Duke Energy 2012 Annual Report Download - page 155

Download and view the complete annual report

Please find page 155 of the 2012 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

135

PART II

Combined Notes to Consolidated Financial Statements – (Continued)

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. • CAROLINA POWER & LIGHT COMPANY d/b/a PROGRESS ENERGY

CAROLINAS, INC. • FLORIDA POWER CORPORATION d/b/a PROGRESS ENERY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

lower building elevations, of which Zapata estimated costs of approximately

$2.44 billion with a project duration of 60 months, and; (iv) a “worst case”

scenario, assuming Progress Energy Florida performed the more limited scope

of work, and at the conclusion of that work, additional damage occurred in

the dome and in the lower elevations, which forced replacement of each, of

which Zapata estimated costs of $3.43 billion with a project duration of 96

months. The principal difference between Zapata’s estimate and Progress

Energy Florida’s previous estimate appears to be due to the respective levels of

contingencies included by each party, including higher project risk and longer

project duration. Progress Energy Florida has fi led a copy of the Zapata report

with the FPSC and with the NRC. The FPSC held a status conference on October

30, 2012 to discuss Duke Energy’s analysis of the Zapata report.

On February 5, 2013, following the completion of a comprehensive

analysis, Duke Energy announced its intention to retire Crystal River Unit 3.

Duke Energy concluded that it did not have a high degree of confi dence

that repair could be successfully completed and licensed within estimated

costs and schedule, and that it was in the best interests of Progress Energy

Florida’s customers and joint owners and Duke Energy’s investors to retire

the unit. Progress Energy Florida developed initial estimates of the cost to

decommission the plant during its analysis of whether to repair or retire Crystal

River Unit 3. With the fi nal decision to retire, Progress Energy Florida is working

to develop a comprehensive decommissioning plan, which will evaluate

various decommissioning options and costs associated with each option. The

plan will determine resource needs as well as the scope, schedule and other

elements of decommissioning. Progress Energy Florida intends to use a safe

storage (SAFSTOR) option for decommissioning. Generally, SAFSTOR involves

placing the facility into a safe storage confi guration, requiring limited staffi ng to

monitor plant conditions, until the eventual dismantling and decontamination

activities occur, usually in 40 to 60 years. This decommissioning approach is

currently utilized at a number of retired domestic nuclear power plants and is

one of three generally accepted approaches to decommissioning required by

the NRC. Once an updated site specifi c decommissioning study is completed

it will be fi led with the FPSC. As part of the evaluation of repairing Crystal

River Unit 3, initial estimates of the cost to decommission the plant under the

SAFSTOR option were developed which resulted in an estimate in 2011 dollars

of $989 million. See Note 9 for additional information. Additional specifi cs about

the decommissioning plan are being developed.

Progress Energy Florida maintains insurance coverage against

incremental costs of replacement power resulting from prolonged accidental

outages at Crystal River Unit 3 through NEIL. NEIL provides insurance coverage

for repair costs for covered events, as well as the cost of replacement power

of up to $490 million per event when the unit is out of service as a result of

these events. Actual replacement power costs have exceeded the insurance

coverage. Progress Energy Florida also maintains insurance coverage through

NEIL’s accidental property damage program, which provides insurance coverage

up to $2.25 billion with a $10 million deductible per claim.

Throughout the duration of the Crystal River Unit 3 outage, Progress

Energy Florida worked with NEIL for recovery of applicable repair costs and

associated replacement power costs. NEIL has made payments on the fi rst

delamination; however, NEIL has withheld payment of approximately $70 million

of replacement power cost claims and repair cost claims related to the fi rst

delamination event. NEIL had not provided a written coverage decision for either

delamination and no payments were made on the second delamination and no

replacement power reimbursements were made by NEIL since May 2011. These

considerations led Progress Energy Florida to conclude, in the second quarter of

2012, that it was not probable that NEIL would voluntarily pay the full coverage

amounts that Progress Energy Florida believes them to owe under the applicable

insurance policies. Consistent with the terms and procedures under the

insurance coverage with NEIL, Progress Energy Florida agreed to non-binding

mediation prior to commencing any formal dispute resolution. On February 5,

2013, Progress Energy Florida announced it and NEIL had accepted the

mediator’s proposal whereby NEIL will pay Progress Energy Florida an additional

$530 million. Along with the $305 million which NEIL previously paid, Progress

Energy Florida will receive a total of $835 million in insurance proceeds.

