Duke Energy 2012 Annual Report Download - page 190

Download and view the complete annual report

Please find page 190 of the 2012 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

170

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. • CAROLINA POWER & LIGHT COMPANY d/b/a PROGRESS ENERGY

CAROLINAS, INC. • FLORIDA POWER CORPORATION d/b/a PROGRESS ENERY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

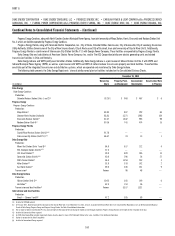

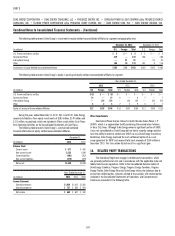

Years Ended December 31,

(in millions) 2012 2011 2010

Duke Energy Carolinas

Corporate governance and shared service expenses(a) $1,112 $1,009 $1,016

Indemnifi cation coverages(b) 21 21 25

Joint Dispatch Agreement (JDA) revenue(c) 18 — —

Joint Dispatch Agreement (JDA) expense(c) 91 — —

Progress Energy

Corporate governance and shared services provided

by Duke Energy(a) $ 63 $—$—

Corporate governance and shared services provided

to Duke Energy(d) 47 ——

Indemnifi cation coverages(b) 17 ——

Joint Dispatch Agreement (JDA) revenue(c) 91 ——

Joint Dispatch Agreement (JDA) expense(c) 18 ——

Progress Energy Carolinas

Corporate governance and shared service expenses(a) $ 254 $ 203 $ 176

Indemnifi cation coverages(b) 8 ——

Joint Dispatch Agreement (JDA) revenue(c) 91 ——

Joint Dispatch Agreement (JDA) expense(c) 18 ——

Progress Energy Florida

Corporate governance and shared service expenses(a) $ 186 $ 160 $ 156

Indemnifi cation coverages(b) 8 — —

Duke Energy Ohio

Corporate governance and shared service expenses(a) $ 358 $ 401 $ 369

Indemnifi cation coverages(b) 15 17 19

Duke Energy Indiana

Corporate governance and shared service expenses(a) $ 419 $ 415 $ 364

Indemnifi cation coverages(b) 8 7 8

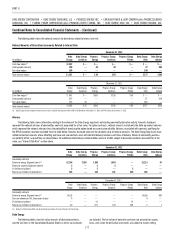

(a) The Subsidiary Registrants are charged their proportionate share of corporate governance and other costs

by unconsolidated affi liates that are consolidated affi liates of Duke Energy and Progress Energy. Corporate

governance and other shared services costs are primarily related to human resources, employee benefi ts,

legal and accounting fees, as well as other third -party costs. These amounts are recorded in Operation,

maintenance and other on the Consolidated Statements of Operations and Comprehensive Income.

(b) The Subsidiary Registrants incur expenses related to certain indemnifi cation coverages through Bison,

Duke Energy’s wholly owned captive insurance subsidiary. These expenses are recorded in Operation,

maintenance and other on the Consolidated Statements of Operations and Comprehensive Income.

(c) Effective with the consummation of the merger between Duke Energy and Progress Energy, Duke Energy

Carolinas and Progress Energy Carolinas began to participate in a JDA which allowed the collective

dispatch of power plants between the service territories to reduce customer rates. Revenues from the

sale of power under the JDA are recorded in Regulated electric within revenue on the Consolidated

Statements of Operations and Comprehensive Income. Expenses from the purchase of power under

the JDA are recorded in Fuel used in electric generation and purchased power — regulated on the

Consolidated Statements of Operations and Comprehensive Income.

(d) Progress Energy charges a proportionate share of corporate governance and other costs to unconsolidated

affi liates that are consolidated affi liates of Duke Energy. Corporate governance and other shared costs

are primarily related to human resources, employee benefi ts, legal and accounting fees, as well as other

third-party costs. These charges are recorded as an offset to Operation, maintenance and other in the

Statements of Operations and Comprehensive Income.

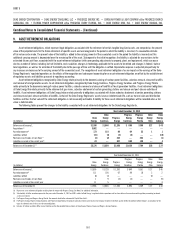

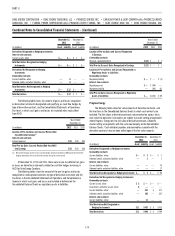

In addition to the amounts presented above, the Subsidiary Registrants

record income associated with the rental of offi ce space to consolidated

affi liates of Duke Energy, as well as their proportionate share of certain charged

expenses from affi liates of Duke Energy. The Duke Energy registrants participate

in a money pool arrangement with Duke Energy and certain of its subsidiaries.

