Duke Energy 2012 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2012 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

115

PART II

Combined Notes to Consolidated Financial Statements – (Continued)

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. • CAROLINA POWER & LIGHT COMPANY d/b/a PROGRESS ENERGY

CAROLINAS, INC. • FLORIDA POWER CORPORATION d/b/a PROGRESS ENERY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

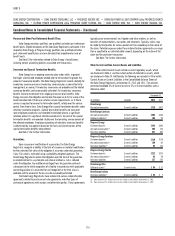

Pension and Other Post-Retirement Benefi t Plans.

Duke Energy maintains qualifi ed, non-qualifi ed and other post-retirement

benefi t plans. Eligible employees of the Subsidiary Registrants participate in the

respective Duke Energy or Progress Energy qualifi ed, non-qualifi ed and other

post-retirement benefi t plans and are allocated their proportionate share of

benefi t costs.

See Note 23 for information related to Duke Energy’s benefi t plans,

including certain accounting policies associated with these plans.

Severance and Special Termination Benefi ts.

Duke Energy has an ongoing severance plan under which, in general,

the longer a terminated employee worked prior to termination the greater the

amount of severance benefi ts. The Duke Energy Registrants record a liability for

involuntary severance once an involuntary severance plan is committed to by

management, or sooner, if involuntary severances are probable and the related

severance benefi ts can be reasonably estimated. For involuntary severance

benefi ts that are incremental to its ongoing severance plan benefi ts, Duke

Energy measures the obligation and records the expense at its fair value at the

communication date if there are no future service requirements, or, if future

service is required to receive the termination benefi t, ratably over the service

period. From time to time, Duke Energy offers special termination benefi ts under

voluntary severance programs. Special termination benefi ts are measured

upon employee acceptance and recorded immediately absent a signifi cant

retention period. If a signifi cant retention period exists, the cost of the special

termination benefi ts are recorded ratably over the remaining service periods of

the affected employees. Employee acceptance of voluntary severance benefi ts

is determined by management based on the facts and circumstances of the

special termination benefi ts being offered.

See Note 21 for further information.

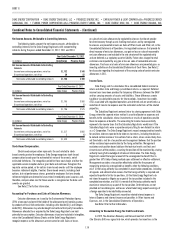

Guarantees.

Upon issuance or modifi cation of a guarantee, the Duke Energy

Registrants recognize a liability at the time of issuance or material modifi cation

for the estimated fair value of the obligation it assumes under that guarantee,

if any. Fair value is estimated using a probability-weighted approach. The

Duke Energy Registrants reduce the obligation over the term of the guarantee

or related contract in a systematic and rational method as risk is reduced

under the obligation. Any additional contingent loss for guarantee contracts

subsequent to the initial recognition of a liability in accordance with applicable

accounting guidance is accounted for and recognized at the time a loss is

probable and the amount of the loss can be reasonably estimated.

The Duke Energy Registrants have entered into various indemnifi cation

agreements related to purchase and sale agreements and other types of

contractual agreements with vendors and other third parties. These agreements

typically cover environmental, tax, litigation and other matters, as well as

breaches of representations, warranties and covenants. Typically, claims may

be made by third parties for various periods of time, depending on the nature of

the claim. Potential exposure under these indemnifi cation agreements can range

from a specifi ed to an unlimited dollar amount, depending on the nature of the

claim and the particular transaction.

See Note 7 for further information.

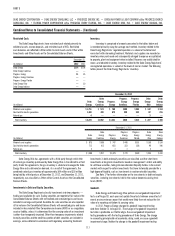

Other Current and Non-Current Assets and Liabilities.

Other within Current Assets includes current regulatory assets, which

are disclosed in Note 4, and the current portion of deferred tax assets, which

are disclosed in Note 24. Additionally, the following are included in Other within

Current Assets or Current Liabilities in the Consolidated Balance Sheets of

the Duke Energy Registrants at December 31, 2012 and 2011. The amounts

presented exceeded 5% of Current assets or 5% of Current liabilities unless

otherwise noted.

December 31,

(in millions) Location 2012 2011

Duke Energy

Accrued compensation Current Liabilities $725 $407

Duke Energy Carolinas

Accrued compensation Current Liabilities $203 $163

Collateral liabilities(a) Current Liabilities 105 94

Progress Energy

Customer deposits Current Liabilities $342 $340

Accrued compensation(a) Current Liabilities 304 155

Derivative liabilities Current Liabilities 221 382

Progress Energy Carolinas

Customer deposits Current Liabilities $120 $116

Accrued compensation(a) Current Liabilities 160 82

Derivative liabilities(b) Current Liabilities 94 123

Progress Energy Florida

Customer deposits Current Liabilities $222 $224

Accrued compensation(a) Current Liabilities 95 49

Derivative liabilities Current Liabilities 127 220

Duke Energy Ohio

Collateral assets(a) Current Assets $ 99 $ 31

Duke Energy Indiana

Derivative liabilities(a) Current Liabilities $ 63 $1

(a) Does not exceed 5% of Total current assets or Total current liabilities at December 31, 2011.

(b) Does not exceed 5% of Total current assets or Total current liabilities at December 31, 2012.