Duke Energy 2012 Annual Report Download - page 153

Download and view the complete annual report

Please find page 153 of the 2012 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

133

PART II

Combined Notes to Consolidated Financial Statements – (Continued)

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. • CAROLINA POWER & LIGHT COMPANY d/b/a PROGRESS ENERGY

CAROLINAS, INC. • FLORIDA POWER CORPORATION d/b/a PROGRESS ENERY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

is required to pay dividends solely out of retained earnings and to maintain a

minimum of 35% equity in its capital structure.

Duke Energy Indiana

Under the Cinergy Merger Conditions, Duke Energy Indiana shall limit

cumulative distributions paid subsequent to the merger to (i) the amount of

retained earnings on the day prior to the closing of the merger plus (ii) any

future earnings recorded by Duke Energy Indiana subsequent to the merger. In

addition, Duke Energy Indiana will not declare and pay dividends out of capital

or unearned surplus without prior authorization of the IURC.

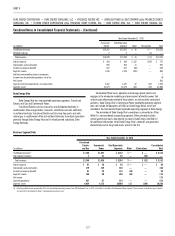

The following table includes information regarding the Subsidiary

Registrants and other Duke Energy subsidiaries’ restricted net assets at

December 31, 2012.

(in billions)

Total Duke

Energy

Subsidiaries

Duke

Energy

Carolinas

Progress

Energy

Progress

Energy

Carolinas

Duke

Energy

Ohio(a)

Duke

Energy

Indiana

Amounts that may

not be transferred

to Duke Energy

without appropriate

approval based on

above mentioned

Merger Conditions $10.3 $2.8 $2.0 $1.9 $3.9 $1.4

(a) As of December 31, 2012, the equity balance available for payment of dividends, based on the FERC and

PUCO order discussed above, was $1.3 billion.

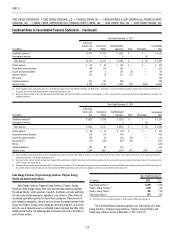

Rate Related Information

The NCUC, PSCSC, FPSC, IURC, PUCO and KPSC approve rates for

retail electric and gas services within their states. Nonregulated sellers of gas

and electric generation are also allowed to operate in Ohio once certifi ed by

the PUCO. The FERC approves rates for electric sales to wholesale customers

served under cost-based rates, as well as sales of transmission service.

Duke Energy Carolinas

2013 North Carolina Rate Case.

On February 4, 2013, Duke Energy Carolinas fi led an application with the

NCUC for an increase in base rates of approximately $446 million, or an average

9.7% increase in retail revenues. The request for increase is based upon an

11.25% return on equity and a capital structure of 53% equity and 47% long-

term debt. The rate increase is designed primarily to recover the cost of plant

modernization, environmental compliance and the capital additions.

Duke Energy Carolinas expects revised rates, if approved, to go into effect

late third quarter of 2013.

2011 North Carolina Rate Case.

On January 27, 2012, the NCUC approved a settlement agreement

between Duke Energy Carolinas and the North Carolina Utilities Public Staff

(Public Staff). The terms of the agreement include an average 7.2% increase in

retail revenues, or approximately $309 million annually beginning in February

2012. The agreement includes a 10.5% return on equity and a capital structure

of 53% equity and 47% long-term debt.

On March 28, 2012, the North Carolina Attorney General fi led a notice of

appeal with the NCUC challenging the rate of return approved in the agreement.

On April 17, 2012, the NCUC denied Duke Energy Carolinas’ request to dismiss

the notice of appeal. Briefs were fi led on August 22, 2012 by the North Carolina

Attorney General and the AARP with the North Carolina Supreme Court, which is

hearing the appeal. Duke Energy Carolinas fi led a motion to dismiss the appeal

on August 31, 2012 and the North Carolina Attorney General fi led a response

to that motion on September 13, 2012. Briefs by the appellees, Duke Energy

Carolinas and the Public Staff, were fi led on September 21, 2012. The North

Carolina Supreme Court denied Duke Energy Carolinas’ motion to dismiss on

procedural grounds and oral arguments were held on November 13, 2012.

Duke Energy Carolinas is awaiting an order.

2011 South Carolina Rate Case.

On January 25, 2012, the PSCSC approved a settlement agreement

between Duke Energy Carolinas and the ORS, Wal-Mart Stores East, LP, and

Sam’s East, Inc. The Commission of Public Works for the city of Spartanburg,

South Carolina and the Spartanburg Sanitary Sewer District were not parties

to the agreement; however, they did not object to the agreement. The terms of

the agreement include an average 5.98% increase in retail and commercial

revenues, or approximately $93 million annually beginning February 6, 2012.

The agreement includes a 10.5% return on equity, a capital structure of 53%

equity and 47% long-term debt.

Cliffside Unit 6.

On March 21, 2007, the NCUC issued an order allowing Duke Energy

Carolinas to build an 800 MW coal-fi red unit. Following fi nal equipment

selection and the completion of detailed engineering, Cliffside Unit 6 has a

net output of 825 MW. On January 31, 2008, Duke Energy Carolinas fi led its

updated cost estimate of $1.8 billion (excluding AFUDC of $600 million) for

Cliffside Unit 6. In March 2010, Duke Energy Carolinas fi led an update to

the cost estimate of $1.8 billion (excluding AFUDC) with the NCUC where it

reduced the estimated AFUDC fi nancing costs to $400 million as a result of the

December 2009 rate case settlement with the NCUC that allowed the inclusion

of construction work in progress in rate base prospectively. Cliffside Unit 6

began commercial operation in the fourth quarter of 2012.

Dan River Combined Cycle Facility.

In June 2008, the NCUC issued its order approving the Certifi cate of

Public Convenience and Necessity (CPCN) applications to construct a 620 MW

combined cycle natural gas fi red generating facility at Duke Energy Carolinas’

existing Dan River Steam Station. The Division of Air Quality (DAQ) issued a

fi nal air permit authorizing construction of the Dan River combined cycle natural

gas-fi red generating unit in August 2009. Dan River began commercial operation

in the fourth quarter of 2012.

William States Lee III Nuclear Station.

In December 2007, Duke Energy Carolinas fi led an application with the

NRC, which has been docketed for review, for a combined Construction and

Operating License (COL) for two Westinghouse AP1000 (advanced passive)

reactors for the proposed William States Lee III Nuclear Station (Lee Nuclear

Station) at a site in Cherokee County, South Carolina. Each reactor is capable

of producing 1,117 MW. Submitting the COL application does not commit Duke

Energy Carolinas to build nuclear units. Through several separate orders, the

NCUC and PSCSC have concurred with the prudency of Duke Energy incurring

project development and pre-construction costs.