Duke Energy 2012 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2012 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

61

PART II

Other Financing Matters.

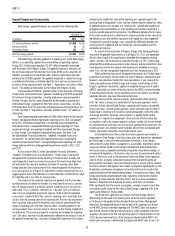

The following table shows signifi cant amounts presented as Current

maturities of long-term debt on the Duke Energy Registrants respective

Consolidated Balance Sheets as of December 31, 2012. The amounts were

presented as Long-term debt as of December 31, 2011, except for the secured

debt. The Duke Energy Registrants’ currently anticipates satisfying these

obligations with proceeds from additional borrowings, unless otherwise noted.

(in millions) Maturity Date Interest Rate December 31, 2012

Unsecured Debt:

Duke Energy (Parent) June 2013 5.650 % $ 250

Duke Energy Indiana September 2013 5.000 % 400

Secured Debt:

Duke Energy(a) December 2013 3.796 % 423

Duke Energy(b) June 2013 1.009 % 190

First Mortgage Bonds:

Duke Energy Carolinas November 2013 5.750 % 400

Progress Energy Carolinas September 2013 5.125 % 400

Progress Energy Florida March 2013 4.800 % 425

Duke Energy Ohio June 2013 2.100 % 250

Other 372

Current maturities of

long-term debt $3,110

(a) Represents a construction loan related to a renewable energy project that will be converted to a term loan

once construction is complete.

(b) Notes are fully offset with cash collateral, which is recorded in Other current assets in the Consolidated

Balance Sheets as of December 31, 2012.

On November 13, 2012, Duke Energy fi led a prospectus supplement to

the September 2010 Form S-3 with the Securities and Exchange Commission

(SEC), to sell up to $1 billion of fi xed or variable rate unsecured senior notes,

called InterNotes, due one year to 30 years from the date of issuance. The

InterNotes will be issued in the retail markets as direct, unsecured and

unsubordinated obligations of Duke Energy Corporation. The net proceeds from

the sale of InterNotes will be used to fund capital expenditures in Duke Energy’s

unregulated businesses and for general corporate purposes. The balance as of

December 31, 2012 is $35 million, with maturities ranging from 10 to14 years.

The notes refl ect long-term debt obligations of Duke Energy and are refl ected as

Long-term debt on Duke Energy’s Consolidated Balance Sheets.

On March 1, 2012, Progress Energy, as a well-known seasoned issuer,

Progress Energy Carolinas and Progress Energy Florida fi led a combined shelf

registration statement with the SEC, which became effective upon fi ling with

the SEC. The registration statement is effective for three years and does not

limit the amount or number of various securities that can be issued. On July 3,

2012, Progress Energy deregistered its equity securities from the registration

statement in connection with the merger with Progress Energy, but retained

its ability to issue senior debt securities and junior subordinated debentures

under the registration statement. However, we do not expect Progress Energy

to issue any new securities of these types in the future. Under Progress Energy

Carolinas’ and Progress Energy Florida’s registration statements, they may issue

various long-term debt securities and preferred stock.

On April 4, 2011, Duke Energy fi led a registration statement (Form S-3)

with the SEC to sell up to $1 billion (maximum of $500 million of notes

outstanding at any particular time) of variable denomination fl oating rate

demand notes, called PremierNotes. The notes are offered on a continuous basis

and bear interest at a fl oating rate per annum determined by the Duke Energy

PremierNotes Committee, or its designee, on a weekly basis. The interest rate

payable on notes held by an investor may vary based on the principal amount of

the investment. The notes have no stated maturity date, but may be redeemed

in whole or in part by Duke Energy at any time. The notes are non-transferable

and may be redeemed in whole or in part at the investor’s option. Proceeds from

the sale of the notes will be used for general corporate purposes. The balance as

of December 31, 2012 and December 31, 2011, is $395 million and $79 million,

respectively. The notes refl ect a short-term debt obligation of Duke Energy

and are refl ected as Notes Payable and Commercial Paper on Duke Energy’s

Consolidated Balance Sheets.

In September 2010, Duke Energy fi led a Form S-3 with the SEC. Under

this Form S-3, which is uncapped, Duke Energy, Duke Energy Carolinas, Duke

Energy Ohio and Duke Energy Indiana may issue debt and other securities in the

future at amounts, prices and with terms to be determined at the time of future

offerings. The registration statement also allows for the issuance of common

stock by Duke Energy.

Duke Energy has paid quarterly cash dividends for 87 consecutive years

and expects to continue its policy of paying regular cash dividends in the future.

There is no assurance as to the amount of future dividends because they

depend on future earnings, capital requirements, fi nancial condition and are

subject to the discretion of the Board of Directors.

Dividend and Other Funding Restrictions of Duke Energy Subsidiaries.

As discussed in Note 4 to the Consolidated Financial Statements

“Regulatory Matters,” Duke Energy’s wholly owned public utility operating

companies have restrictions on the amount of funds that can be transferred to

Duke Energy via dividend, advance or loan as a result of conditions imposed

by various regulators in conjunction with Duke Energy’s mergers with Cinergy

and Progress Energy. Progress Energy Carolinas and Progress Energy Florida

also have restrictions imposed by their fi rst mortgage bond indentures and

Articles of Incorporation which, in certain circumstances, limited their ability

to make cash dividends or distributions on common stock. Additionally, certain

other Duke Energy subsidiaries have other restrictions, such as minimum

working capital and tangible net worth requirements pursuant to debt and other

agreements that limit the amount of funds that can be transferred to Duke

Energy. At December 31, 2012, the amount of restricted net assets of wholly

owned subsidiaries of Duke Energy that may not be distributed to Duke Energy

in the form of a loan or dividend is $10.3 billion. However, Duke Energy does

not have any legal or other restrictions on paying common stock dividends to

shareholders out of its consolidated equity accounts. Although these restrictions

cap the amount of funding the various operating subsidiaries can provide to

Duke Energy, management does not believe these restrictions will have any

signifi cant impact on Duke Energy’s ability to access cash to meet its payment

of dividends on common stock and other future funding obligations.

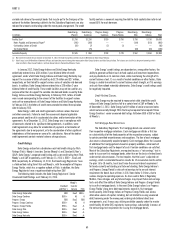

Off-Balance Sheet Arrangements

Duke Energy and certain of its subsidiaries enter into guarantee

arrangements in the normal course of business to facilitate commercial

transactions with third parties. These arrangements include performance

guarantees, stand-by letters of credit, debt guarantees, surety bonds and

indemnifi cations.

Most of the guarantee arrangements entered into by Duke Energy enhance

the credit standing of certain subsidiaries, non-consolidated entities or less

than wholly owned entities, enabling them to conduct business. As such, these

guarantee arrangements involve elements of performance and credit risk, which

are not included on the Consolidated Balance Sheets. The possibility of Duke

Energy, either on its own or on behalf of Spectra Energy Capital, LLC (Spectra

Capital) through indemnifi cation agreements entered into as part of the spin-off

of Spectra Energy Corp (Spectra Energy), having to honor its contingencies is

largely dependent upon the future operations of the subsidiaries, investees and

other third parties, or the occurrence of certain future events.

Duke Energy performs ongoing assessments of their respective guarantee

obligations to determine whether any liabilities have been incurred as a result of

potential increased non-performance risk by third parties for which Duke Energy

has issued guarantees.