Duke Energy 2012 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2012 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

112

PART II

Combined Notes to Consolidated Financial Statements – (Continued)

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. • CAROLINA POWER & LIGHT COMPANY d/b/a PROGRESS ENERGY

CAROLINAS, INC. • FLORIDA POWER CORPORATION d/b/a PROGRESS ENERY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

date nor the merger resulted in any changes to the Progress Energy reporting

units. Due to signifi cant judgments and estimates that are utilized in a goodwill

impairment analysis, Progress Energy determined it was impracticable to

objectively determine, without the use of hindsight, projected cash fl ows and

related valuation estimates as of each August 31, for periods prior to August 31,

2012. As such, the change in the annual goodwill impairment testing date was

prospectively applied from August 31, 2012.

Duke Energy, Progress Energy and Duke Energy Ohio perform the annual

review for goodwill impairment at the reporting unit level, which Duke Energy

and Progress Energy have determined to be an operating segment or one

level below and which Duke Energy Ohio has determined to be an operating

segment.

The annual goodwill impairment test may fi rst consider qualitative factors

to determine whether it is more likely than not (i.e. greater than 50 percent

chance) that the fair value of a reporting unit is less than its book value. This

is sometimes referred to as “step zero” and is an optional step in the annual

goodwill impairment analysis (see further discussion as discussed in “New

Accounting Standards” below). If the results of qualitative assessments indicate

that the fair value of a reporting unit is more likely than not less than the

carrying value of the reporting unit, the two-step impairment test is required.

Step one of the impairment test involves comparing the fair values of reporting

units with their carrying values, including goodwill. If the carrying amount is

less than fair value in step one, further testing of goodwill is not performed. If

the carrying amount of a reporting unit exceeds the reporting unit’s fair value,

step two must be performed to determine the amount, if any, of the goodwill

impairment loss. Step two of the goodwill impairment test involves comparing

the implied fair value of the reporting unit’s goodwill against the carrying value

of the goodwill. Under step two, determining the implied fair value of goodwill

requires the valuation of a reporting unit’s identifi able tangible and intangible

assets and liabilities as if the reporting unit had been acquired in a business

combination on the testing date. The difference between the fair value of the

entire reporting unit as determined in step one and the net fair value of all

identifi able assets and liabilities represents the implied fair value of goodwill.

The goodwill impairment charge, if any, would be the excess of the carrying

amount of goodwill over the implied fair value of goodwill upon the completion

of step two.

As a result of the Progress Energy merger, Duke Energy, Progress Energy

and Duke Energy Ohio performed step one of the goodwill impairment test as of

August 31, 2012, and concluded the fair value of the reporting units exceeded

their respective carrying values, and thus, did not record any impairment

charges. In 2011, Duke Energy and Duke Energy Ohio performed the qualitative

assessments under step zero and concluded that it was more likely than not the

fair value of each reporting unit exceeded its carrying value. In 2011, Progress

Energy performed step one of the goodwill impairment test, which indicated the

carrying amounts of goodwill were not impaired. In 2010, Duke Energy, Progress

Energy and Duke Energy Ohio used the two-step process to test goodwill for

impairment, which resulted in impairments recorded by Duke Energy and Duke

Energy Ohio.

See Note 12 for further information.

Long-Lived Asset Impairments.

The Duke Energy Registrants evaluate whether long-lived assets,

excluding goodwill, have been impaired when circumstances indicate the

carrying value of those assets may not be recoverable. For such long-lived

assets, an impairment exists when its carrying value exceeds the sum of

estimates of the undiscounted cash fl ows expected to result from the use and

eventual disposition of the asset. When alternative courses of action to recover

the carrying amount of a long-lived asset are under consideration, a probability-

weighted approach is used for developing estimates of future undiscounted

cash fl ows. If the carrying value of the long-lived asset is not recoverable based

on these estimated future undiscounted cash fl ows, the impairment loss is

measured as the excess of the carrying value of the asset over its fair value,

such that the asset’s carrying value is adjusted to its estimated fair value.

Management assesses the fair value of long-lived assets using commonly

accepted techniques, and may use more than one source. Sources to determine

fair value include, but are not limited to, recent third -party comparable sales,

internally developed discounted cash fl ow analysis and analysis from outside

advisors. Signifi cant changes in market conditions resulting from events such

as, among others, changes in commodity prices or the condition of an asset,

or a change in management’s intent to utilize the asset are generally viewed

by management as triggering events to re-assess the cash fl ows related to the

long-lived assets.

See Note 12 for further information.

Property, Plant and Equipment.

Property, plant and equipment are stated at the lower of historical cost less

accumulated depreciation or fair value, if impaired. The Duke Energy Registrants

capitalize all construction-related direct labor and material costs, as well as

indirect construction costs. Indirect costs include general engineering, taxes and

the allowance for funds used during construction (AFUDC). See “AFUDC and

Interest Capitalized,” below for additional information. The cost of renewals

and betterments that extend the useful life of property, plant and equipment

are also capitalized. The cost of repairs, replacements and major maintenance

projects, which do not extend the useful life or increase the expected output of

the asset, are expensed as incurred. Depreciation is generally computed over the

estimated useful life of the asset using the composite straight-line method. For

regulated operations, depreciation studies are conducted periodically to update

the composite rates and are approved by the various state commissions. The

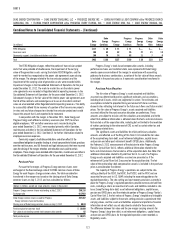

composite weighted-average depreciation rates, excluding nuclear fuel, for each

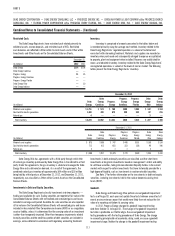

of the Duke Energy Registrants are included in the following table:

Years Ended December 31,

(percentages) 2012 2011 2010

Duke Energy 2.9 3.2 3.2

Duke Energy Carolinas 2.8 2.6 2.7

Progress Energy 2.6 2.3 2.0

Progress Energy Carolinas 2.7 2.1 2.1

Progress Energy Florida 2.5 2.4 1.9

Duke Energy Ohio 3.2 3.5 4.1

Duke Energy Indiana 3.3 3.4 3.5

When the Duke Energy Registrants retire regulated property, plant and

equipment under what is considered a normal retirement, the original cost

plus the cost of retirement, less salvage value, is charged to accumulated

depreciation, consistent with regulated rate-making practices. When it becomes

probable that a regulated generation asset will be retired substantially in

advance of its original expected useful life or is abandoned, the cost of the

asset and the corresponding accumulated depreciation is removed from

Cost and Accumulated depreciation and amortization within Property, Plant

and Equipment on the Consolidated Balance Sheets and a separate asset

is recognized. If the plant is still in operation, the amount is classifi ed as

Generation facilities to be retired, net on the Consolidated Balance Sheets. If the

plant is no longer operating, then a regulatory asset is recognized. The carrying

value of the asset is based on historical cost if the Duke Energy Registrants are