Duke Energy 2012 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2012 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

117

PART II

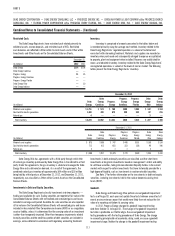

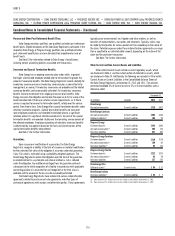

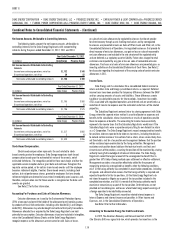

Combined Notes to Consolidated Financial Statements – (Continued)

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. • CAROLINA POWER & LIGHT COMPANY d/b/a PROGRESS ENERGY

CAROLINAS, INC. • FLORIDA POWER CORPORATION d/b/a PROGRESS ENERY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

form of ITC or cash grants for renewable energy facilities and renewable

generation property either placed in service through specifi ed dates or for which

construction has begun prior to specifi ed dates. Under the Stimulus Bill, Duke

Energy may elect an ITC, which is determined based on a percentage of the tax

basis of the qualifi ed property placed in service, for property placed in service

after 2008 and before 2014 (2013 for wind facilities) or a cash grant, which

allows entities to elect to receive a cash grant in lieu of the ITC for certain

property either placed in service in 2009 or 2010 or for which construction

begins in 2009 and 2010. In 2010, the Tax Relief, Unemployment Insurance

Reauthorization, and Job Creation Act of 2010 (the 2010 Tax Relief Act) extended

the cash grant program for renewable energy property for one additional year,

through 2011. In 2011, the Budget Control Act of 2011 (BCA) was passed which

provided for an automatic reduction in defense and non-defense spending

beginning January 1, 2013, which could reduce future cash grant payments

since such grants are likely to be treated as non-defense discretionary spending

subject to reduction under the sequester. In 2012, the American Taxpayer

Relief Act of 2012 (the ATRA) extended the ITC (energy credit) and production

tax credits available for wind facilities one year, through 2013, and changed

the timing for determining property eligible for the ITC, from property placed

in service before the credit deadline, to property under construction by the

applicable deadline for the credit. The ATRA delayed the start of the automatic

reductions/sequester under the BCA from January 1 to March 1, 2013. When

Duke Energy elects either the ITC or cash grant on Commercial Power’s wind

or solar facilities that meet the stipulations of the Stimulus Bill, Duke Energy

reduces the basis of the property recorded on the Consolidated Balance

Sheets by the amount of the ITC or cash grant and, therefore, the ITC or grant

benefi t is recognized ratably over the life of the associated asset through

reduced depreciation expense. Additionally, certain tax credits and government

grants received under the Stimulus Bill provide for an incremental initial tax

depreciable base in excess of the carrying value for GAAP purposes, creating

an initial deferred tax asset equal to the tax effect of one half of the ITC or

government grant. Duke Energy records the deferred tax benefi t as a reduction to

income tax expense in the period that the basis difference is created.

Excise Taxes.

Certain excise taxes levied by state or local governments are collected

by the Duke Energy Registrants from their customers. These taxes, which are

required to be paid regardless of the Duke Energy Registrants’ ability to collect

from the customer, are accounted for on a gross basis. When the Duke Energy

Registrants act as an agent, and the tax is not required to be remitted if it is

not collected from the customer, the taxes are accounted for on a net basis.

The Duke Energy Registrants’ excise taxes accounted for on a gross basis and

recorded as operating revenues in the Consolidated Statements of Operations

were as follows:

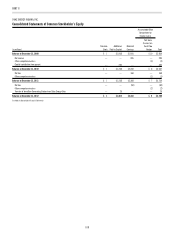

For the Years Ended December 31,

(in millions) 2012 2011 2010

Duke Energy $466 $293 $300

Duke Energy Carolinas 161 153 156

Progress Energy 317 315 345

Progress Energy Carolinas 113 110 119

Progress Energy Florida 205 205 226

Duke Energy Ohio 102 109 115

Duke Energy Indiana 33 31 29

Foreign Currency Translation.

The local currencies of Duke Energy’s foreign operations have been

determined to be their functional currencies, except for certain foreign operations

whose functional currency has been determined to be the U.S. Dollar, based on an

assessment of the economic circumstances of the foreign operation. Assets and

liabilities of foreign operations, except for those whose functional currency is the

U.S. Dollar, are translated into U.S. Dollars at the exchange rates in effect at period

end. Translation adjustments resulting from fl uctuations in exchange rates are

included as a separate component of AOCI. Revenue and expense accounts of these

operations are translated at average exchange rates prevailing during the year. Gains

and losses arising from balances and transactions denominated in currencies other

than the functional currency are included in the results of operations in the period in

which they occur.

Di vidend Restrictions and Unappropriated Retained Earnings.

Duke Energy does not have any legal, regulatory or other restrictions on

paying common stock dividends to shareholders. However, as further described

in Note 4, due to conditions established by regulators at the time of the Duke

Energy/Cinergy merger in April 2006 and the Duke Energy/Progress Energy

merger in 2012, certain wholly owned subsidiaries, including Duke Energy

Carolinas, Progress Energy Carolinas, Duke Energy Ohio and Duke Energy

Indiana, have restrictions on paying dividends or otherwise advancing funds

to Duke Energy. At December 31, 2012 and 2011, an insignifi cant amount of

Duke Energy’s consolidated Retained earnings balance represents undistributed

earnings of equity method investments.

New Accounting Standards.

The following new accounting standards were adopted by the Duke Energy

Registrants during the year ended December 31, 2012, and the impact of such

adoption, if applicable, has been presented in the accompanying Consolidated

Financial Statements:

Financial Accounting Standards Board (FASB) Accounting

Standards Codifi cation (ASC) 220 — Comprehensive Income. In

June 2011, the FASB amended the existing requirements for presenting

comprehensive income in fi nancial statements primarily to increase the

prominence of items reported in other comprehensive income (OCI) and to

facilitate the convergence of U.S. GAAP and International Financial Reporting

Standards (IFRS). Specifi cally, the revised guidance eliminates the option

previously provided to present components of OCI as part of the statement

of changes in stockholders’ equity. Accordingly, all non-owner changes in

stockholders’ equity are required to be presented either in a single continuous

statement of comprehensive income or in two separate but consecutive

fi nancial statements. For the Duke Energy Registrants, this revised guidance

was effective on a retrospective basis for interim and annual periods beginning

January 1, 2012. The adoption of this standard changed the presentation of the

Duke Energy Registrants’ fi nancial statements but did not affect the calculation

of net income, comprehensive income or earnings per share.

ASC 820 — Fair Value Measurements and Disclosures. In May 2011,

the FASB amended existing requirements for measuring fair value and for

disclosing information about fair value measurements. This revised guidance

results in a consistent defi nition of fair value, as well as common requirements

for measurement and disclosure of fair value information between U.S. GAAP

and IFRS. In addition, the amendments set forth enhanced disclosure

requirements with respect to recurring Level 3 measurements, nonfi nancial