Duke Energy 2012 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2012 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48

PART II

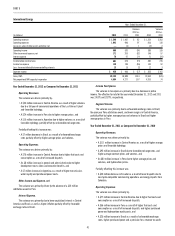

The following table shows the percent changes in GWh sales and average number of customers for Progress Energy Florida. Except as otherwise noted, the

below percentages represent billed sales only for the periods presented and are not weather normalized.

Increase (decrease) over prior year 2012 2011

Residential sales(a) (5.1)% (6.3)%

General service sales(a) (1.0)% (0.4)%

Industrial sales(a) (2.5)% 0.7%

Wholesale power sales (34.2)% (25.1)%

Total sales(b) (2.9)% (8.5)%

Average number of customers 0.8% 0.5%

(a) Major components of retail sales.

(b) Consists of all components of sales, including all billed and unbilled retail sales, and wholesale sales to incorporated municipalities and to public and private utilities and power marketers.

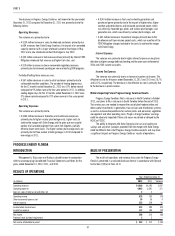

The decrease in Progress Energy Florida’s net income for the year ended

December 31, 2012 compared to December 31, 2011 was primarily due to the

following factors:

Operating Revenues.

The variance was primarily due to:

• A $266 million increase in fuel and capacity revenues driven primarily

by the 2011 charge of $288 million for the amount to be refunded

through the fuel clause in accordance with the 2012 FPSC settlement

agreement and the impact of higher residential fuel rates, partially offset

by unfavorable weather conditions that impacted wholesale and retail

fuel revenues. Also, Progress Energy Florida had lower capacity revenues

resulting from a lower capacity rate and the lower sales volume,

• A $28 million increase in other operating revenues primarily due to

higher OATT rates, and

• A $15 million increase in sales to wholesale customers primarily due to

a new contract with a major customer.

Partially offsetting these increases was:

• A $19 million decrease in sales to retail customers due to unfavorable

weather conditions. The number of heating degree days for the 12

months ended December 31, 2012 was 22% below normal compared

to 12% below normal in the same period in 2011. In addition, cooling

degree days for the 12 months ended December 31, 2012 were 4% above

normal compared to 5% above normal in the same period in 2011.

Operating Expenses.

The variance was primarily due to:

• A $146 million increase in Impairment charges due to the impact of the

decision to retire Crystal River Unit 3 (See Note 4),

• A $121 million increase in Fuel used in electric generation and purchased

power primarily due to the impact of establishing a regulatory liability

for replacement power in accordance with the 2012 FPSC settlement

agreement (See Note 4), and an increase in deferred fuel expense

related to higher under-recovered fuel costs in 2011 as a result of higher

system requirements driven by favorable weather in the prior year. These

increases were partially offset by lower natural gas prices and lower

system requirements as a result of unfavorable weather conditions in the

current year and a lower Crystal River Unit 3 indemnifi cation charge for

the estimated joint owner replacement power costs,

• An $86 million increase in Operation and maintenance expenses primarily

due to higher costs to achieve the merger with Duke Energy, and

• A $23 million increase in Depreciation and amortization primarily due to a

decrease in the reduction of the cost of removal component of amortization

expense as allowed under the 2012 and 2010 settlement agreements

(See Note 4) and higher Environmental Cost Recovery Clause (ECRC)

amortization due to less over-recovery, partially offset by lower nuclear cost-

recovery amortization primarily related to the Levy nuclear station project.

Interest Expense.

The variance was primarily due to the prior-year favorable settlement of

2004 and 2005 income tax audits.

Income Tax Expense.

The variance was primarily due to a decrease in pretax net income. The

effective tax rate for the years ended December 31, 2012 and 2011 were 35.7%

and 36.3%, respectively.

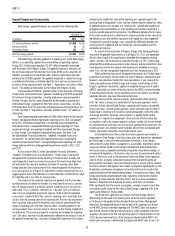

Matters Impacting Future Progress Energy Florida’s Results

In accordance with the terms of the 2012 FPSC Settlement Agreement,

with consumer representatives and approved by the FPSC, Progress Energy

Florida retains the sole discretion and fl exibility to retire Crystal River Unit 3.

As a result of the decision to retire Crystal River Unit 3, under the terms of

the 2012 FPSC Settlement Agreement, Progress Energy Florida is allowed to

recover all remaining Crystal River Unit 3 investments and to earn a return

on the Crystal River Unit 3 investments set at its current authorized overall

cost of capital, adjusted to refl ect a return on equity set at 70 percent of the

current FPSC authorized return on equity, no earlier than the fi rst billing cycle

of January 2017. Progress Energy Florida expects that the FPSC will review

the prudence of the retirement decision in Phase 2 of the Crystal River Unit

3 delamination regulatory docket. Progress Energy Florida has also asked the

FPSC to review the mediated resolution of insurance claims with NEIL as part

of Phase 3 of this regulatory docket. Phase 2 and Phase 3 hearings have been

tentatively scheduled to begin on June 19, 2013. Progress Energy Florida’s

fi nancial condition and results of operations could be adversely impacted if the

FPSC issues an unfavorable ruling.

The ability to integrate with Duke Energy businesses and realize cost

savings and any other synergies expected from the merger with Duke Energy

could be different from what Progress Energy Florida expects and may have a

signifi cant impact on Progress Energy Florida’s results of operations.