Duke Energy 2012 Annual Report Download - page 179

Download and view the complete annual report

Please find page 179 of the 2012 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

159

PART II

Combined Notes to Consolidated Financial Statements – (Continued)

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. • CAROLINA POWER & LIGHT COMPANY d/b/a PROGRESS ENERGY

CAROLINAS, INC. • FLORIDA POWER CORPORATION d/b/a PROGRESS ENERY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

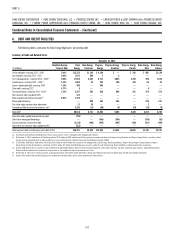

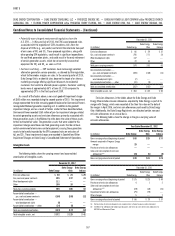

consolidated entities, with the remainder related to guarantees issued on behalf

of third parties and unconsolidated affi liates of Duke Energy.

Of the guarantees noted above, $93 million of the guarantees expire

between 2013 and 2028, with the remaining performance guarantees having no

contractual expiration.

Included in the maximum potential amount of future payments discussed

above is $26 million of maximum potential amounts of future payments

associated with guarantees issued to customers or other third parties related to

the payment or performance obligations of certain entities that were previously

wholly owned by Duke Energy but which have been sold to third parties,

such as DukeSolutions, Inc. (DukeSolutions). These guarantees are primarily

related to payment of lease obligations, debt obligations, and performance

guarantees related to provision of goods and services. Duke Energy received

indemnifi cation from the buyer of DukeSolutions for the fi rst $2.5 million paid

by Duke Energy related to the DukeSolutions guarantees. Further, Duke Energy

granted indemnifi cation to the buyer of DukeSolutions with respect to losses

arising under some energy services agreements retained by DukeSolutions after

the sale, provided that the buyer agreed to bear 1 00% of the performance risk

and 50% of any other risk up to an aggregate maximum of $2.5 million (less any

amounts paid by the buyer under the indemnity discussed above). Additionally,

for certain performance guarantees, Duke Energy has recourse to subcontractors

involved in providing services to a customer. These guarantees have various

terms ranging from 2013 to 2021, with others having no specifi c term.

Duke Energy has guaranteed certain issuers of surety bonds, obligating

itself to make payment upon the failure of a former non-wholly owned entity

to honor its obligations to a third party, as well as used bank-issued stand-by

letters of credit to secure the performance of non-wholly owned entities to a

third party or customer. Under these arrangements, Duke Energy has payment

obligations that are triggered by a draw by the third party or customer due to

the failure of the non-wholly owned entity to perform according to the terms of

its underlying contract. Substantially all of these guarantees issued by Duke

Energy relate to projects at Crescent that were under development at the time of

the joint venture creation in 2006. Crescent fi led Chapter 11 petitions in a U.S.

Bankruptcy Court in June 2009. During 2009, Duke Energy determined that it

was probable that it will be required to perform under certain of these guarantee

obligations and recorded a charge of $2 6 million associated with these

obligations, which represented Duke Energy’s best estimate of its exposure

under these guarantee obligations. At the time the charge was recorded, the

face value of the guarantees was $70 million, which has since been reduced to

$1 8 million as of December 31, 2012, as Crescent continues to complete some

of its obligations under these guarantees.

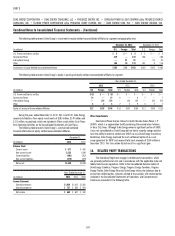

Duke Energy has entered into various indemnifi cation agreements

related to purchase and sale agreements and other types of contractual

agreements with vendors and other third parties. These agreements typically

cover environmental, tax, litigation and other matters, as well as breaches of

representations, warranties and covenants. Typically, claims may be made by

third parties for various periods of time, depending on the nature of the claim.

Duke Energy’s potential exposure under these indemnifi cation agreements can

range from a specifi ed amount, such as the purchase price, to an unlimited

dollar amount, depending on the nature of the claim and the particular

transaction. With the exception of the $217 million at Progress Energy discussed

as follows, Duke Energy is unable to estimate the total potential amount of

future payments under these indemnifi cation agreements due to several factors,

such as the unlimited exposure under certain guarantees.

