Duke Energy 2012 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2012 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

123

PART II

Combined Notes to Consolidated Financial Statements – (Continued)

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. • CAROLINA POWER & LIGHT COMPANY d/b/a PROGRESS ENERGY

CAROLINAS, INC. • FLORIDA POWER CORPORATION d/b/a PROGRESS ENERY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

of Duke Energy Ohio, completed the sale of its 75% undivided ownership

interest in the Vermillion Generating Station (Vermillion) to Duke Energy

Indiana and Wabash Valley Power Association (WVPA). Upon the closing of

the sale, Duke Energy Indiana and WVPA held 62.5% and 37.5% interests in

Vermillion, respectively. Duke Energy Ohio received net proceeds of $82 million,

consisting of $68 million a nd $14 million from Duke Energy Indiana and WVPA,

respectively. Following the transaction, Duke Energy Indiana retired Gallagher

Units 1 and 3 effective February 1, 2012.

As Duke Energy Indiana is an affi liate of Duke Energy Vermillion the

transaction has been accounted for as a transfer between entities under common

control with no gain or loss recorded and did not have a signifi cant impact to

Duke Energy Ohio or Duke Energy Indiana’s results of operations. The proceeds

received from Duke Energy Indiana are included in Net proceeds from the sales

of other assets on Duke Energy Ohio’s Consolidated Statements of Cash Flows.

The cash paid to Duke Energy Ohio is included in Capital expenditures on Duke

Energy Indiana’s Consolidated Statements of Cash Flows. Duke Energy Ohio

and Duke Energy Indiana recognized non-cash equity transfers of $28 million

and $26 million, respectively, in their Consolidated Statements of Common

Stockholder’s Equity on the transaction representing the difference between cash

exchanged and the net book value of Vermillion. These amounts are not refl ected

in Duke Energy’s Consolidated Statements of Cash Flows or Consolidated

Statements of Equity as the transaction is eliminated in consolidation.

The proceeds from WVPA are included in Net proceeds from the sales of

other assets, and sale of and collections on notes receivable on Duke Energy

and Duke Energy Ohio’s Consolidated Statements of Cash Flows. In the second

quarter of 2011, Duke Energy Ohio recorded a pre-tax impairment charge of

$9 million to adjust the carrying value of the proportionate share of Vermillion

to be sold to WVPA to the proceeds to be received from WVPA less costs to sell.

The sale of the proportionate share of Vermillion to WVPA did not result in a

signifi cant additional gain or loss upon close of the transaction.

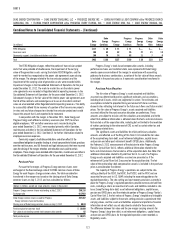

Wind Projects Joint Venture

In April 2012, Duke Energy executed a joint venture agreement with

Sumitomo Corporation of America (SCOA). Under the terms of the agreement,

Duke Energy and SCOA each own a 50% interest in the joint venture

(DS Cornerstone, LLC), which owns two wind generation projects. The facilities

began commercial operations in June 2012 and August 2012. Duke Energy and

SCOA also negotiated a $330 million, Construction and 12-year amortizing

Term Loan Facility, on behalf of the borrower, a wholly owned subsidiary of the

joint venture. The loan agreement is non-recourse to Duke Energy. Duke Energy

received proceeds of $319 million upon execution of the loan agreement. This

amount represents reimbursement of a signifi cant portion of Duke Energy’s

construction costs incurred as of the date of the agreement. See Note 18 for

further information.

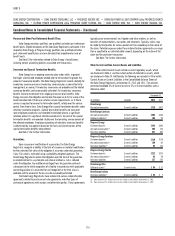

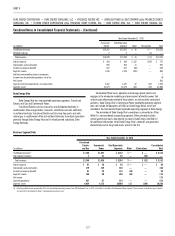

Sales of Other Assets

The following table summarizes net cash proceeds related to the sales of

Other assets not discussed above.

