Duke Energy 2012 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2012 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

119

PART II

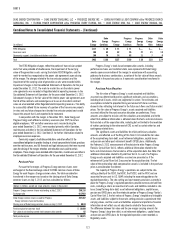

Combined Notes to Consolidated Financial Statements – (Continued)

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. • CAROLINA POWER & LIGHT COMPANY d/b/a PROGRESS ENERGY

CAROLINAS, INC. • FLORIDA POWER CORPORATION d/b/a PROGRESS ENERY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Energy is involved, including entities previously subject to existing accounting

guidance for VIEs, as well as any QSPEs that existed as of the effective date.

Effective with adoption of this revised accounting guidance, the accounting

treatment and/or fi nancial statement presentation of Duke Energy’s accounts

receivable securitization programs were impacted as Duke Energy began

consolidating CRC effective January 1, 2010. Duke Energy Ohio’s and Duke

Energy Indiana’s sales of accounts receivable and related fi nancial statement

presentation were not impacted by the adoption of ASC 810. This revised

accounting guidance did not have a signifi cant impact on any of the Duke Energy

Registrants’ other interests in VIEs.

ASC 820 — Fair Value Measurements and Disclosures. In

January 2010, the FASB amended existing fair value measurements and

disclosures accounting guidance to clarify certain existing disclosure

requirements and to require a number of additional disclosures, including

amounts and reasons for signifi cant transfers between the three levels of the

fair value hierarchy, and presentation of certain information in the reconciliation

of recurring Level 3 measurements on a gross basis. For the Duke Energy

Registrants, certain portions of this revised accounting guidance were effective

on January 1, 2010, with additional disclosures effective for periods beginning

January 1, 2011. The initial adoption of this accounting guidance resulted in

additional disclosure in the notes to the consolidated fi nancial statements but

did not have an impact on the Duke Energy Registrants’ consolidated results of

operations, cash fl ows or fi nancial position.

The following new Accounting Standards Updates (ASU) have been issued,

but have not yet been adopted by Duke Energy, as of December 31, 2012.

ASC 210 — Balance Sheet. In December 2011, the FASB issued

revised accounting guidance to amend the existing disclosure requirements for

offsetting fi nancial assets and liabilities to enhance current disclosures, as well

as to improve comparability of balance sheets prepared under U.S. GAAP and

IFRS. The revised disclosure guidance affects all companies that have fi nancial

instruments and derivative instruments that are either offset in the balance

sheet (i.e., presented on a net basis) or subject to an enforceable master netting

arrangement and/or similar agreement. The revised guidance requires that

certain enhanced quantitative and qualitative disclosures be made with respect

to a company’s netting arrangements and/or rights of setoff associated with

its fi nancial instruments and/or derivative instruments including associated

collateral. For the Duke Energy Registrants, the revised disclosure guidance

is effective on a retrospective basis for interim and annual periods beginning

January 1, 2013. Other than additional disclosures, this revised guidance does

not impact the Duke Energy Registrants’ consolidated results of operations, cash

fl ows or fi nancial position.

ASC 220 — Comprehensive Income. In February 2013, the FASB

amended the existing requirements for presenting comprehensive income in

fi nancial statements to improve the reporting of reclassifi cations out of AOCI.

The amendments in this Update seek to attain that objective by requiring

an entity to report the effect of signifi cant reclassifi cations out of AOCI on

the respective line items in net income if the amount being reclassifi ed is

required under U.S. GAAP to be reclassifi ed in its entirety to net income. For

other amounts that are not required under U.S. GAAP to be reclassifi ed in

their entirety to net income in the same reporting period, an entity is required

to cross-reference other disclosures required under U.S. GAAP that provide

additional detail about those amounts. This would be the case when a portion

of the amount reclassifi ed out of AOCI is reclassifi ed to a balance sheet

account (for example, inventory) instead of directly to income or expense

in the same reporting period. For the Duke Energy Registrants, this revised

guidance is effective on a prospective basis for interim and annual periods

beginning January 1, 2013. Other than additional disclosures or a change in the

presentation on the statement of comprehensive income, this revised guidance

does not impact the Duke Energy Registrants’ consolidated results of operations,

cash fl ows or fi nancial position.

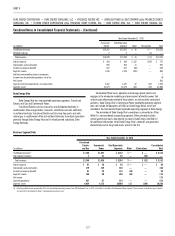

2. ACQUISITIONS, DISPOSITIONS AND SALES

OF OTHER ASSETS

Acquisitions.

The Duke Energy Registrants consolidate assets and liabilities from

acquisitions as of the purchase date, and include earnings from acquisitions in

consolidated earnings after the purchase date.

Merger with Progress Energy

Description of Transaction

On July 2, 2012, Duke Energy completed the merger contemplated by the

Agreement and Plan of Merger (Merger Agreement), among Diamond Acquisition

Corporation, a North Carolina corporation and Duke Energy’s wholly owned

subsidiary (Merger Sub) and Progress Energy, a North Carolina corporation

engaged in the regulated utility business of generation, transmission and

distribution and sale of electricity in portions of North Carolina, South Carolina

and Florida. As a result of the merger, Merger Sub was merged into Progress

Energy and Progress Energy became a wholly owned subsidiary of Duke Energy.

The merger between Duke Energy and Progress Energy provides increased

scale and diversity with potentially enhanced access to capital over the long

term and a greater ability to undertake the signifi cant construction programs

necessary to respond to increasing environmental regulation, plant retirements

and customer demand growth. Duke Energy’s business risk profi le is expected

to improve over time due to the increased proportion of the business that is

regulated. Additionally, cost savings, effi ciencies and other benefi ts are expected

from the combined operations.

Progress Energy’s shareholders received 0.87083 shares of Duke Energy

common stock in exchange for each share of Progress Energy common stock

outstanding as of July 2, 2012. Generally, all outstanding Progress Energy

equity-based compensation awards were converted into Duke Energy equity-

based compensation awards using the same ratio. The merger was structured

as a tax-free exchange of shares.

Refer to Note 5 for information regarding Progress Energy merger

shareholder litigation.

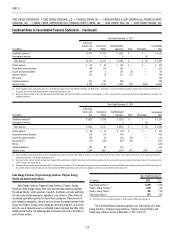

Merger Related Regulatory Matters

Federal Energy Regulatory Commission. On June 8, 2012, the FERC

conditionally approved the merger including Duke Energy and Progress Energy’s

revised market power mitigation plan, the Joint Dispatch Agreement (JDA) and

the joint Open Access Transmission Tariff (OATT). The revised market power

mitigation plan provides for the acceleration of one transmission project and the

construction of seven other transmission projects (Long-term FERC Mitigation)

and interim fi rm power sale agreements during the construction of the

transmission projects (Interim FERC Mitigation). The Long-term FERC Mitigation

will increase power imported into the Duke Energy Carolinas and Progress

Energy Carolinas service areas and enhance competitive power supply options