Duke Energy 2012 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2012 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

55

PART II

a retirement benefi t consisting of pay credits that are based upon a percentage

(which may vary with age and years of service) of current eligible earnings and

current interest credits. Certain Progress Energy and Cinergy U.S. employees

are covered under plans that use a fi nal average earnings formula. Under

the Cinergy fi nal average earnings formula, a plan participant accumulates

a retirement benefi t equal to a percentage of their highest 3-year average

earnings, plus a percentage of their highest 3-year average earnings in excess of

covered compensation per year of participation (maximum of 35 years), plus a

percentage of their highest 3-year average earnings times years of participation

in excess of 35 years. Under the Progress Energy fi nal average earnings formula,

a plan participant accumulates a retirement benefi t equal to a percentage of their

highest 4-year average earnings, plus a percentage of their highest 4-year average

earnings in excess of covered compensation per year of participation (maximum

of 35 years), plus a percentage of their highest 4-year average earnings times

years of participation in excess of 35 years. Duke Energy also maintains, and the

Subsidiary Registrants participate in, non-qualifi ed, non-contributory defi ned

benefi t retirement plans which cover certain executives.

Duke Energy and most of its subsidiaries provide, and the Subsidiary

Registrants participate in, some health care and life insurance benefi ts for

retired employees on a contributory and non-contributory basis. Certain

employees are eligible for these benefi ts if they have met age and service

requirements at retirement, as defi ned in the plans.

Duke Energy recognized pre-tax qualifi ed pension cost of $117 million in

2012. In 2013, Duke Energy’s pre-tax qualifi ed pension cost is expected to be

$61 million higher than in 2012 resulting primarily from a 2013 decrease in the

discount rate on obligations and expected long-term rate of return on assets,

and 12 months of expense recognition in 2013 for the Progress Energy plans.

Duke Energy recognized pre-tax nonqualifi ed pension cost of $19 million and

pre-tax other post-retirement benefi ts cost of $80 million, in 2012. In 2013,

pre-tax non-qualifi ed pension cost is expected to be approximately the same

amount as in 2012. In 2013, pre-tax other post-retirement benefi ts costs are

expected to be approximately $46 million higher than in 2012 resulting primarily

from 12 months of expense recognition in 2013 for the Progress Energy plans.

For both pension and other post-retirement plans, Duke Energy assumes

that its plan’s assets will generate a long-term rate of return of 7.75% as of

December 31, 2012. The assets for Duke Energy’s pension and other post-

retirement plans are maintained in two master trusts, the Duke Energy Master

Retirement Trust and the Progress Energy Master Trust. The investment objective

of the master trusts is to achieve reasonable returns on trust assets, subject

to a prudent level of portfolio risk, for the purpose of enhancing the security

of benefi ts for plan participants. The asset allocation targets were set after

considering the investment objective and the risk profi le. U.S. equities are held for

their high expected return. Non-U.S. equities, debt securities, hedge funds, real

estate and other global securities are held for diversifi cation. Investments within

asset classes are to be diversifi ed to achieve broad market participation and

reduce the impact of individual managers on investments. Duke Energy regularly

reviews its actual asset allocation and periodically rebalances its investments

to its targeted allocation when considered appropriate. Duke Energy also invests

other post-retirement assets in the Duke Energy Corporation Employee Benefi ts

Trust (VEBA I). The investment objective of VEBA I is to achieve suffi cient returns,

subject to a prudent level of portfolio risk, for the purpose of promoting the

security of plan benefi ts for participants. VEBA I is passively managed.

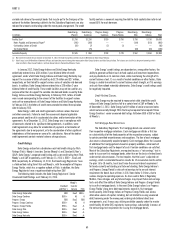

The expected long-term rate of return of 7.75% for the plan’s assets was

developed using a weighted average calculation of expected returns for the

master trusts based primarily on future expected returns across asset classes

considering the use of active asset managers. The weighted average returns

expected by asset classes for the Duke Energy Retirement Master Trust were

2.53% for U.S. equities, 1.46% for Non-U.S. equities, 0.97% for global equities,

1.65% for debt securities, 0.36% for global private equity, 0.22% for hedge

funds, 0.28% for real estate and 0.28% for other global securities. The weighted

average returns expected by asset classes for the Progress Energy Master Trust

were 1.83% for U.S. equities, 1.41% for Non-U.S. equities, 0.78% for global

equities, 1.67% for debt securities, 1.20% for global private equity, 0.57% for

hedge funds, 0.08% for real estate and 0.21% for other global securities.

Duke Energy discounted its future U.S. pension and other

post-retirement obligations using a rate of 4.1% as of December 31,

2012. The discount rates used to measure benefi t plan benefi t obligations

for fi nancial reporting purposes should refl ect rates at which pension

benefi ts could be effectively settled. As of December 31, 2012, Duke Energy

determined its discount rate for U.S. pension and other post-retirement

obligations using a bond selection-settlement portfolio approach. This

approach develops a discount rate by selecting a portfolio of high quality

corporate bonds that generate suffi cient cash fl ow to provide for the projected

benefi t payments of the plan. The selected bond portfolio is derived from a

universe of non-callable corporate bonds rated Aa quality or higher. After the

bond portfolio is selected, a single interest rate is determined that equates the

present value of the plan’s projected benefi t payments discounted at this rate

with the market value of the bonds selected.

Future changes in plan asset returns, assumed discount rates and various

other factors related to the participants in Duke Energy’s pension and

post-retirement plans will impact Duke Energy’s future pension expense and

liabilities. Management cannot predict with certainty what these factors will

be in the future. The following table presents the approximate effect on Duke

Energy’s 2012 pre-tax pension expense, pension obligation and other post-

retirement benefi t obligation if a 0.25% change in rates were to occur.

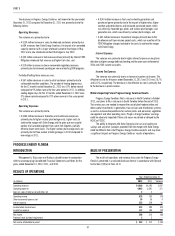

Qualifi ed and Non-

Qualifi ed Pension Plans Other Post-retirement Plans

(in millions) +0.25% -0.25% +0.25% -0.25%

Effect on 2012 pre-tax pension expense

Expected long-term rate of return $ (12) $ 12 $— $—

Discount rate (8) 8 (1) 1

Effect on benefi t obligation at December 31, 2012

Discount rate $(123) $127 $(15) $ 16

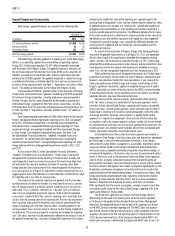

Duke Energy’s U.S. post-retirement plan uses a medical care trend rate which refl ects the near and long-term expectation of increases in medical health care costs.

Duke Energy’s U.S. post-retirement plan uses a prescription drug trend rate which refl ects the near and long-term expectation of increases in prescription drug health care

costs. As of December 31, 2012, the medical care trend rates were 8.5%, which grades to 5.00% by 2020. The following table presents the approximate effect on Duke

Energy’s 2012 pre-tax other post-retirement expense and other post-retirement benefi t obligation if a 1% point change in the health care trend rate were to occur.

Other Post-retirement Plans

(in millions) +1.0% -1.0%

Effect on 2012 other post-retirement expense $ 9 $ (7)

Effect on other post-retirement benefi t obligation at December 31, 2012 164 (133)