See Note 6 for more information regarding money pool. As discussed in Note 18,

certain trade receivables have been sold by Duke Energy Ohio and Duke Energy

Indiana to CRC, an unconsolidated entity formed by a subsidiary of Duke Energy.

The proceeds obtained from the sales of receivables are largely cash but do

include a subordinated note from CRC for a portion of the purchase price. Rental

income, interest income and interest expense on these transactions were not

material for the years ended December 31, 2012, 2011 and 2010.

In January 2012, Duke Energy Ohio recorded a non-cash equity transfer of

$28 million related to the sale of Vermilion to Duke Energy Indiana. Duke Energy

Indiana recorded a non-cash after tax equity transfer of $26 million for the

purchase of Vermillion from Duke Energy Ohio. See note 2 for further discussion.

DECAM is a non regulated, direct subsidiary of Duke Energy Ohio. DECAM

conducts business activities including the execution of commodity transactions,

third -party vendor and supply contracts and service contracts for certain of

Duke Energy’s non regulated entities. The commodity contracts that DECAM

enters either do not qualify as hedges or are accounted for as undesignated

contracts, thus the mark-to-market impacts of these contracts are refl ected in

Duke Energy Ohio’s Consolidated Statements of Operations and Comprehensive

Income. In addition, equal and offsetting mark-to-market impacts of

intercompany contracts with non regulated entities are refl ected in Duke Energy

Ohio’s Consolidated Statements of Operations and Comprehensive Income

representing the pass through of the economics of the original contracts to non-

regulated entities in accordance with contractual arrangements between Duke

Energy Ohio and non regulated entities. Because it is not a rated entity, DECAM

receives its credit support from Duke Energy or its non regulated subsidiaries

and not the regulated utility operations of Duke Energy Ohio. DECAM meets

its funding needs through an intercompany loan agreement from a subsidiary

of Duke Energy. DECAM also has the ability to loan money to the subsidiary

of Duke Energy. DECAM had an outstanding intercompany loan payable with

the subsidiary of Duke Energy of $79 million as of December 31, 2012. This

amount is recorded in Notes payable to affi liated companies on Duke Energy

Ohio’s Consolidated Balance Sheets. DECAM had a $90 million intercompany

loan receivable with the subsidiary of Duke Energy as of December 31, 2011.

This amount is recorded in Notes receivable from affi liated companies on Duke

Energy Ohio’s Consolidated Balance Sheets. As discussed in Note 6, in August

2012, Duke Energy issued $1.2 billion of senior unsecured notes. Proceeds from

the issuances were used in part to repay outstanding notes of $500 million to

DECAM, and such funds were ultimately used to repay at maturity Duke Energy

Ohio’s $ 500 million debentures due September 15, 2012. In conjunction with

the proposed generation asset transfer discussed in Note 4, Duke Energy Ohio’s

capital structure is being restructured to refl ect appropriate debt and equity

ratios for its regulated Franchised Electric and Gas operations.

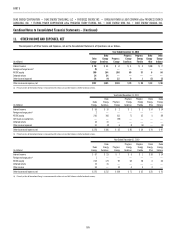

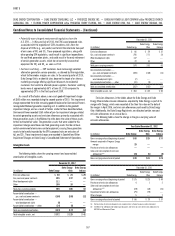

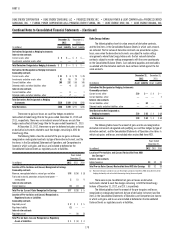

15. RISK MANAGEMENT, DERIVATIVE INSTRUMENTS

AND HEDGING ACTIVITIES

The Duke Energy Registrants closely monitor the risks associated with

commodity price changes and changes in interest rates on their operations and,

where appropriate, use various commodity and interest rate instruments to

manage these risks. Certain of these derivative instruments qualify for hedge

accounting and are designated as hedging instruments, while others either

do not qualify as hedges or have not been designated as hedges (hereinafter

referred to as undesignated contracts). The Duke Energy Registrants’ primary

use of energy commodity derivatives is to hedge the generation portfolio against

exposure to changes in the prices of power and fuel. Interest rate swaps are

entered into to manage interest rate risk primarily associated with the Duke

Energy Registrants’ variable-rate and fi xed-rate borrowings.

The accounting guidance for derivatives requires the recognition of all

derivative instruments not identifi ed as NPNS as either assets or liabilities at

fair value in the Consolidated Balance Sheets. For derivative instruments that

qualify for hedge accounting, the Duke Energy Registrants may elect to designate

such derivatives as either cash fl ow hedges or fair value hedges. The Duke

Energy Registrants offset fair value amounts recognized on the Consolidated