Duke Energy 2012 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2012 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308

|

|

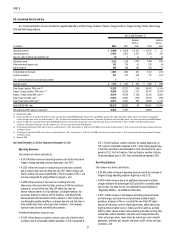

43

PART II

a decrease as a result of the DukeNet deconsolidation in December 2010

and the subsequent accounting for Duke Energy’s investment in DukeNet as

an equity method investment; partially offset by higher costs related to the

proposed merger with Progress Energy.

(Losses) Gains on Sales of Other Assets and other, net.

The variance was primarily due to the $139 million gain from the sale of

a 50% ownership interest in DukeNet in the prior year.

Other Income and Expense, net.

The variance was due primarily to the sale of Duke Energy’s ownership

interest in Q-Comm in the prior year of $109 million; partially offset by prior

year impairments and 2011 gains on sales of investments.

Interest Expense.

The variance was due primarily to higher debt balances as a result of debt

issuances.

Income Tax Benefi t.

The variance is primarily due to a decrease in pre-tax income. The

effective tax rate for the year ended December 31, 2011 and 2010 was 56.0%

and 55.4%, respectively.

Net Expense.

The variance was driven primarily by $172 million of 2010 employee

severance costs related to the voluntary severance plan and the consolidation

of certain corporate offi ce functions from the Midwest to Charlotte, North

Carolina, prior year donations of $56 million to the Duke Energy Foundation,

a decrease as a result of the DukeNet deconsolidation in December 2010 and

the subsequent accounting for Duke Energy’s investment in DukeNet as an

equity method investment, and higher interest expense due to increased debt

issuances in the current year. These negative impacts were partially offset by

prior year impairments and 2011 gains on sales of investments and higher

income tax benefi t due to increased net expense.

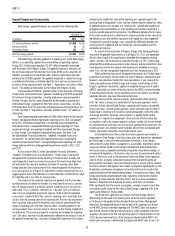

Matters Impacting Future Other Results

Duke Energy previously held an effective 50% interest in Crescent, which

was a real estate joint venture formed by Duke Energy in 2006 that fi led for

Chapter 11 bankruptcy protection in June 2009. On June 9, 2010, Crescent

restructured and emerged from bankruptcy and Duke Energy forfeited its entire

50% ownership interest to Crescent debt holders. This forfeiture caused Duke

Energy to recognize a loss, for tax purposes, on its interest in the second quarter

of 2010. Although Crescent has reorganized and emerged from bankruptcy

with creditors owning all Crescent interest, there remains uncertainty as to the

tax treatment associated with the restructuring. Based on this uncertainty, it

is possible that Duke Energy could incur a future tax liability related to the tax

losses associated with its partnership interest in Crescent and the resolution of

issues associated with Crescent’s emergence from bankruptcy.

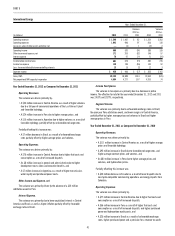

DUKE ENERGY CAROLINAS

INTRODUCTION

Management’s Discussion and Analysis should be read in conjunction

with the accompanying Consolidated Financial Statements and Notes for the

years ended December 31, 2012, 2011, and 2010.

BASIS OF PRESENTATION

The results of operations and variance discussion for Duke Energy

Carolinas is presented in a reduced disclosure format in accordance with

General Instruction (I)(2)(a) of Form 10-K.

RESULTS OF OPERATIONS

Years Ended December 31,

(in millions) 2012 2011 Variance

Operating revenues $6,665 $6,493 $ 172

Operating expenses 5,160 5,014 146

Gains on sales of other assets and other, net 12 111

Operating income 1,517 1,480 37

Other income and expense, net 185 186 (1)

Interest expense 384 360 24

Income before income taxes 1,318 1,306 12

Income tax expense 453 472 (19)

Net income $ 865 $ 834 $ 31