Duke Energy 2012 Annual Report Download - page 245

Download and view the complete annual report

Please find page 245 of the 2012 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

225

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. • CAROLINA POWER & LIGHT COMPANY d/b/a PROGRESS

ENERGY CAROLINAS, INC. • FLORIDA POWER CORPORATION d/b/a PROGRESS ENERY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

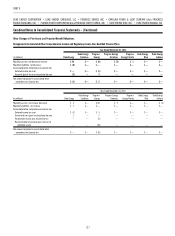

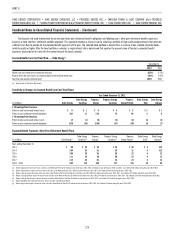

December 31, 2011

(in millions) Duke Energy

Duke Energy

Carolinas

Progress

Energy

Progress Energy

Carolinas

Progress

Energy Florida

Duke Energy

Ohio

Duke Energy

Indiana

Accrued post-retirement liability(a)(b)(c)(d)(e)(f)(g) $ (486) $ (192) $ (804) $(407) $(331) $(52) $(121)

Regulatory assets $ 37 $ 37 $ 277 $ 121 $ 142 $ — $ 83

Regulatory liabilities $ 107 $ — $ — $ — $ — $ 19 $ 70

Accumulated other comprehensive (income) loss

Deferred income tax liability $ 4 $ — $ — $ — $ — $ 4 $ —

Prior service credit (3) — — — — (1) —

Net actuarial loss (gain) (6) — — — — (9) —

Net amounts recognized in accumulated other comprehensive

(income) loss $ (5) $ — $ — $ — $ — $ (6) $ —

(a) Duke Energy amount includes $50 million and $3 million recognized in Other within Current Liabilities on the Consolidated Balance Sheets as of December 31, 2012 and 2011, respectively.

(b) Duke Energy Carolinas amount includes an insignifi cant amount recognized in Other within Current Liabilities on the Consolidated Balance Sheets as of December 31, 2012 and 2011, respectively.

(c) Progress Energy amount includes $47 million and $22 million recognized in Other within Current Liabilities on the Consolidated Balance Sheets as of December 31, 2012 and 2011, respectively.

(d) Progress Energy Carolinas amount includes $23 million and $19 million recognized in Other within Current Liabilities on the Consolidated Balance Sheets as of December 31, 2012 and 2011, respectively.

(e) Progress Energy Florida amount includes $20 million and zero recognized in Other within Current Liabilities on the Balance Sheets as of December 31, 2012 and 2011, respectively.

(f) Duke Energy Ohio amount includes $2 million and $2 million recognized in Other within Current Liabilities on the Consolidated Balance Sheets as of December 31, 2012 and 2011, respectively.

(g) Duke Energy Indiana amount includes an insignifi cant amount recognized in Other within Current Liabilities on the Consolidated Balance Sheets as of December 31, 2012 and 2011, respectively.

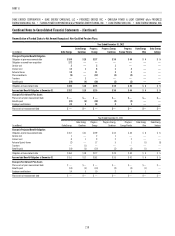

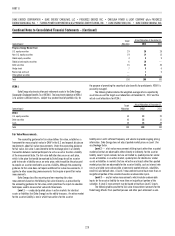

Assumptions Used for Other Post-Retirement Benefi ts Accounting

Duke Energy(a)

December 31,

(percentages) 2012 2011 2010

Benefi t Obligations

Discount rate 4.10 5.10 5.00

Net Periodic Benefi t Cost

Discount rate 4.60-5.10 5.00 5.50

Expected long-term rate of return on plan assets(b) 5.20-8.00 5.36-8.25 5.53-8.50

Assumed tax rate(c)(d) 35 35.0 35.0

(a) For Progress Energy plans, the discount rate used in 2012 to determine expense refl ect remeasurement as of July 1, 2012 due to the merger between Duke Energy and Progress Energy.

(b) The expected long-term rate of return on plan assets for Duke Energy Ohio and Duke Energy Indiana was 8.00%, 8.25% and 8.50% as of December 31, 2012, 2011 and 2010, respectively.

(c) Applicable to the health care portion of funded post-retirement benefi ts.

(d) Does not apply to Duke Energy Ohio and Duke Energy Indiana.

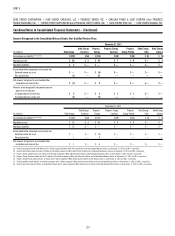

Progress Energy(a)(b)

December 31,

(percentages) 2012 2011 2010

Benefi t Obligations

Discount rate 4.10 4.85 5.75

Net Periodic Benefi t Cost

Discount rate 4.60-4.85 5.70 6.05

Expected long-term rate of return on plan assets(b) N/A-5.00 5.00 6.60

(a) The assumptions used in 2012 to determine expense refl ect remeasurement as of July 1, 2012 due to the merger between Duke Energy and Progress Energy.

(b) The weighted-average actuarial assumptions used by Progress Energy Carolinas and Progress Energy Florida were not materially different from the assumptions above, as applicable, with the exception of the expected long-

term rate of return on plan assets which was 5.00% for all years presented for Progress Energy Florida and 8.75% in 2010 for Progress Energy Carolinas. Progress Energy Florida held no other post-retirement benefi t plan

assets as of December 31, 2012. Progress Energy Carolinas held no other post-retirement plan assets after December 31, 2010.