(in millions) Duke Energy

Duke Energy

Carolinas

Duke Energy

Ohio

Duke Energy

Indiana

Year Ended December 31,

2012(a) $187 $1 $ 6 $—

2011 12271

2010 160 8 13 —

(a) Duke Energy amount relates to proceeds from the disposition of non-core business assets within the

Commercial Power segment for which no material gain or loss was recognized.

Discontinued Operations

Included in Income From Discontinued Operations, net of tax on the

Consolidated Statements of Operations are amounts related to adjustments

for prior sales of diversifi ed businesses. These adjustments are generally due

to indemnifi cations provided for certain legal, tax and environmental matters.

See Note 7 for further discussion of indemnifi cations. The ultimate resolution of

these matters could result in additional adjustments in future periods.

For the year ended December 31, 2012, Duke Energy’s and Progress

Energy’s Income From Discontinued Operations, net of tax was primarily related

to resolution of litigation associated with Progress Energy’s former synthetic

fuel operations and reversal of certain environmental indemnifi cation liabilities

for which the indemnifi cation period expired during 2012. See Note 5 for more

information regarding these operations.

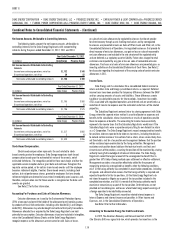

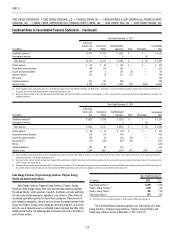

3. BUSINESS SEGMENTS

E ffective with the fi rst quarter of 2012, management began evaluating

segment performance based on Segment Income. Segment Income is defi ned as

income from continuing operations net of income attributable to noncontrolling

interests. Segment Income, as discussed below, includes intercompany revenues

and expenses that are eliminated in the Consolidated Financial Statements.

In conjunction with management’s use of the new reporting measure, certain

governance costs that were previously unallocated have now been allocated to

each of the segments. In addition, direct interest expense and income taxes are

included in Segment Income. Prior year segment profi tability information has

been recast to conform to the current year presentation. None of these changes

impacts the reportable operating segments’ or the Duke Energy Registrants’

previously reported consolidated revenues, net income or earnings per share.

Operating segments for each of the Duke Energy Registrants are

determined based on information used by the chief operating decision maker in

deciding how to allocate resources and evaluate the performance at each of the

Duke Energy Registrants.

Products and services are sold between the affi liate companies and

between the reportable segments of Duke Energy at cost. Segment assets as

presented in the tables that follow exclude all intercompany assets.

Duke Energy

Duke Energy has the following reportable operating segments: U.S. Franchised

Electric and Gas (USFE&G), Commercial Power and International Energy.

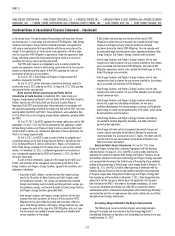

USFE&G generates, transmits, distributes and sells electricity in

North Carolina, South Carolina, west central Florida, central, north central

and southern Indiana, and northern Kentucky. USFE&G also transmits and

distributes electricity in southwestern Ohio. Additionally, USFE&G transports

and sells natural gas in southwestern Ohio and northern Kentucky. It conducts

operations primarily through Duke Energy Carolinas, Progress Energy Carolinas,

Progress Energy Florida, certain regulated portions of Duke Energy Ohio, and

Duke Energy Indiana. Segment information for USFE&G for the year ended

December 31, 2012, includes the results of the regulated operations of Progress

Energy from July 2, 2012 forward.

Commercial Power owns, operates and manages power plants and

engages in the wholesale marketing and procurement of electric power, fuel

and emission allowances related to these plants, as well as other contractual

positions. Commercial Power also has a retail sales subsidiary, Duke Energy

Retail Sales, LLC (Duke Energy Retail), which is certifi ed by the PUCO as a

Competitive Retail Electric Service provider in Ohio. Through Duke Energy