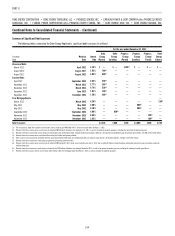

Progress Energy has issued indemnifi cations for certain asset performance,

legal, tax and environmental matters to third parties, including indemnifi cations

made in connection with sales of businesses. At December 31, 2012, the

estimated maximum exposure for these indemnifi cations for which a maximum

exposure is determinable was $2 17 million, including $42 million at Progress

Energy Florida. Related to the sales of businesses, the latest specifi ed notice

period extends until 2013 for the majority of legal, tax and environmental

matters provided for in the indemnifi cation provisions. Indemnifi cations for the

performance of assets extend to 2016. For certain matters for which Progress

Energy receives timely notice, indemnity obligations may extend beyond the

notice period. Certain indemnifi cations related to discontinued operations

have no limitations as to time or maximum potential future payments. At

December 31, 2012 and 2011, Progress Energy had recorded liabilities related

to indemnifi cations to third parties of $25 million and $63 million, respectively.

These amounts included $17 million and $37 million for Progress Energy Florida

at December 31, 2012 and 2011, respectively. These liabilities decreased

primarily due to the reversal of certain environmental indemnifi cation liabilities

for which the indemnifi cation period has expired and the adjustment to the

indemnifi cation for the estimated future years’ joint owner replacement power

costs through the end of the Crystal River Unit 3 joint owner contract. Progress

Energy Florida’s liabilities decreased primarily due to the previously mentioned

indemnifi cation adjustment related to Crystal River Unit 3. During the years

ended December 31, 2012 and 2011, accruals and expenditures related to

indemnifi cations were not material.

In addition, Progress Energy has issued $300 million in guarantees for

certain payments of two wholly owned indirect subsidiaries, FPC Capital I Trust

and Florida Progress Funding Corporation (Funding Corp.). The guarantees

expired February 1, 2013, with the redemption of the associated notes and

securities. See Note 18 for additional information.

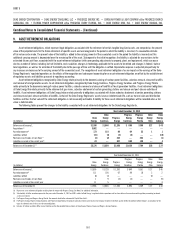

At December 31, 2012 and 2011, the amounts recorded on the

Consolidated Balance Sheets for the guarantees and indemnifi cations mentioned

above was $4 1 million and $19 million, respectively. This amount is primarily

recorded in Other within Deferred Credits and Other Liabilities on the Consolidated

Balance Sheets. The liability for 2011 excludes Progress Energy as Progress

Energy was acquired July 2, 2012. As current estimates change, additional

losses related to guarantees and indemnifi cations to third parties, which could be

material, may be recorded by the Duke Energy Registrants in the future.

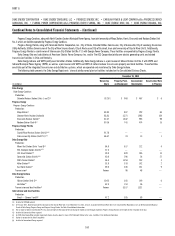

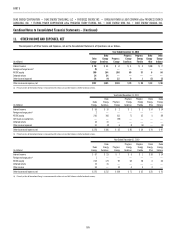

8. JOINT OWNERSHIP OF GENERATING

AND TRANSMISSION FACILITIES

The Duke Energy Registrants hold ownership interests in certain jointly

owned generating facilities. The Duke Energy Registrants are entitled to shares

of the generating capability and output of each unit equal to their respective

ownership interests. The Duke Energy Registrants also pays their ownership

share of additional construction costs, fuel inventory purchases and operating

expenses, except in certain instances where agreements have been executed to

limit certain joint owners’ maximum exposure to the additional costs. The Duke

Energy Registrants share of revenues and operating costs of the jointly owned

generating facilities is included within the corresponding line in the Consolidated

Statements of Operations. Each participant in the jointly owned facilities must

provide its own fi nancing, except in certain instances where agreements have been

executed to limit certain joint owners’ maximum exposure to the additional costs.

Duke Energy Carolinas, along with North Carolina Municipal Power Agency

Number 1, North Carolina Electric Membership Corporation and Piedmont

Municipal Power Agency, have joint ownership of Catawba, which is a facility

operated by Duke Energy Carolinas.