Duke Energy 2012 Annual Report Download - page 158

Download and view the complete annual report

Please find page 158 of the 2012 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

138

PART II

Combined Notes to Consolidated Financial Statements – (Continued)

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. • CAROLINA POWER & LIGHT COMPANY d/b/a PROGRESS ENERGY

CAROLINAS, INC. • FLORIDA POWER CORPORATION d/b/a PROGRESS ENERY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Regional Transmission Organization Realignment.

Duke Energy Ohio, which includes its wholly owned subsidiary Duke

Energy Kentucky, transferred control of its transmission assets to effect a

Regional Transmission Organization (RTO) realignment from MISO to PJM,

effective December 31, 2011.

On December 16, 2010, the FERC issued an order related to MISO’s cost

allocation methodology surrounding Multi-Value Projects (MVP), a type of MISO

Transmission Expansion Planning (MTEP) project cost. MISO expects that MVP

will fund the costs of large transmission projects designed to bring renewable

generation from the upper Midwest to load centers in the eastern portion of the

MISO footprint. MISO approved MVP proposals with estimated project costs of

approximately $5.2 billion prior to the date of Duke Energy Ohio’s exit from MISO

on December 31, 2011. These projects are expected to be undertaken by the

constructing transmission owners from 2012 through 2020 with costs recovered

through MISO over the useful life of the projects. The FERC order did not clearly

and expressly approve MISO’s apparent interpretation that a withdrawing

transmission owner is obligated to pay its share of costs of all MVP projects

approved by MISO up to the date of the withdrawing transmission owners’

exit from MISO. Duke Energy Ohio has historically represented approximately

fi ve-percent of the MISO system. Duke Energy Ohio, among other parties, sought

rehearing of the FERC MVP order. On October 21, 2011, the FERC issued an

order on rehearing in this matter largely affi rming its original MVP order and

conditionally accepting MISO’s compliance fi ling as well as determining that

the MVP allocation methodology is consistent with cost causation principles

and FERC precedent. The FERC also reiterated that it would not prejudge any

settlement agreement between an RTO and a withdrawing transmission owner

for fees that a withdrawing transmission owner owes to the RTO. The order

further states that any such fees that a withdrawing transmission owner owes

to an RTO are a matter for those parties to negotiate, subject to review by the

FERC. The FERC also ruled that Duke Energy Ohio’s challenge of MISO’s ability

to allocate MVP costs to a withdrawing transmission owner is beyond the

scope of the proceeding. The order further stated that MISO’s tariff withdrawal

language establishes that once cost responsibility for transmission upgrades is

determined, withdrawing transmission owners retain any costs incurred prior

to the withdrawal date. In order to preserve its rights, Duke Energy Ohio fi led

an appeal of the FERC order in the D.C. Circuit Court of Appeals. The case was

consolidated with appeals of the FERC order by other parties in the Seventh

Circuit Court of Appeals.

On October 14, 2011, Duke Energy Ohio fi led an application with the

FERC to establish new wholesale customer rates for transmission service under

PJM’s Open Access Transmission Tariff. In this fi ling, Duke Energy Ohio sought

recovery of its legacy MTEP costs, including MVP costs, and submitted an

analysis showing that the benefi ts of the RTO realignment outweigh the costs to

the customers. The new rates went into effect, subject to refund, on January 1,

2012. Protests were fi led by certain transmission customers. On April 24, 2012,

FERC issued an order in which it, denied recovery of legacy MTEP costs without

prejudice to the right of Duke Energy Ohio to make another fi ling including a

more comprehensive cost-benefi t analysis to support such recovery and set

the return on equity component of the rate for hearing. Duke Energy Ohio has

entered into a settlement agreement with the only remaining protester, American

Municipal Power, Inc. (AMP) under which the return on equity will be set at

11.38% legacy MTEP costs will be recovered in rates, and AMP will receive a credit

equal to 75% of its share of the legacy MTEP costs. The settlement agreement was

fi led with the FERC on February 4, 2012 and requires FERC approval.