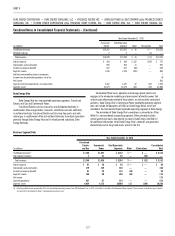

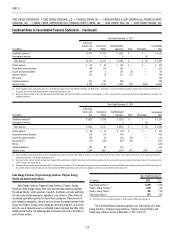

The following table summarizes the Crystal River Unit 3 replacement

power and repair costs and recovery through December 31, 2012.

(in millions)

Replacement

Power Costs

Repair

Costs Total

Spent to date $ 614 $ 338 $ 952

NEIL proceeds received to date (162) (143) (305)

Balance for recovery(a) $ 452 $ 195 $ 647

(a) The portion of replacement power costs that has not been previously recovered from retail customers is

classifi ed within Regulatory assets on Duke Energy’s Consolidated Balance Sheets and Progress Energy

Florida’s Balance Sheet as of December 31, 2012. Also, the $195 million of repair costs are classifi ed within

Regulatory assets on Duke Energy’s Consolidated Balance Sheets and Progress Energy Florida’s Balance Sheets

as of December 31, 2012.

As a result of the 2012 FPSC Settlement Agreement, Progress Energy

Florida will be permitted to recover prudently incurred fuel and purchased

power costs through its fuel clause without regard for the absence of Crystal

River Unit 3 for the period from the beginning of the Crystal River Unit 3 outage

through December 31, 2016.

In accordance with the terms of the 2012 FPSC Settlement Agreement,

with consumer representatives and approved by the FPSC, Progress Energy

Florida retained the sole discretion to retire Crystal River Unit 3. Progress Energy

Florida expects that the FPSC will review the prudence of the retirement decision

in Phase 2 of the Crystal River Unit 3 delamination regulatory docket. Progress Energy

Florida has also asked the FPSC to review the mediated resolution of insurance

claims with NEIL as part of Phase 3 of this regulatory docket. Phase 2 and Phase 3

hearings have been tentatively scheduled to begin on June 19, 2013.

Progress Energy Florida did not begin the repair of Crystal River Unit 3

prior to December 31, 2012. Consistent with the 2012 FPSC Settlement

Agreement regarding the timing of commencement of repairs, Progress Energy

Florida recorded a Regulatory liability of $100 million in the third quarter of 2012

related to replacement power obligations. This amount is included within fuel

used in electric generation and purchased power in Progress Energy Florida’s

and Progress Energy’s Statements of Operations and Comprehensive Income for

the year ended December 31, 2012. Progress Energy Florida will refund this

replacement power liability on a pro rata basis based on the in-service date of

up to $40 million in 2015 and $60 million in 2016. This amount is refl ected as

part of the purchase price allocation of the merger with Progress Energy in Duke

Energy’s Consolidated Financial Statements.

Progress Energy Florida also retained sole discretion to retire the unit

without challenge from the parties to the agreement. As a result, Progress

Energy Florida will be allowed to recover all remaining Crystal River Unit 3

investments and to earn a return on the Crystal River Unit 3 investments set

at its current authorized overall cost of capital, adjusted to refl ect a return on

equity set at 70 percent of the current FPSC authorized return on equity, no

earlier than the fi rst billing cycle of January 2017.

In conjunction with the decision to retire Crystal River Unit 3, Progress

Energy Florida reclassifi ed all Crystal River Unit 3 investments, including

property, plant and equipment; nuclear fuel; inventory; and deferred assets to

a regulatory asset account. At December 31, 2012, Progress Energy Florida had

$1,637 million of net investment in Crystal River Unit 3 recorded in Regulatory