Duke Energy 2012 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2012 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

128

PART II

Combined Notes to Consolidated Financial Statements – (Continued)

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. • CAROLINA POWER & LIGHT COMPANY d/b/a PROGRESS ENERGY

CAROLINAS, INC. • FLORIDA POWER CORPORATION d/b/a PROGRESS ENERY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

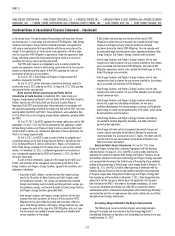

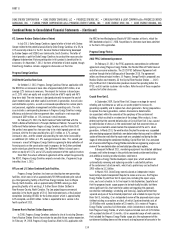

Year Ended December 31, 2011

(in millions)

Franchised

Electric and

Gas

Commercial

Power

Total Reportable

Segments Other Eliminations

Consolidated

Total

Unaffi liated revenues(a) $1,474 $1,707 $ 3,181 $ —$ — $ 3,181

Intersegment revenues — 4 4 — (4) —

Total revenues $1,474 $1,711 $ 3,185 $ — $ (4) $ 3,181

Interest expense $ 68 $ 36 $ 104 $ — $ — $ 104

Depreciation and amortization 168 167 335 — — 335

Income tax expense (benefi t) 98 6 104 (8) — 96

Segment income(b) 133 78 211 (17) — 194

Net income 194

Capital expenditures 375 124 499 — — 499

Segment assets 6,293 4,740 11,033 259 (353) 10,939

(a) Duke Energy Ohio earned approximately 24% of its consolidated operating revenues from PJM Interconnection, LLC (PJM) in 2011, all of which is included in the Commercial Power segment. These revenues relate to the sale

of capacity and electricity from Commercial Power’s nonregulated generation assets.

(b) Commercial Power recorded an after-tax impairment charge of $51 million, net of tax of $28 million, during the year ended December 31, 2011, to write-down the carrying value of certain emission allowances. See Note 12 for

additional information.

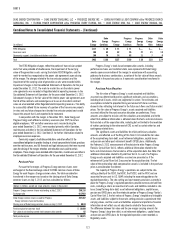

Year Ended December 31, 2010

(in millions)

Franchised

Electric and

Gas

Commercial

Power

Total Reportable

Segments Other Eliminations

Consolidated

Total

Unaffi liated revenues(a) $1,623 $1,706 $ 3,329 $ — $ — $ 3,329

Intersegment revenues — 5 5 — (5) —

Total revenues $1,623 $1,711 $ 3,334 $ — $ (5) $ 3,329

Interest expense $ 68 $ 41 $ 109 $ — $ — $ 109

Depreciation and amortization 226 174 400 — — 400

Income tax expense (benefi t) 106 40 146 (14) — 132

Segment loss(b)(c) (61) (361) (422) (19) — (441)

Net loss (441)

Capital expenditures 353 93 446 — — 446

Segment assets 6,258 4,821 11,079 192 (247) 11,024

(a) Duke Energy Ohio earned approximately 13% of its consolidated operating revenues from PJM in 2010, all of which is included in the Commercial Power segment. These revenues relate to the sale of capacity and electricity

from Commercial Power’s nonregulated generation assets.

(b) Franchised Electric and Gas recorded an impairment charge of $216 million related to the Ohio Transmission and Distribution reporting unit. This impairment charge was not applicable to Duke Energy as this reporting unit has

a lower carrying value at Duke Energy.

(c) Commercial Power recorded impairment charges of $621 million, which consisted of a $461 million goodwill impairment charge associated with the nonregulated Midwest generation operations and a $102 million charge, net

of tax of $58 million, to write-down the value of certain nonregulated Midwest generating assets and emission allowances primarily associated with these generation assets.

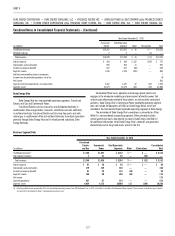

Duke Energy Carolinas, Progress Energy Carolinas, Progress Energy

Florida and Duke Energy Indiana

Duke Energy Carolinas, Progress Energy Carolinas, Progress Energy

Florida and Duke Energy Indiana each have one reportable operating segment,

Franchised Electric, which generates, transmits, distributes and sells electricity.

The remainder of each companies’ operations is classifi ed as Other. While not

considered reportable segments for any of these companies, Other consists of

each respective companies’ share of costs to achieve the merger between Duke

Energy and Progress Energy, certain corporate severance programs, and certain

costs for use of corporate assets as allocated to each company. See Note 14 for

additional information. The following table summarizes the net loss for Other at

each of these entities.

Years Ended December 31,

(in millions) 2012 2011

Duke Energy Carolinas(a) $(169) $ (46)

Progress Energy Carolinas(a) (139) (18)

Progress Energy Florida(a) (58) (16)

Duke Energy Indiana(a) (27)(12)

(a) The net loss for the year ended December 31, 2010, recorded in Other was not material.

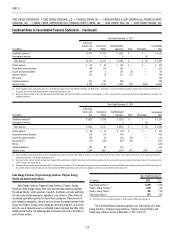

The Franchised Electric operating segments own substantially all of Duke

Energy Carolinas’, Progress Energy Carolinas’, Progress Energy Florida’s and

Duke Energy Indiana’s assets at December 31, 2012 and 2011.