Duke Energy 2012 Annual Report Download - page 229

Download and view the complete annual report

Please find page 229 of the 2012 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

209

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. • CAROLINA POWER & LIGHT COMPANY d/b/a PROGRESS

ENERGY CAROLINAS, INC. • FLORIDA POWER CORPORATION d/b/a PROGRESS ENERY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

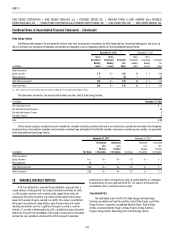

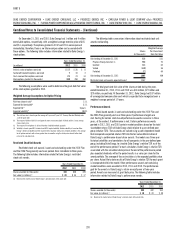

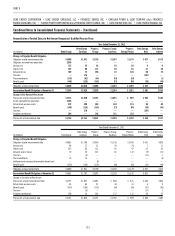

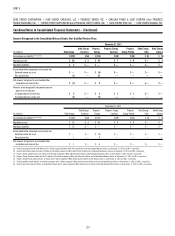

On December 31, 2011 and 2010, Duke Energy had 1 million and 4 million

exercisable options, respectively, with a weighted-average exercise price of $45

and $51, respectively. The options granted in 2012 and 2011 were expensed

immediately; therefore, there is no future compensation cost associated with

these options. The following table includes information related to Duke Energy’s

stock options.

Years Ended December 31,

(in millions) 2012 2011 2010

Intrinsic value of options exercised $ 17 $ 26 $ 8

Tax benefi t related to options exercised 7 10 3

Cash received from options exercised 21 74 14

Stock options granted (in thousands) 340 358 368

The following assumptions were used to determine the grant date fair value

of the stock options granted in 2012.

Weighted-Average Assumptions for Option Pricing

Risk-free interest rate(a) 1.1 %

Expected dividend yield(b) 5.1 %

Expected life(c) 6 years

Expected volatility(d) 18.8 %

(a) The risk-free rate is based upon the average of 5-year and 7-year U.S. Treasury Constant Maturity rates

as of the grant date.

(b) The expected dividend yield is based upon the most recent annualized dividend and the 1-year average

closing stock price.

(c) The expected life of options is derived from the simplifi ed method approach.

(d) Volatility is based upon 50% historical and 50% implied volatility. Historic volatility is based on Duke

Energy’s historical volatility over the expected life using daily stock prices. Implied volatility is the average

for all option contracts with a term greater than six months using the strike price closest to the stock

price on the valuation date.

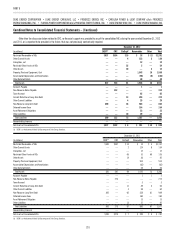

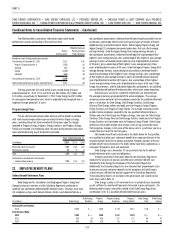

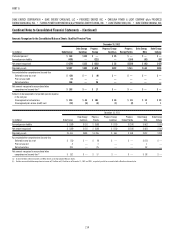

Restricted Stock Unit Awards

Restricted stock unit awards issued and outstanding under the 2010 Plan

and the 2006 Plan generally vest over periods from immediate to three years.

The following table includes information related to Duke Energy’s restricted

stock unit awards.

Years Ended December 31,

2012 2011 2010

Shares awarded (in thousands) 443 636 349

Fair value (in millions)(a) $28 $34 $ 17

(a) Based on the market price of Duke Energy’s common stock at the grant date.

The following table summarizes information about restricted stock unit

awards outstanding.

Shares

(in thousands)

Weighted-Average

Per Share Grant

Date Fair Value

Outstanding at December 31, 2011 856 $51

Progress Energy transfers in 988 70

Granted 443 63

Vested (608) 56

Forfeited (72) 64

Outstanding at December 31, 2012 1,607 64

Restricted stock unit awards expected to vest 1,567 64

The total grant date fair value of the shares vested during the years

ended December 31, 2012, 2011 and 2010 was $34 million, $19 million and

$29 million, respectively. At December 31, 2012, Duke Energy had $37 million

of unrecognized compensation cost which is expected to be recognized over a

weighted-average period of 1.9 years.

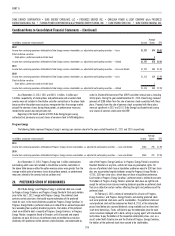

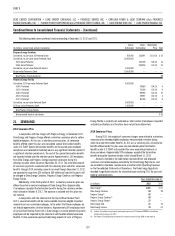

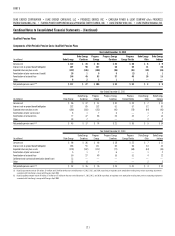

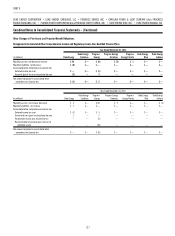

Performance Awards

Stock-based awards issued and outstanding under the 2010 Plan and

the 2006 Plan generally vest over three years if performance targets are

met. Vesting for certain stock-based performance awards can occur in three

years, at the earliest, if performance is met. Certain performance awards

granted in 2012, 2011 and 2010 contain market conditions based on the total

shareholder return (TSR) of Duke Energy stock relative to a pre-defi ned peer

group (relative TSR). These awards are valued using a path-dependent model

that incorporates expected relative TSR into the fair value determination of

Duke Energy’s performance-based share awards. The model uses three-year

historical volatilities and correlations for all companies in the pre-defi ned peer

group, including Duke Energy, to simulate Duke Energy’s relative TSR as of the

end of the performance period. For each simulation, Duke Energy’s relative TSR

associated with the simulated stock price at the end of the performance period

plus expected dividends within the period results in a value per share for the

award portfolio. The average of these simulations is the expected portfolio value

per share. Actual life to date results of Duke Energy’s relative TSR for each grant

is incorporated within the model. Other performance awards not containing

market conditions were awarded in 2012, 2011 and 2010. The performance

goal for the awards is Duke Energy’s return on equity over a three-year

period. Awards are measured at grant date price. The following table includes

information related to Duke Energy’s performance awards.

Years Ended December 31,

2012 2011 2010

Shares awarded (in thousands) 352 432 912

Fair value (in millions)(a) $19 $20 $ 38

(a) Based on the market price of Duke Energy’s common stock at the grant date.