On December 29, 2011, MISO fi led with FERC a Schedule 39 to MISO’s

tariff. Schedule 39 provides for the allocation of MVP costs to a withdrawing

owner based on the owner’s actual transmission load after the owner’s

withdrawal from MISO, or, if the owner fails to report such load, based on the

owner’s historical usage in MISO assuming annual load growth. On January 19,

2012, Duke Energy Ohio fi led with FERC a protest of the allocation of MVP

costs to them under Schedule 39. On February 27, 2012, the FERC accepted

Schedule 39 as a just and reasonable basis for MISO to charge for MVP costs, a

transmission owner that withdraws from MISO after January 1, 2012. The FERC

set for hearing whether MISO’s proposal to use the methodology in Schedule 39

to calculate the obligation of transmission owners who withdrew from MISO

prior to January 1, 2012 (such as Duke Energy Ohio) to pay for MVP costs is

consistent with the MVP-related withdrawal obligations in the tariff at the time

that they withdrew from MISO, and, if not, what amount of, and methodology for

calculating, any MVP cost responsibility should be.

On March 28, 2012, Duke Energy Ohio fi led a request for rehearing of

FERC’s February 27, 2012 order on MISO’s Schedule 39. On December 19,

2012, the FERC Trial Staff submitted testimony in the Schedule 39 hearing

proceeding in which its witness stated his opinion that Duke Energy Ohio should

not be liable for any MVP costs. The role of the FERC Trial Staff is to act as an

independent party in the proceeding; it has no judicial authority. The hearing has

been scheduled for April 2013.

On December 31, 2011, Duke Energy Ohio recorded a liability for its

MISO exit obligation and share of MTEP costs, excluding MVP, of approximately

$110 million. This liability was recorded within Other in Current liabilities

and Other in Deferred credits and other liabilities on Duke Energy Ohio’s

Consolidated Balance Sheets upon exit from MISO on December 31, 2011.

Approximately $74 million of this amount was recorded as a regulatory asset

while $36 million was recorded to Operation, maintenance and other in Duke

Energy Ohio’s Consolidated Statements of Operations and Comprehensive

Income. In addition to the above amounts, Duke Energy Ohio may also be

responsible for costs associated with MISO MVP projects. Duke Energy Ohio is

contesting its obligation to pay for such costs. However, depending on the fi nal

outcome of this matter, Duke Energy Ohio could incur material costs associated

with MVP projects, which are not reasonably estimable at this time. Regulatory

accounting treatment will be pursued for any costs incurred in connection with

the resolution of this matter.

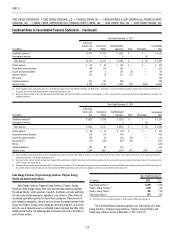

The following table provides a reconciliation of the beginning and ending

balance of Duke Energy Ohio’s recorded obligations related to its withdrawal

from MISO.

(in millions)

Balance at

December 31,

2011

Provision/

Adjustments

Cash

Reductions

Balance at

December 31,

2012

Duke Energy Ohio $110 $5 $(18) $ 97

Duke Energy Indiana

Edwardsport IGCC Plant.

On November 20, 2007, the IURC issued an order granting Duke Energy

Indiana a CPCN for the construction of a 618 MW IGCC power plant at Duke

Energy Indiana’s Edwardsport Generating Station in Knox County, Indiana with a

cost estimate of $1.985 billion and timely recovery of costs related to the project.

On January 25, 2008, Duke Energy Indiana received the fi nal air permit from the

Indiana Department of Environmental Management. The Citizens Action Coalition

of Indiana, Inc. (CAC), Sierra Club, Inc., Save the Valley, Inc., and Valley Watch,

Inc., all intervenors in the CPCN proceeding, have appealed the air permit.

On May 1, 2008, Duke Energy Indiana fi led its fi rst semi-annual IGCC rider

and ongoing review proceeding with the IURC as required under the CPCN order

issued by the IURC. In its fi ling, Duke Energy Indiana requested approval of a