Duke Energy 2012 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2012 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART I

23

Duke Energy’s investments and projects located outside of the United

States expose it to risks related to fl uctuations in currency rates. These

risks, and Duke Energy’s activities to mitigate such risks, may adversely

affect its cash fl ows and results of operations.

Duke Energy’s operations and investments outside the U.S. expose it

to risks related to fl uctuations in currency rates. As each local currency’s

value changes relative to the U.S. dollar — Duke Energy’s principal reporting

currency — the value in U.S. dollars of Duke Energy’s assets and liabilities

in such locality and the cash fl ows generated in such locality, expressed in

U.S. dollars, also change. Duke Energy’s primary foreign currency rate exposure

is to the Brazilian Real.

Duke Energy selectively mitigates some risks associated with foreign

currency fl uctuations by, among other things, indexing contracts to the U.S. dollar

and/or local infl ation rates, hedging through debt denominated or issued in the

foreign currency and hedging through foreign currency derivatives. These efforts,

however, may not be effective and, in some cases, may expose Duke Energy to

other risks that could negatively affect its cash fl ows and results of operations.

Duke Energy’s merger with Progress Energy may not achieve its

intended results.

The merger is expected to result in various benefi ts, including, among other

things, cost savings and operating effi ciencies relating to the joint dispatch of

generation and combining of fuel purchasing power. Achieving the anticipated

benefi ts of the merger is subject to a number of uncertainties, including market

conditions, risks related to Duke Energy’s businesses, and whether the business

of Progress Energy is integrated in an effi cient and effective manner. Failure to

achieve these anticipated benefi ts could result in increased costs; decreases

in the amount of expected revenues generated by the combined company and

diversion of management’s time and energy and could have an adverse effect on

the combined company’s fi nancial position, results of operations or cash fl ows.

Duke Energy’s and Progress Energy’s ability to fully utilize tax credits may

be limited.

In accordance with the provisions of Internal Revenue Code

Section 29/45K, Duke Energy and Progress Energy have generated tax credits

based on the content and quantity of coal-based solid synthetic fuels produced

and sold to unrelated parties. This tax credit program expired at the end of

2007. The timing of the utilization of the tax credits is dependent upon Duke

Energy’s and Progress Energy’s taxable income. The timing of the utilization can

also be impacted by certain substantial changes in ownership, including the

merger of Duke Energy and Progress Energy. Additionally, in the normal course

of business, Duke Energy’s and Progress Energy’s tax returns are audited by

the IRS. If Duke Energy’s and Progress Energy’s tax credits were disallowed in

whole or in part as a result of an IRS audit, there could be signifi cant additional

tax liabilities and associated interest for previously recognized tax credits,

which could have a material adverse impact on Duke Energy’s and Progress

Energy’s earnings and cash fl ows. Although Duke Energy and Progress Energy

are unaware of any currently proposed legislation or new IRS regulations or

interpretations impacting previously recorded synthetic fuels tax credits, the

value of credits generated could be unfavorably impacted by such legislation or

IRS regulations and interpretations.

Duke Energy Carolinas, Progress Energy Carolinas and Progress Energy

Florida may incur substantial costs and liabilities due to their ownership

and operation of nuclear generating facilities.

Ownership interest in and operation of nuclear stations by Duke Energy

Carolinas, Progress Energy Carolinas and Progress Energy Florida subject them

to various risks. These risks include, among other things: the potential harmful

effects on the environment and human health resulting from the operation

of nuclear facilities and the storage, handling and disposal of radioactive

materials; limitations on the amounts and types of insurance commercially

available to cover losses that might arise in connection with nuclear operations;

and uncertainties with respect to the technological and fi nancial aspects of

decommissioning nuclear plants at the end of their licensed lives.

Ownership and operation of nuclear generation facilities requires

compliance with licensing and safety-related requirements imposed by the NRC.

In the event of non-compliance, the NRC may increase regulatory oversight,

impose fi nes, and/or shut down a unit, depending upon its assessment of the

severity of the situation. Revised security and safety requirements promulgated

by the NRC, which could be prompted by, among other things, events within

or outside of Duke Energy Carolinas’, Progress Energy Carolinas’ and Progress

Energy Florida’s control, such as a serious nuclear incident at a facility owned

by a third party, could necessitate substantial capital and other expenditures, as

well as assessments to cover third-party losses. In addition, if a serious nuclear

incident were to occur, it could have a material adverse effect on Duke Energy

Carolinas’, Progress Energy Carolinas’ and Progress Energy Florida’s results of

operations and fi nancial condition.

Ownership and operation of nuclear generation facilities also requires the

maintenance of funded trusts that are intended to pay for the decommissioning

costs of the respective nuclear power plants. As discussed below, poor

investment performance of these decommissioning trusts’ holdings and other

factors impacting decommissioning costs could unfavorably impact Duke Energy

Carolinas’, Progress Energy Carolinas’ and Progress Energy Florida’s liquidity

and results of operations as they could be required to signifi cantly increase their

cash contributions to the decommissioning trusts.

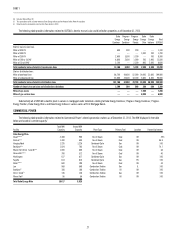

Market performance and other changes may decrease the value of Duke

Energy Carolinas’, Progress Energy Carolinas’ and Progress Energy

Florida’s Nuclear Decommissioning Trust Fund (NDTF) investments, which

then could require signifi cant additional funding.

The performance of the capital markets affects the values of the assets

held in trust to satisfy future obligations to decommission nuclear plants. Duke

Energy Carolinas, Progress Energy Carolinas and Progress Energy Florida have

signifi cant obligations in this area and hold signifi cant assets in these trusts.

These assets are subject to market fl uctuations and will yield uncertain returns,

which may fall below projected rates of return. Although a number of factors

impact funding requirements, a decline in the market value of the assets may

increase the funding requirements of the obligations for decommissioning

nuclear plants. If Duke Energy Carolinas, Progress Energy Carolinas and

Progress Energy Florida are unable to successfully manage the NDTF assets,

their fi nancial condition, results of operations and cash fl ows could be

negatively affected.

The costs of retiring Progress Energy Florida’s Crystal River Unit 3 could

prove to be more extensive than is currently identifi ed. All costs associated

with retirement of the Crystal River Unit 3 asset, including replacement

power, may not be fully recoverable through the regulatory process.

Early retirement could result in continued purchases of replacement power

and/or additional capital and operating costs associated with construction of

replacement capacity resources to continue to service Progress Energy Florida’s

customer needs. However, there is no defi nitive plan for new generating

capacity at this time. In addition, exit costs to wind down operations and

ultimately to retire and decommission the plant could exceed estimates and,

if not recoverable through the regulatory process, could adversely affect Duke

Energy’s, Progress Energy’s and Progress Energy Florida’s fi nancial condition,

results of operations and cash fl ows.

While the foregoing refl ects Progress Energy Florida’s current intentions

and estimates with respect to the retirement of Crystal River Unit 3, the cost