Duke Energy 2012 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2012 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

116

PART II

Combined Notes to Consolidated Financial Statements – (Continued)

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. • CAROLINA POWER & LIGHT COMPANY d/b/a PROGRESS ENERGY

CAROLINAS, INC. • FLORIDA POWER CORPORATION d/b/a PROGRESS ENERY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

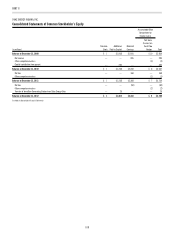

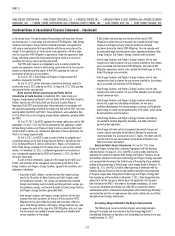

Net Income Amounts Attributable to Controlling Interests.

The following tables present the net income amounts attributable to

controlling interests for the Duke Energy Registrants with noncontrolling

interests during the years ended December 31, 2012, 2011 and 2010.

Year Ended December 31, 2012

(in millions) Duke Energy Progress Energy

Net Income Amounts Attributable to Controlling

Interests

Income from continuing operations, net of tax $ 1,732 $ 348

Discontinued operations, net of tax 36 52

Net income attributable to controlling interests $ 1,768 $ 400

Year Ended December 31, 2011

(in millions) Duke Energy Progress Energy

Net Income Amounts Attributable to Controlling

Interests

Income from continuing operations, net of tax $ 1,705 $ 580

Discontinued operations, net of tax 1 (5)

Net income attributable to controlling interests $1,706 $ 575

Year Ended December 31, 2010

(in millions) Duke Energy Progress Energy

Net Income Amounts Attributable to Controlling

Interests

Income from continuing operations, net of tax $ 1,317 $ 860

Discontinued operations, net of tax 3 (4)

Net income attributable to controlling interests $1,320 $ 856

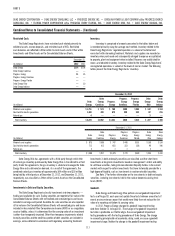

Stock-Based Compensation.

Stock-based compensation represents the cost related to stock-

based awards granted to employees. Duke Energy recognizes stock-based

compensation based upon the estimated fair value of the awards, net of

estimated forfeitures. The recognition period for these costs begin at either the

applicable service inception date or grant date and continues throughout the

requisite service period, or for certain share-based awards until the employee

becomes retirement eligible, if earlier. Share-based awards, including stock

options, but not performance shares, granted to employees that are already

retirement eligible are deemed to have vested immediately upon issuance, and,

therefore, compensation cost for those awards is recognized on the date such

awards are granted.

See Note 22 for further information.

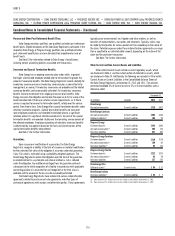

Accounting For Purchases and Sales of Emission Allowances.

Emission allowances are issued by the Environmental Protection Agency

(EPA) at zero cost and permit the holder of the allowance to emit certain gaseous

by-products of fossil fuel combustion, including sulfur dioxide (SO2) and nitrogen

oxide (NOx). Allowances may also be bought and sold via third-party transactions.

Allowances allocated to or acquired by the Duke Energy Registrants are held

primarily for consumption. Emission allowances at cost are included in Intangibles,

net on the Consolidated Balance Sheets and the Duke Energy Registrants

recognize expense as the allowances are consumed or sold. Gains or losses

on sales of emission allowances by regulated businesses that do not provide

for direct recovery through a cost-tracking mechanism and by nonregulated

businesses are presented in Gains on Sales of Other Assets and Other, net, in the

Consolidated Statements of Operations. For regulated businesses that provide for

direct recovery of emission allowances, any gain or loss on sales of recoverable

emission allowances are included in the rate structure of the regulated entity

and are deferred as a regulatory asset or liability. Future rates charged to retail

customers are impacted by any gain or loss on sales of recoverable emission

allowances. Purchases and sales of emission allowances are presented gross as

investing activities on the Consolidated Statements of Cash Flows. See Note 12

for discussion regarding the impairment of the carrying value of certain emission

allowances in 2011.

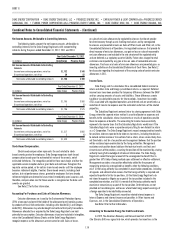

Income Taxes.

Duke Energy and its subsidiaries fi le a consolidated federal income tax

return and other state and foreign jurisdictional returns as required. Deferred

income taxes have been provided for temporary differences between the GAAP

and tax carrying amounts of assets and liabilities. These differences create

taxable or tax-deductible amounts for future periods. Investment tax credits

(ITC) associated with regulated operations are deferred and are amortized as a

reduction of income tax expense over the estimated useful lives of the related

properties.

The Subsidiary Registrants entered into a tax sharing agreement with Duke

Energy, where the separate return method is used to allocate tax expenses and

benefi ts to the subsidiaries whose investments or results of operations provide

these tax expenses or benefi ts. The accounting for income taxes essentially

represents the income taxes that the Subsidiary Registrants would incur if the

Subsidiary Registrants were a separate company fi ling its own federal tax return

as a C-Corporation. The Duke Energy Registrants record unrecognized tax benefi ts

for positions taken or expected to be taken on tax returns, including the decision

to exclude certain income or transactions from a return, when a more-likely-than-

not threshold is met for a tax position and management believes that the position

will be sustained upon examination by the taxing authorities. Management

evaluates each position based solely on the technical merits and facts and

circumstances of the position, assuming the position will be examined by a taxing

authority having full knowledge of all relevant information. The Duke Energy

Registrants record the largest amount of the unrecognized tax benefi t that is

greater than 50% likely of being realized upon settlement or effective settlement.

Management considers a tax position effectively settled for the purpose of

recognizing previously unrecognized tax benefi ts when the following conditions

exist: (i) the taxing authority has completed its examination procedures, including

all appeals and administrative reviews that the taxing authority is required and

expected to perform for the tax positions, (ii) the Duke Energy Registrants do

not intend to appeal or litigate any aspect of the tax position included in the

completed examination, and (iii) it is remote that the taxing authority would

examine or reexamine any aspect of the tax position. Deferred taxes are not

provided on translation gains and losses where Duke Energy expects earnings of

a foreign operation to be indefi nitely reinvested.

The Duke Energy Registrants record tax-related interest expense in

Interest Expense and interest income and penalties in Other Income and

Expenses, net, in the Consolidated Statements of Operations.

See Note 24 for further information.

Accounting for Renewable Energy Tax Credits and Grants.

In 2009, The American Recovery and Reinvestment Act of 2009

(the Stimulus Bill) was signed into law, which provides tax incentives in the