Duke Energy 2012 Annual Report Download - page 154

Download and view the complete annual report

Please find page 154 of the 2012 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

134

PART II

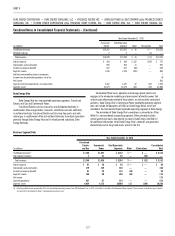

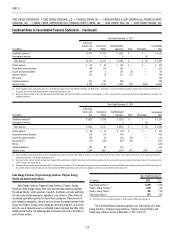

Combined Notes to Consolidated Financial Statements – (Continued)

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. • CAROLINA POWER & LIGHT COMPANY d/b/a PROGRESS ENERGY

CAROLINAS, INC. • FLORIDA POWER CORPORATION d/b/a PROGRESS ENERY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

V.C. Summer Nuclear Station Letter of Intent.

In July 2011, Duke Energy Carolinas signed a letter of intent with Santee

Cooper related to the potential acquisition by Duke Energy Carolinas of a 5% to

10% ownership interest in the V.C. Summer Nuclear Station being developed

by Santee Cooper and SCE&G near Jenkinsville, South Carolina. The letter of

intent provides a path for Duke Energy Carolinas to conduct the necessary due

diligence to determine if future participation in this project is benefi cial for its

customers. On November 7, 2012, the term of the letter of intent expired, though

Duke Energy Carolinas remains engaged in discussions at this time.

Progress Energy Carolinas

2012 North Carolina Rate Case.

On October 12, 2012, Progress Energy Carolinas fi led an application with

the NCUC for an increase in base rates of approximately $387 million, or an

average 12% increase in revenues. The request for increase is based upon

an 11.25% return on equity and a capital structure of 55% equity and 45%

long-term debt. The rate increase is designed primarily to recover the cost of

plant modernization and other capital investments in generation, transmission

and distribution systems, as well as increased expenditures for nuclear plants

and personnel, vegetation management and other operating costs. The rate

case includes a corresponding decrease in Progress Energy Carolinas’ energy

effi ciency and demand side management rider, resulting in a net requested

increase of $359 million, or 11% increase in retail revenues.

On February 25, 2013, the North Carolina Public Staff fi led with the

NCUC a Notice of Settlement in Principle (Settlement Notice). Pursuant to the

Settlement Notice between Progress Energy Carolinas and the Public Staff,

the parties have agreed to a two year step-in to a total agreed upon net rate

increase, with the fi rst year providing for a $151 million, or 4.7% average

increase in rates, and the second year providing for rates to be increased by

an additional $31 million, or 1.0% average increase in rates. This second year

increase is a result of Progress Energy Carolinas agreeing to delay collection of

fi nancing costs on the construction work in progress for the Sutton combined

cycle natural gas plant for one year. The Settlement Notice is based upon a

return on equity of 10.2% and a 53% equity component of the capital structure.

Once fi led, the actual settlement agreement will be subject to approval by

the NCUC. Progress Energy Carolinas expects revised rates, if approved, to go

into effect June 1, 2013.

HF Lee and L.V. Sutton Combined Cycle Facilities.

Progress Energy Carolinas has been constructing two new generating

facilities, which consist of an approximately 920 MW combined cycle natural

gas-fi red generating facility at the HF Lee Energy Complex (Lee) in Wayne

County, North Carolina, and an approximately 625 MW natural gas-fi red

generating facility at its existing L.V. Sutton Steam Station (Sutton) in

New Hanover County, North Carolina. The Lee project began commercial

operation in the fourth quarter of 2012. Total estimated costs at fi nal project

completion (including AFUDC) for the Sutton project, which is approximately

64% complete, are $600 million. Sutton is expected to be in service in the

fourth quarter of 2013.

Shearon Harris Nuclear Station Expansion.

In 2006, Progress Energy Carolinas selected a site at its existing Shearon

Harris Nuclear Station (Harris) to evaluate for possible future nuclear expansion.

On February 19, 2008, Progress Energy Carolinas fi led its COL application with

the NRC for two Westinghouse Electric AP1000 reactors at Harris, which the

NRC docketed on April 17, 2008. No petitions to intervene have been admitted

in the Harris COL application.

Progress Energy Florida

2012 FPSC Settlement Agreement.

On February 22, 2012, the FPSC approved a comprehensive settlement

agreement among Progress Energy Florida, the Florida Offi ce of Public Counsel

and other consumer advocates. The 2012 FPSC Settlement Agreement will

continue through the last billing cycle of December 2016. The agreement

addresses three principal matters: (i) Progress Energy Florida’s proposed Levy

Nuclear Station cost recovery, (ii) the Crystal River Nuclear Station — Unit 3

(Crystal River Unit 3) delamination prudence review then pending before the

FPSC, and (iii) certain customer rate matters. Refer to each of these respective

sections for further discussion.

Crystal River Unit 3.

In September 2009, Crystal River Unit 3 began an outage for normal

refueling and maintenance as well as an uprate project to increase its

generating capability and to replace two steam generators. During preparations

to replace the steam generators, workers discovered a delamination

(or separation) within the concrete at the periphery of the containment

building, which resulted in an extension of the outage. After analysis, it was

determined that the concrete delamination at Crystal River Unit 3 was caused

by redistribution of stresses in the containment wall that occurred when an

opening was created to accommodate the replacement of the unit’s steam

generators. In March 2011, the work to return the plant to service was suspended

after monitoring equipment identifi ed a new delamination that occurred in a different

section of the outer wall after the repair work was completed and during the late

stages of retensioning the containment building. Crystal River Unit 3 has remained

out of service while Progress Energy Florida conducted an engineering analysis and

review of the new delamination and evaluated possible repair options.

Subsequent to March 2011, monitoring equipment has detected additional

changes and further damage in the partially tensioned containment building

and additional cracking or delaminations could occur.

Progress Energy Florida developed a repair plan, which would entail

systematically removing and replacing concrete in substantial portions

of the containment structure walls, which had a preliminary cost estimate of

$900 million to $1.3 billion.

In March 2012, Duke Energy commissioned an independent review

team led by Zapata Incorporated (Zapata) to review and assess the Progress

Energy Florida Crystal River Unit 3 repair plan, including the repair scope,

risks, costs and schedule. In its fi nal report in late September, Zapata found

that the proposed repair scope appears to be technically feasible, but there

were signifi cant risks that need to be addressed regarding the approach,

construction methodology, scheduling and licensing. Zapata performed four

separate analyses of the estimated project cost and schedule to repair Crystal

River Unit 3, including; (i) an independent review of the proposed repair scope

(without existing assumptions or data), of which Zapata estimated costs of

$1.49 billion with a project duration of 35 months; (ii) a review of Progress

Energy Florida’s previous bid information, which included cost estimate data

from Progress Energy Florida, of which Zapata estimated costs of $1.55 billion

with a project duration of 31 months; (iii) an expanded scope of work scenario,

that included the Progress Energy Florida scope plus the replacement of the

containment building dome and the removal and replacement of concrete in the