Duke Energy 2012 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2012 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58

PART II

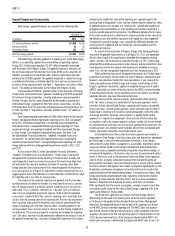

The decrease in net cash provided by fi nancing activities in 2012 as

compared to 2011 was due primarily to the following:

• A $620 million decrease in net issuances of long-term debt, primarily

due to the timing of issuances and redemptions between years and

• A $420 million increase in quarterly dividends primarily due to an

increase in common shares outstanding, resulting from the merger with

Progress Energy and an increase in dividends per share from $0.75 to

$0.765 in the third quarter of 2012. The total annual dividend per share

was $3.03 in 2012 compared to $2.97 in 2011;

These decreases in cash provided were partially offset by:

• A $70 million increase in proceeds from net issuances of notes payable

and commercial paper, primarily due to the PremierNotes program, net

of paydown of commercial paper.

The increase in net cash provided by fi nancing activities in 2011 as

compared to 2010 was due primarily to the following:

• A $1,200 million net increase in long-term debt primarily due to

fi nancings associated with the ongoing fl eet modernization program and

• A $260 million increase in proceeds from net issuances of notes

payable and commercial paper, primarily due to PremierNotes and

commercial paper issuances.

These increases in cash provided were partially offset by:

• A $240 million decrease in proceeds from the issuances of common

stock primarily related to the Dividend Reinvestment Plan (DRIP) and

other internal plans, due to the discontinuance of new share issuances

in the fi rst quarter of 2011 and

• A $50 million increase in dividends paid in 2011 due to an increase in

dividends per share from $0.735 to $0.75 in the third quarter of 2011.

The total annual dividend per share was $2.97 in 2011 compared to

$2.91 in 2010.

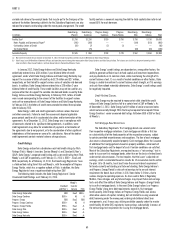

Signifi cant Notes Payable and Long-Term Debt Activities – 2012 - 2013.

Duke Energy’s outstanding long-term debt, including current maturities

as of December 31, 2012, includes approximately $17.8 billion assumed in the

merger with Progress Energy. This amount includes $2.3 billion of fair value

adjustments recorded in connection with purchase accounting for the Progress

Energy merger, which are not part of future principal payments and will amortize

over the remaining life of the debt. See Note 2 to the Consolidated Financial

Statements “Acquisitions, Dispositions and Sales of Other Assets” for additional

information related to the merger with Progress Energy.

On February 6, 2013, Duke Energy announced that it will redeem all shares

of the three and fi ve series of preferred stock issued by Progress Energy Carolinas

and Progress Energy Florida, respectively, of $93 million on March 8, 2013.

In January 2013, Duke Energy issued $500 million of unsecured junior

subordinated debentures, which carry a fi xed interest rate of 5.125%, are

callable at par after fi ve years and mature January 15, 2073. Proceeds from the

issuance were used to redeem at par $300 million of 7.10% junior subordinated

debt in February 2013, with the remainder to repay a portion of commercial

paper as it matures, to fund capital expenditures of our unregulated businesses

and for general corporate purposes.

In December 2012, Duke Energy entered credit agreements with a

commercial bank for a $190 million bridge loan and a $200 million revolving

loan. The bridge loan carries a variable interest rate equal to the 180-day Libor

rate plus 0.80% and matures on June 20, 2013. The revolving loan carries a

variable interest rate equal to the 360-day Libor rate plus 1.35% and is payable

in full on December 20, 2013; Duke Energy has the right to extend the term of

the revolving loan for an additional 1-year terms, not to exceed a fi nal maturity

of 13 years from the date of the initial funding. Both loans are collateralized

with cash deposits equal to 101% of the loan amounts, and therefore no net

proceeds from the fi nancings exist as of December 31, 2012.

In December 2012, Los Vientos Windpower IA, LLC (Los Vientos 1A) and

Los Vientos Windpower 1B, LLC (Los Vientos 1B), subsidiaries of Duke Energy

Generation Services, Inc. (DEGS) an indirect wholly owned subsidiary of Duke

Energy, each entered into long-term loan agreements of $246 million and

$177 million, respectively. Of the total loan amounts for Los Vientos 1A and

Los Vientos 1B, $110 million for each is at a fi xed interest rate of 4.740% that

mature in June, 2037 and June, 2036, respectively. The remainder of the Los

Vientos 1A and Los Vientos 1B loan amounts of $136 million and $67 million,

respectively, is at the six month adjusted London Interbank Offered Rate (LIBOR)

plus an applicable margin that was initially set at 2.774% for each loan. In

connection with the variable rate portion of the loans, Los Vientos 1A and Los

Vientos 1B entered into interest rate swaps to convert the substantial majority

of the variable rate loan interest payments from a variable rate to a fi xed rate

of 2.055% and 2.0175%, respectively, plus the applicable margin, which was

2.25% as of December 31, 2012 for each loan and each of these loans is due

to mature June 30, 2030. The collateral for the loans are substantially all of

the assets of Los Vientos Windpower IA, LLC and Los Vientos Windpower 1B,

LLC. Proceeds from the issuances will be used to help fund the existing wind

portfolio.

In November 2012, Progress Energy Florida issued $650 million principal

amount of fi rst mortgage bonds, of which $250 million carry a fi xed interest

rate of 0.65% and mature November 15, 2015 and $400 million carry a fi xed

interest rate of 3.85% and mature November 15, 2042. Proceeds from the

issuances will be used to repay $425 million 4.80% fi rst mortgage bonds due

March 1, 2013, as well as for general corporate purposes.

In September 2012, Duke Energy Carolinas issued $650 million principal

amount of fi rst mortgage bonds, which carry a fi xed interest rate of 4.00% and

mature September 30, 2042. Proceeds from the issuance were used to repay at

maturity the $420 million debentures due through November 2012, as well as

for general corporate purposes, including the funding of capital expenditures.

In August 2012, Duke Energy Corporation issued $1.2 billion of senior

unsecured notes, of which $700 million carry a fi xed interest rate of 1.625%

and mature August 15, 2017 and $500 million carry a fi xed interest rate

of 3.05% and mature August 15, 2022. Proceeds from the issuances were

used to repay at maturity Duke Energy Ohio’s $500 million debentures due

September 15, 2012 as well as for general corporate purposes, including the

repayment of commercial paper.

In April 2012, Duke Energy executed a joint venture agreement with

Sumitomo Corporation of America (SCOA). Under the terms of the agreement,

Duke Energy and SCOA each own a 50% interest in the joint venture

(DS Cornerstone, LLC), which owns two wind generation projects. The facilities

began commercial operations in June 2012 and August 2012. Duke Energy and

SCOA also negotiated a $330 million, Construction and 12-year amortizing

Term Loan Facility, on behalf of the borrower, a wholly owned subsidiary of the

joint venture. The loan agreement is non-recourse to Duke Energy. Duke Energy

received proceeds of $319 million upon execution of the loan agreement. This

amount represents reimbursement of a signifi cant portion of Duke Energy’s

construction costs incurred as of the date of the agreement. See Note 18 to

the Consolidated Financial Statements, “Variable Interest Entities” for further

information.