Duke Energy 2012 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2012 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART I

22

could be required to fund its plans with signifi cant amounts of cash. Such cash

funding obligations, and the Subsidiary Registrants’ proportionate share of such

cash funding obligations, could have a material impact on the Duke Energy

Registrants’ fi nancial position, results of operations or cash fl ows.

Potential terrorist activities or military or other actions, including cyber system

attacks, could adversely affect the Duke Energy Registrants’ businesses.

The continued threat of terrorism and the impact of retaliatory military and

other action by the U.S. and its allies may lead to increased political, economic

and fi nancial market instability and volatility in prices for natural gas and oil

which may have material adverse affects in ways the Duke Energy Registrants

cannot predict at this time. In addition, future acts of terrorism and any possible

reprisals as a consequence of action by the U.S. and its allies could be directed

against companies operating in the U.S. or their international affi liates. Cyber

systems, infrastructure and generation facilities such as the Duke Energy

Registrants’ nuclear plants could be potential targets of terrorist activities

or harmful activities by individuals or groups. The potential for terrorism has

subjected the Duke Energy Registrants’ operations to increased risks and

could have a material adverse effect on their businesses. In particular, the

Duke Energy Registrants may experience increased capital and operating costs

to implement increased security for their cyber systems and plants, including

nuclear power plants under the NRC’s design basis threat requirements, such

as additional physical plant security, additional security personnel or additional

capability following a terrorist incident.

The insurance industry has also been disrupted by these potential

events. As a result, the availability of insurance covering risks the Duke Energy

Registrants and their competitors typically insure against may decrease.

In addition, the insurance the Duke Energy Registrants are able to obtain may

have higher deductibles, higher premiums, lower coverage limits and more

restrictive policy terms.

Information security risks have generally increased in recent years as a

result of the proliferation of new technologies and the increased sophistication

and activities of cyber attacks. Through our smart grid and other initiatives, the

Duke Energy Registrants have increasingly connected equipment and systems

related to the generation, transmission and distribution of electricity to the

Internet. Because of the critical nature of the infrastructure and the increased

accessibility enabled through connection to the Internet, the Duke Energy

Registrants may face a heightened risk of cyber attack. In the event of such an

attack, the Duke Energy Registrants could have business operations disrupted,

property damaged and customer information stolen; experience substantial

loss of revenues, response costs and other fi nancial loss; and be subject to

increased regulation, litigation and damage to our reputation.

Additional risks and uncertainties not currently known to the Duke Energy

Registrants or which they currently deem to be immaterial also may materially

adversely affect the Duke Energy Registrants’ fi nancial condition, results of

operations or cash fl ows.

Failure to attract and retain an appropriately qualifi ed workforce could

unfavorably impact the Duke Energy Registrants’ results of operations.

Certain events, such as an aging workforce, mismatch of skill set or

complement to future needs, or unavailability of contract resources may lead

to operating challenges and increased costs. The challenges include lack

of resources, loss of knowledge base and the lengthy time required for skill

development. In this case, costs, including costs for contractors to replace

employees, productivity costs and safety costs, may rise. Failure to hire and

adequately train replacement employees, including the transfer of signifi cant

internal historical knowledge and expertise to the new employees, or the

future availability and cost of contract labor may adversely affect the ability

to manage and operate the business. If the Duke Energy Registrants are

unable to successfully attract and retain an appropriately qualifi ed workforce,

their fi nancial position or results of operations could be negatively affected.

The Duke Energy Registrants rely on access to short-term borrowings and

longer-term capital markets to fi nance their capital requirements and

support their liquidity needs. Access to those markets can be adversely

affected by a number of conditions, many of which are beyond the Duke

Energy Registrants’ control.

The Duke Energy Registrants’ businesses are fi nanced to a large

degree through debt and the maturity and repayment profi le of debt used to

fi nance investments often does not correlate to cash fl ows from their assets.

Accordingly, as a source of liquidity for capital requirements not satisfi ed by

the cash fl ow from their operations and to fund investments originally fi nanced

through debt instruments with disparate maturities, Duke Energy and the

Subsidiary Registrants rely on access to short-term money markets as well as

longer-term capital markets and the Subsidiary Registrants also rely on access

to short-term intercompany borrowings. If the Duke Energy Registrants are not

able to access capital at competitive rates or at all, the ability to fi nance their

operations and implement their strategy and business plan as scheduled could

be adversely affected. An inability to access capital may limit the Duke Energy

Registrants’ ability to pursue improvements or acquisitions that they may

otherwise rely on for future growth.

Market disruptions may increase the Duke Energy Registrants’ cost

of borrowing or adversely affect their ability to access one or more fi nancial

markets. Such disruptions could include: economic downturns; the bankruptcy

of an unrelated energy company; capital market conditions generally; market

prices for electricity and gas; terrorist attacks or threatened attacks on their

facilities or unrelated energy companies; or the overall health of the energy

industry. The availability of credit under Duke Energy’s revolving credit facilities

depends upon the ability of the banks providing commitments under such

facilities to provide funds when their obligations to do so arise. Systematic risk

of the banking system and the fi nancial markets could prevent a bank from

meeting its obligations under the facility agreement.

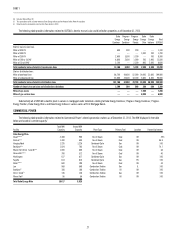

Duke Energy maintains revolving credit facilities to provide back-up for

a commercial paper program for variable rate demand tax-exempt bonds that

may be put to the Duke Energy Registrant issuer at the option of the holder

and certain letters of credit at various entities. These facilities typically include

borrowing sublimits for the Subsidiary Registrants and fi nancial covenants

that limit the amount of debt that can be outstanding as a percentage of the

total capital for the specifi c entity. Failure to maintain these covenants at a

particular entity could preclude Duke Energy from issuing commercial paper or

the Duke Energy Registrants from issuing letters of credit or borrowing under

the revolving credit facility. Additionally, failure to comply with these fi nancial

covenants could result in Duke Energy being required to immediately pay down

any outstanding amounts under other revolving credit agreements.

Duke Energy’s investments and projects located outside of the United

States expose it to risks related to laws of other countries, taxes, economic

conditions, political conditions and policies of foreign governments. These

risks may delay or reduce Duke Energy’s realization of value from its

international projects.

Duke Energy currently owns and may acquire and/or dispose of material

energy-related investments and projects outside the U.S. The economic,

regulatory, market and political conditions in some of the countries where Duke

Energy has interests or in which it may explore development, acquisition or

investment opportunities could present risks related to, among others, Duke

Energy’s ability to obtain fi nancing on suitable terms, its customers’ ability

to honor their obligations with respect to projects and investments, delays in

construction, limitations on its ability to enforce legal rights, and interruption of

business, as well as risks of war, expropriation, nationalization, renegotiation,

trade sanctions or nullifi cation of existing contracts and changes in law,

regulations, market rules or tax policy.