 353 17,236

Accumulated impairment charges — (871) — (871)

Balance at December 31, 2012,

as adjusted for accumulated

impairment charges $15,950 $ 62 $

353 $16,365

(a) USFE&G amount relates to the merger with Progress Energy. International Energy amount relates to the

Ibener acquisition. See Note 2 for further information.

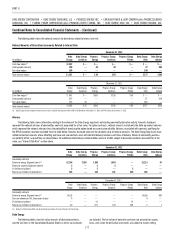

Duke Energy Ohio

(in millions)

Franchised

Electric &

Gas

Commercial

Power Total

Balance at December 31, 2011:

Goodwill $1,137 $ 1,188 $ 2,325

Accumulated impairment charges (216) (1,188) (1,404)

Balance at December 31, 2011, as adjusted for

accumulated impairment charges 921 — 921

Balance at December 31, 2012:

Goodwill 1,137 1,188 2,325

Accumulated impairment charges (216) (1,188) (1,404)

Balance at December 31, 2012, as adjusted for

accumulated impairment charges $ 921 $ — $ 921

Progress Energy had Goodwill of $ 3,655 million as of December 31, 2012

and 2011, for which there are no accumulated impairment charges.

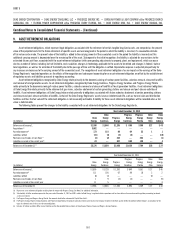

In the fourth quarter of 2012, goodwill for the Renewables reporting unit

within Commercial Power was analyzed for impairment primarily as a result

of changes in the tax benefi ts for renewable projects. Based on results of the

fourth quarter 2012 impairment analysis, the fair value of the Renewables

reporting unit exceeded its carrying value thus no impairment was recorded. The

fair value of the Renewables reporting unit is impacted by a multitude of factors,

including legislative actions related to tax credit extensions, long-term growth

rate assumptions, the market price of power and discount rates. Management

continues to monitor these assumptions for any indicators that the fair value of

the reporting unit could be below the carrying value, and will assess goodwill for

impairment as appropriate.

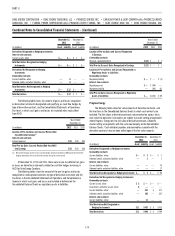

Midwest Generation Asset Impairment.

In the second quarter of 2010, based on circumstances discussed below,

management determined that it was more likely than not that the fair value

of Commercial Power’s nonregulated Midwest generation reporting unit was

below its respective carrying value. Accordingly, an interim impairment test was

performed for this reporting unit. Determination of reporting unit fair value was

based on a combination of the income approach, which estimates the fair value

of Duke Energy’s reporting units based on discounted future cash fl ows, and

the market approach, which estimates the fair value of Duke Energy’s reporting

units based on market comparables within the utility and energy industries.

Based on completion of step one of the second quarter 2010 impairment

analysis, management determined that the fair value of Commercial Power’s

non regulated Midwest generation reporting unit was less than its carrying value,

which included goodwill of $ 500 million.

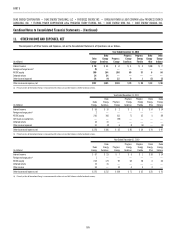

Commercial Power’s nonregulated Midwest generation reporting unit

includes nearly 4,000 MW of primarily coal-fi red generation capacity in Ohio

which was dedicated under the ESP through December 31, 2011. Additionally,

this reporting unit has approximately 3,600 MW of gas-fi red generation capacity

in Ohio, Pennsylvania, Illinois and Indiana which provides generation to

unregulated energy markets in the Midwest. The businesses within Commercial

Power’s nonregulated Midwest generation reporting unit operate in unregulated

markets which allow for customer choice among suppliers. As a result, the

operations within this reporting unit are subjected to competitive pressures that

do not exist in any of Duke Energy’s regulated jurisdictions.

Commercial Power’s other businesses, including the renewable generation

assets, are in a separate reporting unit for goodwill impairment testing

purposes. No impairment existed with respect to Commercial Power’s renewable

generation assets.

The fair value of Commercial Power’s nonregulated Midwest generation

reporting unit is impacted by a multitude of factors, including current and

forecasted customer demand, forecasted power and commodity prices,

uncertainty of environmental costs, competition, the cost of capital, valuation

of peer companies and regulatory and legislative developments. Management’s

assumptions and views of these factors continually evolve, and certain views

and assumptions used in determining the fair value of the reporting unit in

the 2010 interim impairment test changed signifi cantly from those used in

the 2009 annual impairment test. These factors had a signifi cant impact

on the valuation of Commercial Power’s nonregulated Midwest generation

reporting unit. More specifi cally, the following factors signifi cantly impacted

management’s valuation of the reporting unit:

• Sustained lower forward power prices — In Ohio, Duke Energy’s

Commercial Power segment provided power to retail customers under

the ESP, which utilizes rates approved by the PUCO through 2011.

These rates in 2010 were above market prices for generation services,

resulting in customers switching to other generation providers. As

discussed in Note 4, Duke Energy Ohio will establish a new SSO for

retail load customers for generation after the current ESP expires on

December 31, 2011. Given forward power prices, which declined from

the time of the 2009 impairment, signifi cant uncertainty existed with

respect to the generation margin that would be earned under the new SSO.