Duke Energy 2012 Annual Report Download - page 248

Download and view the complete annual report

Please find page 248 of the 2012 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

228

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. • CAROLINA POWER & LIGHT COMPANY d/b/a PROGRESS

ENERGY CAROLINAS, INC. • FLORIDA POWER CORPORATION d/b/a PROGRESS ENERY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

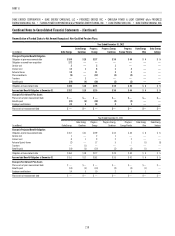

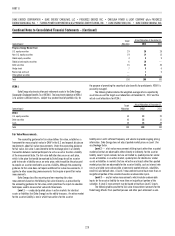

Target

Allocation

Actual Allocation at December 31,

(percentages) 2012 2011

Progress Energy Master Trust

U.S. equity securities 29 20 28

Non-U.S. equity securities 19 14 15

Global equity securities 4 8 9

Global private equity securities 6 10 —

Debt securities 35 35 36

Hedge funds 7 9 6

Real estate and cash — 1 6

Other global securities — 3 —

Total 100 100 100

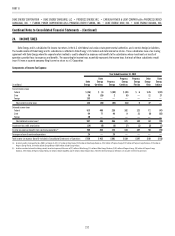

VEBA I.

Duke Energy also invests other post-retirement assets in the Duke Energy

Corporation Employee Benefi ts Trust (VEBA I). The investment objective of VEBA I

is to achieve suffi cient returns, subject to a prudent level of portfolio risk, for

the purpose of promoting the security of plan benefi ts for participants. VEBA I is

passively managed.

The following table includes the weighted-average returns expected by

asset classes and the target asset allocations at December 31, 2012 and the

actual asset allocations for VEBA I.

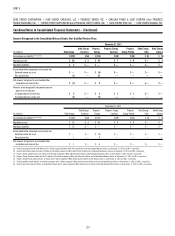

Target

Allocation

Actual Allocation at December 31,

(percentages) 2012 2011

VEBA I

U.S. equity securities 30 23 20

Debt securities 45 32 31

Cash 25 45 49

Total 100 100 100

Fair Value Measurements.

The accounting guidance for fair value defi nes fair value, establishes a

framework for measuring fair value in GAAP in the U.S. and expands disclosure

requirements about fair value measurements. Under the accounting guidance

for fair value, fair value is considered to be the exchange price in an orderly

transaction between market participants to sell an asset or transfer a liability

at the measurement date. The fair value defi nition focuses on an exit price,

which is the price that would be received by Duke Energy to sell an asset or

paid to transfer a liability versus an entry price, which would be the price paid

to acquire an asset or received to assume a liability. Although the accounting

guidance for fair value does not require additional fair value measurements, it

applies to other accounting pronouncements that require or permit fair value

measurements.

Duke Energy classifi es recurring and non-recurring fair value

measurements based on the following fair value hierarchy, as prescribed by

the accounting guidance for fair value, which prioritizes the inputs to valuation

techniques used to measure fair value into three levels:

Level 1 — unadjusted quoted prices in active markets for identical

assets or liabilities that Duke Energy has the ability to access. An active market

for the asset or liability is one in which transactions for the asset or

liability occurs with suffi cient frequency and volume to provide ongoing pricing

information. Duke Energy does not adjust quoted market prices on Level 1 for

any blockage factor.

Level 2 — a fair value measurement utilizing inputs other than a quoted

market price that are observable, either directly or indirectly, for the asset or

liability. Level 2 inputs include, but are not limited to, quoted prices for similar

assets or liabilities in an active market, quoted prices for identical or similar

assets or liabilities in markets that are not active and inputs other than quoted

market prices that are observable for the asset or liability, such as interest rate

curves and yield curves observable at commonly quoted intervals, volatilities,

credit risk and default rates. A Level 2 measurement cannot have more than an

insignifi cant portion of the valuation based on unobservable inputs.

Level 3 — any fair value measurements which include unobservable

inputs for the asset or liability for more than an insignifi cant portion of the

valuation. A Level 3 measurement may be based primarily on Level 2 inputs.

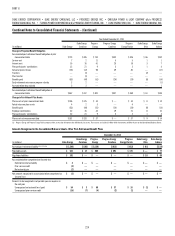

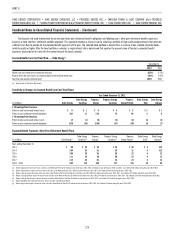

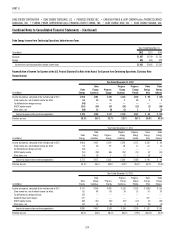

The following tables provide the fair value measurement amounts for the

Duke Energy Master Trust qualifi ed pension and other post-retirement assets.